BlackRock developing AI copilots for Aladdin

The world's largest asset manager hints at new AI assistants for investment management clients.

BlackRock is building AI “copilots” for Aladdin, its flagship investment management platform, according to chairman and CEO Larry Fink.

“The Aladdin platform is constantly in a state of innovation. Investments in Aladdin AI copilots, enhancements in openness, supporting ecosystem partnerships, and advancing whole portfolio solutions—including private markets and digital assets—are going to further augment the value of Aladdin for our clients,” Fink told investors on the firm’s Q4 earnings call.

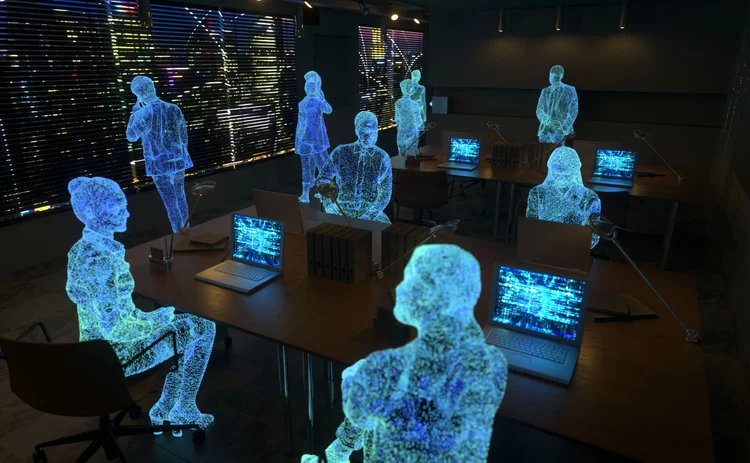

Copilots are digital personal assistants built using large language models (LLMs) enriched with a user’s own data to help augment their workflows. BlackRock did not give details on the copilots, but one potential use of the technology could help investment professionals visualize the performance of selected aspects of their portfolios in different scenarios, all based on written instructions.

For example, last year, Microsoft unveiled plans to integrate copilots into its suite of enterprise products. The Microsoft 365 Copilot, which was released to the market last November, can already be used to scan a user’s email inbox for outstanding tasks or remind them about commitments they have made.

The first assistive copilot launched by the software giant was on developer platform GitHub. In an exclusive interview with WatersTechnology, Microsoft’s corporate vice president of worldwide financial services, Bill Borden, said that the trial yielded productivity gains in excess of 55% for coders. It’s unclear at this point if BlackRock will use copilots developed by Microsoft, a different third-party provider, or if the company will build these copilots internally.

Last year, WatersTechnology reported on BlackRock’s plans to turn Aladdin into a one-stop shop catering not only to trading, but also to adjacent business functions like accounting books of record and data warehouses.

“It will be risk management, it will be the investment book of record, it will be performance, it will be accounting, and it will be the data surface,” said Sudhir Nair, global head of the Aladdin business, at BlackRock’s 2023 Investor Day.

Aladdin has around 130,000 users at more than 200 financial institutions. On today’s earnings call, BlackRock executives signaled future technology investments as it attempts to grow the platform’s functionalities.

In the 2023 financial year, BlackRock brought in over $1.5bn in tech services revenue. In the same period, more than 50% of Aladdin sales were multi-product, reflecting the firm’s strategy of upselling additional services to existing clients.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

This Week: Trading Technologies completes ANS deal; State Street; Equinix; and more

A summary of the latest financial technology news.

Interactive Brokers looks beyond US borders for growth opportunities

As retail trading has grown in volume and importance, Interactive Brokers and others are expanding international offerings and marketing abroad.

JP Morgan’s goal of STP in loans materializes on Versana’s platform

The accomplishment highlights the budding digitization of private credit, though it’s still a long road ahead.

As data volumes explode, expect more outages

Waters Wrap: At least for those unprepared—though preparation is no easy task—says Anthony.

This Week: ICE Bonds and MarketAxess plan to connect liquidity networks, TS Imagine, Bloomberg, and more

A summary of the latest financial technology news.