BlackRock

Nevirs Trades BlackRock for Franklin Templeton

Data vet has also served at Interactive Data, Thomson Financial and Moody's over a 24-year career in market data.

No Risk Management Without Technology, Says Blackrock’s Fishwick

Technologies that underpin investment risk management are fundamental says Blackrock co-chief risk officer.

BlackRock Ups Counterparty Due Diligence with Thomson Reuters Org ID

Buy-side giant complements existing process with outsourced service.

Japan Unconvinced of Big Data’s Potential

Firms still waiting for 'eureka' moment on Big Data's value in capital markets.

Notebook: Some More Industry Feedback on Fixed-Income ETFs

Industry experts give their thoughts on the fixed-income ETF space.

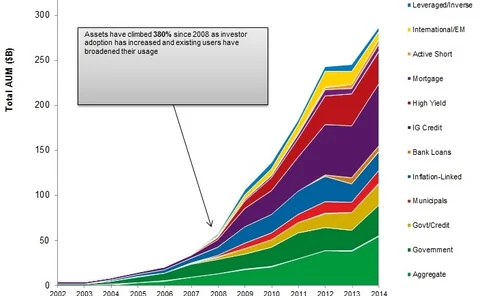

Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed…

Old Bonds, New Pillars

Where to go for analytics-based intelligence is changing with needs.

Competing on Tech Keys BNP Paribas Sec Services' Growth, Says CEO

Acquisitions, analytics demand significant investment

Rebuffing HFT, Nine Buy Sides to Launch Luminex Dark Pool

Fidelity will have the largest ownership stake in Luminex Trading & Analytics

Goldman-Led Consortium Unveils Symphony Communication Services

In what's seen as an effort to compete with the likes of Bloomberg, Thomson Reuters and Markit, Goldman Sachs and 13 other industry partners have invested in a new company called Symphony Communication Services Holdings, after it acquired Perzo Inc.,…

Top Banks, Hedge Funds Buy Perzo Messaging Platform for $66M

A consortium of 14 major financial firms has acquired Palo Alto, Calif.-based messaging platform provider Perzo and renamed it Symphony with a $66 million investment to provide an open-source, secure and compliant messaging platform for financial…

BlackRock's Aladdin: More Powerful Than Politics?

Bold, hyperbolic statements about technology are commonplace in 2014, whether reveling in its potential or damning its influence. Tim examines one such argument that takes the latter bent, relating to BlackRock's massive Aladdin platform.

Front-Office Influence Wanes in Modern Buy-Side Firms

A hard-and-fast rule in buy-side firms used to be that the trader’s word was God, at least for middle- and back-office teams who often had to scramble to implement their requests at short notice. Given the increased focus on cost savings and efficiency,…

Extending 'Continuum of Innovation', BlackRock and Tradeweb Ally on Electronic Rates Trading

A recently announced and newly-integrated electronic trading solution will fuse Tradeweb's marketplace with Aladdin for order management, pricing, and execution of interest rate products and derivatives, serving only to deepen one the industry's longest…

Collateral Transformation, Agency Execution to Reinforce Swap Dealers' 'Stickiness'

As the buy side ramps up simulation of electronic swaps execution ahead of next year, panelists say old questions remain about what sell-side services will gain steam, and which are technologically feasible at all.

Collateral Transformation, Agency Execution to Reinforce Swap Dealers' 'Stickiness'

As the buy side ramps up simulation of electronic swaps execution ahead of next year, panelists say old questions remain about what sell-side services will gain steam, and which are technologically feasible at all.

Moving Parts and Closing Gaps

Corporate actions professionals are looking at how to automate more complex pieces of processing these events, Michael Shashoua reports. Messaging standards and complex instructions and choices are key factors

IRD's Editor on ISO 20022 and LEI Developments

Support for the ISO 20022 messaging standard could be wavering in the industry. In contrast, a maneuver by the US Office of Financial Research could improve the LEI's prospects

ISO 20022 Likely Stalled For Years More, Say Corporate Actions Execs

Efforts to phase out the use of the older ISO 15022 standard for corporate actions messaging on a worldwide basis are still failing to gain traction in the industry, executives from BlackRock and Barclays Capital said in a recent webcast

Corporate Actions: Off and Running -- webcast

Inside Reference Data gathered leading industry experts for a webcast on July 17, 2013 to discuss how financial services firms are managing the challenges of upgrades to messaging standards and increases in volumes and types of corporate actions events.

BlackRock's VedBrat Explains SEFs to the Buy Side

While the sell side and larger buy-side institutions have been preparing for the entrance of swap execution facilities (SEFs) to the market for some time, medium and small buy-siders have not. Supurna VedBrat, BlackRock's co-head of electronic trading…

BGI’s IBOR System Offered Strengths, But Also Weaknesses

During a case study presentation at the recent Buy-Side Technology European Summit 2013, Jon Rushman, professor of practice in the finance group at Warwick Business School, outlined construction methods for an Investment Book of Record (IBOR) system,…