AI

Six corporate actions prototype aims to slash data delivery time

If the prototype is put into production, delivery of corporate actions data for dividends could be reduced from up to 24 hours to 15 to 30 minutes.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

FactSet, Microsoft collaborate on voice-activated analytics

The data vendor has deployed machine learning across its ETF and fund screening datasets, and plans to interoperate with other big tech firms in the future.

People Moves: Tradeweb, BondLink, Boosted.ai, Transcend, and more

A look at some of the key "people moves" from this week, including Devi Shanmugham (pictured), who joins Tradeweb as global head of compliance.

AI helps one investor screen targets against UN ethical goals

PanAgora has developed a two-stage process that aims to weed out the greenwashers.

Waters Wrap: Can interop connect the bond market better than consortiums? (Yes)

Anthony says that if trading firms want to take advantage of new datasets in fixed income and advancements in machine learning, they’re going to first have to embrace interoperability.

Show your workings: Lenders push to demystify AI models

Machine learning could help with loan decisions—but only if banks can explain how it works. And that’s not easy.

Research management systems vie to double as data, analytics providers in one-stop-shop bid

RMS providers Sentieo and MackeyRMS feel the pressure to become quasi-data and analytics providers in their quest to cover the gamut of the buy-side research analyst workflow.

Dutch asset manager turns to decision trees for currency predictions

APG has improved prediction accuracy for G10 currency movements after adopting decision tree-based machine learning.

EBA to consult on banks’ machine learning use

The watchdog will set out a new stance on ML-based capital models at a time of conflicting guidance from other supervisors.

Symphony taps Google for cloud, AI, data-sharing tools

By leveraging Google’s AI and data-sharing capabilities, Symphony is strengthening its ties with the tech giant, which is also an investor in the platform.

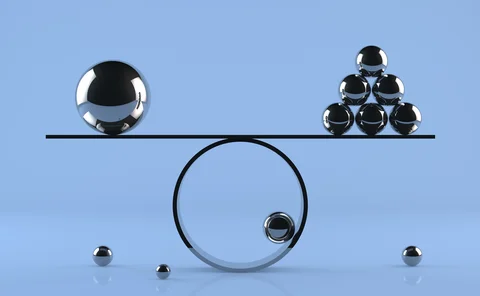

Regulators must find a balance with artificial intelligence

There's rapid digital transformation underway in the industry and regulators must get with the game plan while not over-regulating the use of AI.

SF quant firm uses 'nearest neighbor' machine learning for equities predictions

Creighton AI is using a regression-based approach to machine learning to help make predictions about the excess return of a stock relative to the market.

AML models face explainability challenges

Data gaps and potential biases must be accounted for in approaches to tackling money laundering.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

Quants turn to machine learning to unlock private data

Replication could allow financial firms to use—and monetize—data that was previously off-limits

Brown Brothers Harriman continues AI ‘transformation’ of fund accounting unit

A new tool that helps business users test and validate their own POCs is set to join the bank’s ranks alongside its other AI projects implemented over the last two years: Linc, Guardrail, and Ants.

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Waters Wrap: The Symphony-Cloud9 tie-up hints at a new tune for the comms provider

Anthony talks with Brad Levy about the company’s acquisition of Cloud9, its plan for future acquisitions, the possibility of an IPO, his thoughts on Big Tech providers, and more.

Former Standard Chartered CDO details AI in capital markets and regulators’ approach

Waters Wavelength Podcast Interview Series: Shameek Kundu, now head of financial services and chief strategy officer at AI startup firm Truera, talks AI, the state of the art of infrastructure, and how regulators are keeping a keen eye on the space.

Direxion turns to Two Sigma’s Venn for thematic ETFs

The firm is using the platform as a comparison tool as it evolves its fund offerings.

Banks fear Fed crackdown on AI models

Dealers say the agencies’ request for info could prompt new rules that stifle model innovation.

Meme stocks: Data providers conflicted on offering investment analyses

While some alternative data providers are jumping in on the meme-stock craze by producing new datasets and analyses geared toward risk management and alpha generation, others—perhaps rightly so—are staying cautious.

.jpg.webp?itok=Ljuced7s)