Automation

Bulletproof building: DTCC, AWS debut app resiliency prototype

The cloud provider and industry utility have jointly released a prototype and guidelines for building resilient financial services applications.

FactSet lays out AI blueprint for discoverability, workflows, and innovation

The data provider is utilizing generative AI and large language models to provide a conversational interface in FactSet Workstation that will complement AI-powered workflows and products.

Settlement ‘instructions’: Firms look to US for guidance as Europe braces for T+1

Operations professionals in Europe look across the pond for lessons in managing shorter settlement cycles.

Isda doubles down on digital push with new tech team

The new division is tasked with identifying new areas for standardization.

Broadridge’s LTX looks to GenAI as it competes for market share

LTX has pinned its hopes of breaking into the fixed-income market on innovative use of AI. But how successful has its approach been, and what is it up against?

IBM outlines ‘hybrid’ AI approach as revenues rise

It’s been two years since IBM’s pivot to a hybrid cloud and AI strategy, and the tech giant saw strong earnings as it continues to invest in the watsonx platform.

BNY Mellon streamlines the hunt for liquidity with LiquidityDirect updates

The bank spent the last three years evolving and expanding LiquidityDirect to include additional asset classes, and will white label the platform to customers.

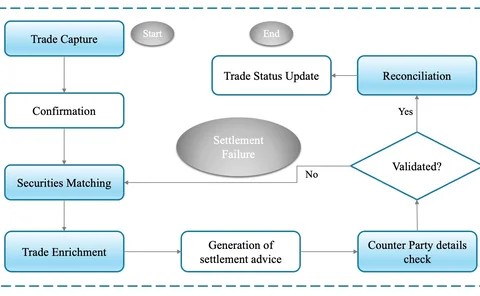

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

BlackRock forecasts return to fixed income amid efforts to electronify market

The world's largest asset manager expects bond markets to make headway once rates settle.

Goldman’s Marquee is a gradual revelation

Multiple apps are being corralled into a sticky cross-asset ecosystem, updated with Python and cloud

This Week: TNS, Cboe, State Street, ICE, and more

A summary of the latest financial technology news.

HSBC hikes tech spend, scales up AI projects

The bank is hoping to turn higher technology costs to its advantage, investing in its new digital trade platform and increasing its exploration of generative AI.

MarketAxess looks to proprietary data and automation with new offerings

The fixed-income trading provider’s Adaptive Auto-X automation tool and new data offerings were a bright spot amid lackluster Q2 earnings.

Automation in fixed income: Sorting the bluster from the bleeding edge

Automation is gaining traction in fixed-income markets, but use cases are limited and progress is slow. Market participants must overcome some uniquely human problems before they fully embrace the machine.

This Week: Confluence Technologies, Genesis, LexisNexis, and more

A summary of the latest financial technology news.

Buy side demands better data aggregation for primary corporate bonds

With electronification and tech development increasing in fixed income, participants are looking for better data access in the primary market for corporate bonds.

Save the date: How an events calendar can improve corporate actions workflow

Having a visual 'calendar' of corporate actions events could free up staff who manually capture this information.

Pay now or pay later: Regtechs make play to spare banks steep fines

After a record year of fines issued by the SEC, financial services firms are rushing to implement regtech solutions that can help mitigate their financial exposures.

Waters Wrap: Blockchain—let’s put the hammer back in the box

With the ASX Chess DLT failure and users ignoring DTCC’s DLT option for its Trade Information Warehouse, Anthony wonders what it will take for the industry to stop touting this buzzword for non-specialized needs.

The buy-side burden: Capturing every document, everywhere, all at once

Ensuring that buy-side firms capture all relevant disclosures from funds—especially in the private markets—can be an onerous and costly task. Accelex is aiming to change that.

OK regulator? How AI became respectable for AML controls

Dutch court case pressures supervisors to accept new tech; explainability the key challenge

Regulatory reporting: Firms seek flexibility, automation and the cloud

This report, created by WatersTechnology in association with Regnology, focuses on the state of play across the industry with regard to regulatory reporting.

Inside look: Taking aim at data processing blockages

A startup is looking to automate the bulk of banks’ data processing workflows.

.jpg.webp?itok=o1aIsAwN)