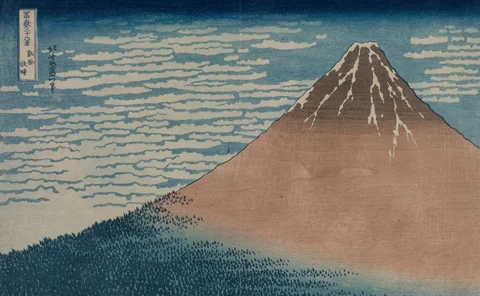

Asia

Technical difficulties: OpenFin says it’s committed to FDC3, while others have their doubts

After quietly pulling its Finos membership this year, OpenFin’s involvement—at least in the public forum that governs it—with the interop standard it has championed for years, continues to dip. Though the vendor has re-affirmed its commitment to FDC3…

This Week: FlexTrade Systems, NeoXam, Eventus Systems, Substantive Research

A summary of some of the past week's financial technology news.

Shorter settlement cycles could hit non-US firms hard

As efforts continue to shorten the settlement cycle for US securities to T+1, market participants in Asia worry about the potential implications.

Waters Wrap: When will Big Tech providers turn sights on the market data space? (And deep learning)

In recent years, the major cloud providers have expanded their service offerings specific to capital markets firms. Some industry observers believe it’s just a matter of time until they get involved in market data M&A activity.

This Week: SimCorp/JP Morgan; SGX/TNS; Barclays/MarketAxess and more

A summary of some of the past week's financial technology news.

Waters Wrap: Market data & consolidation—a never-ending timeline (And rise of the fees)

While last week it was announced that Exegy and Vela are merging, Anthony says that the deal is only a sign of what’s to come in the market data space. He also poses some questions about the LSE raising its Sedol fees.

People Moves: HKEx, LSEG, Esma, Finos, and more

A look at some of the key people moves from the past week, including Nicolas Aguzin (pictured), who joins HKEx as its new CEO.

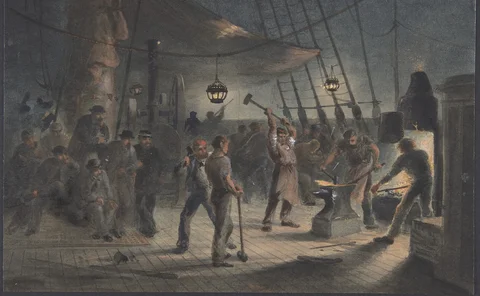

What can HKEx’s Synapse learn from watching ASX’s game of Chess?

HKEx is looking to leverage smart contracts for its Synapse platform. Sell-side participants are generally positive as to the reasoning behind the build, but observers warn the ambitious project still has challenges to overcome.

People Moves: BNY Mellon, State Street, Citadel Securities and more

A look at some of the key people moves from this week, including Laide Majiyagbe (pictured), who has been appointed head of financing and liquidity at BNY Mellon Markets.

This Week: Bloomberg, Ice, DTCC, & More

A summary of some of the past week's financial technology news.

Waters Wavelength Podcast: Asian exchanges

Keiren Harris, a strategy-based market data consultant and founder of DataCompliance, joins the podcast to talk about exchanges in Asia and their data strategies.

Quandl goes live with new dataset for measuring dollar value of patents

The data vendor’s product is its first that aims to sort what it believes to be truly innovative companies from the pack.

Vendors add surveillance support for WhatsApp alternatives

Concerns about data leakage have driven some users to rival privacy-focused messaging apps like Telegram and Signal, as WhatsApp policy changes come into force on May 15.

Waters Wrap: Buzzwords and the hype machine (And editorial judgment)

Anthony previews some of the major trend topics that WatersTechnology will look to cover over the next eight months.

This Week: ICE, IHS Markit, Commerzbank/Deutsche Börse, TNS & more

A summary of some of the past week’s financial technology news.

Waters Wrap: The looming data storage wars (And Bloomberg killers)

Anthony first looks at the data storage space, explaining that fees are likely to increase for buy- and sell-side firms in the near-term. He also wonders if there’s a market in the terminal/workstation space for innovative startups to gain traction. As…

Symphony suspends Sparc pending registration talks with CFTC

The comms provider may have to register its RFQ workflow and messaging tool as a Sef, or perhaps permanently shut down the business line.

Bloomberg’s new data retention policy vexes buy-side firms

Impacted users will have to pay extra costs to retain communications data for longer than two years.

Waters Wrap: Would DLT really have prevented Archegos? (And thoughts on Itiviti)

While Christopher Giancarlo says distributed ledger technology could’ve helped prime brokers better monitor their risk exposures to Archegos Capital Management, Anthony (and others) are not so sure about that. He also looks at the Broadridge-Itiviti deal.

Small alt data providers feel pressure to specialize

GTCOM-US, once a bespoke alt data shop for the buy side, has narrowed its offering to focus on Chinese datasets as the largest alt data players get even bigger.

Waters Wrap: Big Tech takes control of cutting-edge encryption (And consortium flat circles)

In addition to growing their cloud presence in the capital markets, Big Tech companies are, unsurprisingly, taking the lead on encryption and security in the cloud. Anthony sees positives and negatives. He also looks at bank-led consortiums.

Waters Wrap: The nature of data and information (And Ion-List thoughts)

Anthony takes a look at the alternative data industry post-GameStop, and wonders about Ion Group’s strategy going forward after recent acquisitions.

A kick in the privates: In-demand unlisted stock trading faces tech, transparency challenges

Private stocks are opaque, illiquid, behave differently from public markets, and lack the same infrastructure as public marketplaces, creating back-office integration challenges for firms that want to trade these stocks in a more liquid manner. But as…

People Moves: State Street, Northern Trust, JonesTrading, LiquidityBook & More

A look at some of the key “people moves” from this week, including Vincent Georgel-O’Reilly (pictured), who's been appointed Emea head of alternatives at State Street.