Algorithmic trading

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

Better tech brings threat of two-speed trading in fixed income

Smaller asset managers may get left behind as automation allows the big players to prosper.

GenAI and HFT: A competitive edge?

Timing is critical in the capital markets. IBM researchers say genAI’s predictive abilities in combination with AI/ML models can translate into profitable HFT opportunities.

Traders, vendors seek to modernize chronically underinvested FX tech

The average FX professional uses eight applications at any one time. But integrating the FX workflow is a daunting task.

Waters Wrap: Reading the fixed-income tea leaves

A lot gets made about how much fixed income has been electronified. Anthony says that “percentage” ignores the important technological evolutions and strategic shifts being made by the vendor community.

Getting the message out about Aeron’s messaging

A year after Adaptive’s acquisition of Real Logic’s Aeron, the search for users of the open-source tech continues as Adaptive promises that UDP messaging can usurp TCP.

ICE to offer ultra-low latency data between the US and Europe

The offering will run eastward, connecting routes in the US with European markets in London, Frankfurt, and Bergamo.

Technology trends in capital markets: Transforming the sell-side FX front office

The capital markets landscape is witnessing a technological revolution – a wave transforming the sell-side FX front office. Firms such as smartTrade Technologies are at the forefront of this transformation, leveraging technologies such as artificial…

Goldman’s Marquee is a gradual revelation

Multiple apps are being corralled into a sticky cross-asset ecosystem, updated with Python and cloud

Terminal velocity: MarketAxess bets on algo trading as electronification of fixed income gathers speed

MarketAxess hopes to bring fresh ideas from other asset classes with acquisition of multi-asset algorithm provider Pragma.

BoE model risk rule may drive real-time monitoring of AI

New rule requires banks to rerun performance tests on models that recalibrate dynamically.

RBC eyes AI to bolster FX and rates algos

Canadian bank plans to take deep reinforcement learning tech from equities to fixed income and currencies

Can algos collude? Quants are finding out

Oxford-Man Institute is among those asking: could algorithms gang up and squeeze customers?

Spot the difference: Why crypto data can’t be treated like traditional market data

As institutional participation in cryptocurrency markets increases, traditional data vendors and new specialist crypto data providers are taking different approaches to supplying necessary data to financial firms.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

Barclays (and others) strive for machine learning at quantum speed

Embryonic work on quantum neural networks raises hope of faster, more accurate models

People Moves: Digital Asset, Coalition Greenwich, NZX, Symphony, and more

A look at some of the key "people moves" from this week, including J. Christopher Giancarlo (pictured), who joins the board of directors of Digital Asset.

The future of algo trading: Using deep learning to more accurately predict equity market volumes

OpEd by Sam Clapp, Mizuho Americas equities, and Don Hundley, Japan head of Mizuho equities electronic trading

Buy one, get one free: Algos learn to multi-task

For years, brokers have offered suites of algorithms, each geared toward a certain strategy and outcome. Now, firms are compressing these into multifaceted algorithms that can switch between different strategies or markets in response to trading…

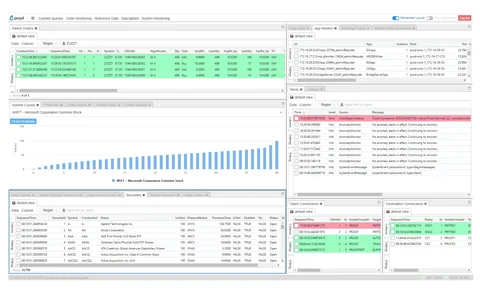

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

This Week: BNY Mellon/Milestone Group, IHS Markit, Broadridge/China Renaissance, and more

A summary of some of the past week’s financial technology news.