Blockchain Investments Survive the Crypto Winter

Investments into blockchain have continued to grow despite the crypto winter and the downfall of ICOs. VC investors are banking on their belief that blockchain will ultimately offer transformation across many industries,.

Bitcoin may have fallen from grace in the eyes of investors, but blockchain’s bull run shows little sign of slowing down.

After peaking at nearly $20,000 per coin in December 2017, the price of the cryptocurrency dove off a cliff, reaching lows of around $3,500 by the end of 2018. A series of enforcement actions by regulators over initial coin offerings (ICOs) also continued to damage the reputation of crypto generally. However, while the conversation had generally shifted to crypto, blockchain technology continued to receive large levels of investment.

“There’s a misconception that the cryptocurrency price drop is indicative of blockchain adoption but these are two very separate issues, and blockchain is immensely useful for many business cases, regardless of what happens in the cryptocurrency market,” says Eli Stern, partner, and principal at consultancy EY.

Estimated investments into blockchain vary, and few make the distinction between blockchain as a technology and digital assets. However, the general trend is that investments since 2014 have only gone up.

According to KPMG’s Pulse of Fintech 2018 report, global investments into blockchain reached $4.5 billion in 2018 from $700 million in 2014. The report noted a sharp increase in investments into blockchain from 2016 to 2017. Research firm CB Insights also found that investment activity from a pool of 23 venture capital (VC) firms it tracks ballooned to $465 million by the fourth quarter of 2018, led by a few major investment rounds.

ICO-No

While the precise delineation of investments is hard to come by, it’s also clear that VC firms have become increasingly selective in digital currency investments, preferring to focus on distributed-ledger technology firms rather than ICOs.

Pierre Lavaux, a venture partner at SGH Capital, says blockchain intrigued him because it’s a nascent product, but he took a more cautious approach when ICOs started becoming popular.

“The reason we started looking into blockchain is that we’re an early stage venture firm. But we saw a lot of ICOs coming out and that seemed to be the new funding mechanism for a lot of these firms. We saw that many of the teams seemed inexperienced and their milestones were ambitious,” Lavaux says. “Basically, it looked to be an excuse for people to get a large amount of money.”

Lavaux says firms that have more than a passing interest in digital assets and technology see great potential in blockchain and digital assets because they believe it can change many inefficient business processes.

However, a common refrain from many investors is that the noise of the hype machine and the rise of the ICO cast a cloud over public perception of the blockchain.

KPMG said in its report that 2018 “saw more private investment by count within the blockchain and cryptocurrency space than ever before,” adding that sober-minded institutional investors recognized that business processes could be made more efficient with the technology in play.

Regional investments in distributed-ledger technology are also growing. IDC said in its semi-annual blockchain spending report that European blockchain investments would grow to $815 million in 2019. Beyond the West, firms based in Asia-Pacific are also steadily betting on blockchain, particularly as projects like the Australian Securities Exchange’s (ASX’s) transformation of its clearinghouse to blockchain technology moves forward. By far though, it is North America, particularly the US, that outspends other regions.

There is also a growing interest in putting money toward infrastructure around crypto assets such as trading platforms, custody, and clearing operations, some of which are being developed using blockchain. Many investors say crypto trading infrastructure will play a much bigger role in the future.

EY’s Stern says investments tend to be cyclical depending on what has generated the most hype, so when people start talking about the importance of infrastructure around crypto trading, investors start putting money there. However, in the long run, investors want to go with something they feel provides the best long-term value.

In the past 12 months alone, money has been pouring into established blockchain firms. Recent fundraising announcements include Symbiont, which received a $20 million investment lift from Nasdaq Ventures and other investors in January. Curv, a cryptography firm for blockchain and distributed ledger databases, raised $6.5 million in late February and crypto industry research firm Chainalysis received $30 million in its last funding round.

Despite being in similar fields, however, the distinction between cryptocurrencies and blockchain is important to understand. The two offer different value for investors and often have vastly different business models.

“The crypto winter caused a false perception that blockchain is not a good investment, but people are still bullish. It has tremendous value in its use. Bitcoin is a small derivative of blockchain that people sometimes conflate,” says Stern.

Crypto Winter

The so-called crypto winter—the cryptocurrency industry’s moniker for its ongoing bear market—saw prices of bitcoin fall over 75% from $19,873 to 2018 lows of around $3,000. While some of this, the popular wisdom contends, was due to the introduction of futures by CME Group and Cboe Global Markets in December 2017, price stabilization can only account for so much of the fall.

The public perception around blockchain and cryptocurrencies took another hit around the time ICOs started becoming popular.

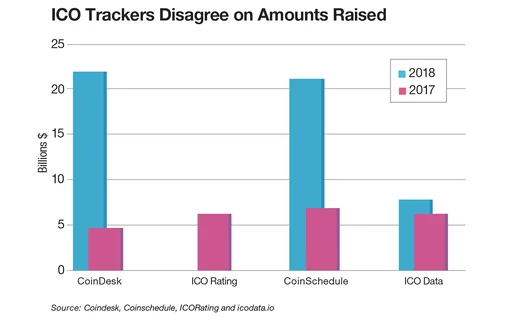

ICOs became a preferred method of fundraising for many start-up firms that were either working on technology, sometimes blockchain, pushing a token or a new cryptocurrency. ICOs proved to be a successful way of making quick money. After all, ICOs did not necessarily require the extensive prospectuses and other documentation that traditional initial public offerings must have, and the ease of starting one inevitably attracted bad elements. ICOs raised an estimated collective $22 billion in 2018 alone, according to news outlet CoinDesk, which tracks ICO figures. With such eye-watering sums at stake, the sector quickly came under the scrutiny of regulators like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The SEC cracked down on ICOs by declaring them as securities offerings, and in November 2018 fined two companies—CarrierEQ, also known as Airfox, and Paragon Coin $250,000 for failing to comply with requirements to register securities. This action, and others like it, turned off a lot of institutional investors.

Ben Spiegelman, head of strategy at Symbiont, says he started seeing a shift in how blockchain firms raised funds at the time.

“Investment dollars shifted a bit with ICOs down. The money went to more specific companies, and people who are more interested in the technology are still hopeful we can get that breakthrough technology with a single source of truth,” says Spiegelman. “So if an investor believes in the technology and its benefits, you’re going to see investment dollars there.”

The ICO debacle, investors and blockchain executives say, made investors more diligent about researching companies they want to invest in but did not dampen their excitement over blockchain’s potential.

Spiegelman says the past few years has changed much in the investment spectrum for blockchain technology companies despite the drop in bitcoin prices and the general perception of the technology.

“In terms of the investment spectrum, a lot has happened in the past two to three years. Early investments in 2015 and 2016 were really focused on enterprise blockchain, but we saw a back-and-forth in interest between blockchain and crypto, particularly when bitcoin hit $1,000,” Spiegelman says. “And yeah, some investments into cryptocurrencies may have done well, but when you go down into the weeds, there’s more money invested into technology. So we just kept our heads down and continued to work on our technology.”

Hype Cycle

Ultimately, one of the best things to happen to blockchain, and investments into the technology, is the waning of its hype cycle.

“The hype is more of a distraction. It does get you some marketing, like having a conversation with you or going to conferences, and that sort of thing,” says Bill McGraw, CEO of VC firm Northstar Technology Ventures. “There’s more of a proof of the technology now, and instead of just talking about the market, we can talk more about the nuances in the technology and look further into where we can best invest.”

McGraw notes he saw firms hunker down and perfect their products, which of course gave investors confidence that they will see a strong return once the platforms are commercialized.

Spiegelman and others who work in enterprise blockchain say the slowdown in the hype cycle may even have benefited the industry because it kept speculators at bay and expectations at a manageable level. The hype around blockchain as a technology has now largely settled, compared to the frenzy of just four or five years ago, when its most ardent evangelists were claiming the technology would reform everything from capital markets to cancer treatment.

With the waning of the cycle, much of that hot air has left the room. Spiegelman, and even SGH’s Lavaux, point out that companies began to trim down use-cases to projects that have a better chance at commercial production.

Of course, the more transformative projects based on blockchain have not fully materialized yet, but many investors and industry observers still have faith. Some simpler blockchain solutions, particularly those involving databases, have moved ahead. One key project, the renovated Trade Information Warehouse from the Depository Trust and Clearing Corp. (DTCC) is set to go ahead in late 2019 and is expected to serve as a litmus test for the deployment of the technology in a demanding use-case. The ASX’s clearinghouse, the next evolution of which is scheduled to run on blockchain technology, had to be pushed back to 2021.

Still, other blockchain projects moved closer to production. Financial firms have begun building applications and smart contracts on the blockchain. Symbiont, for example, is already offering its smart-contract platform for banks to experiment with the technology. Digital Asset also made its smart contract language DAML open-source, because it saw increased interest. R3’s Corda blockchain has seen growth in applications. Other industries and sectors, like supply chain management, have built systems to track goods using the technology while payment providers continue to explore its utility.

McGraw says blockchain technology’s potential did not dim, even if the hype cycle has essentially died down.

“I think the compelling part of this never really went away. Again, if we go back to how people got into this, there was the craze around the investment around the ICOs and crypto, and that I think skewered the market. But underlying it, there was—and still is—real confidence that this is going to change the way that business interacts,” he says.

McGraw says his firm is primarily interested in investing in projects and technologies that it feels will bring smart securities to capital markets, and provide an enterprise solution to the movement of money and management of supply chains.

Both McGraw and SGH Capital’s Lavaux point out that people who invest in blockchain understand there is an adoption curve to consider when a new technology is evolving.

“There is a sense of ‘build it, and they will come’ in the blockchain industry because things get adopted incrementally. However, we see those projects around issuance, identity security or things that require trust are getting more focus, and we’re very much interested in,” McGraw says. “But it is also good to point out that companies that are established outside of blockchain that then add some sort of blockchain component become trusted compared to purely blockchain firms.”

Scott Freeman, co-founder, and partner at VC firm JST Capital, says he envisions a time where blockchain technology is ubiquitous, so much so that people don’t even realize the technology is being used to facilitate their transactions. He notes there is a big opportunity in investing in blockchain technology and more actual dollars are involved in producing a solution.

Educating Investment

Venture capitalists like Northstar, SGH Capital, and JST Capital make their bets on blockchain because of its potential uses not just in the financial services industry but also for projects in healthcare, logistics, insurance, and others.

Investments into blockchain technology also grew because the companies looking for funding are further along on their journey and need larger amounts. The technology may be early stage still, but the companies developing it are less start-up in outlook, and a little more mature.

Tim Coates, Synechron’s assistant director and head of blockchain for North America, says the investors coming into blockchain understand a lot more about the technology and believe they can get a solid return on their money.

“Many investments into blockchain have been overinflated, but they’re overinflated because so many people have made so much money in the space. In the ICO era, people were investing with their hearts, but now people are investing more with their heads,” he says. “You see ICOs die out, but VC firms entering now have strong engineering backgrounds and can pinpoint the areas where they see the best financial return in such a nascent space that is rich in opportunities. I think everyone thinks there is something transformative about blockchain and getting in now means you can get returns.”

With maturity also comes the ability to rationalize which areas to focus on and bring to production. Companies are already working on fewer proofs-of-concept and use-cases, and more on advanced-stage projects.

The sector’s maturation has also attracted other kinds of investors into distributed-ledger technology. Over the past few years, corporate-backed venture arms have also begun to put money in with the early-stage VCs. Symbiont’s Spiegelman says his firm has begun looking for more strategic partners, like Nasdaq, who can inject capital, but also allow for co-development of products or services, while introducing them to a wider customer base. He says it was a conscious decision to look for companies that offer the ability to experiment with real financial services problems.

Investors like Northstar’s McGraw say they are in blockchain for the long run, even if the line between blockchain technology and cryptocurrencies blurs even further. Blockchain, after all, began life as the underlying technology for bitcoin, and companies are now looking at ways to use blockchain as a means to issue securities and support crypto asset trading.

Synechron’s Coates says it’s possible that investments in blockchain will move away from individual chains.

“I think the strongest community is in the public blockchain. There are still missing pieces to the jigsaw to be able to do issuance of securities on a public blockchain in a regulated manner, and there are many limitations on the underlying Ethereum protocol and other protocols as well,” he says. “Lots of firms are looking to provide all sorts of different services in the space where with time we can be doing strictly legal transfers over the public blockchain.”

Tallying the Blockchain Leaders

As the hype around blockchain dies down, many firms working with the technology have gone through their portfolios and trimmed them down. Cutting down on simple use-cases ideally allows firms to focus on projects that may actually make it to production. These are some of the highest-profile blockchain projects in the capital markets to date.

DTCC’s Trade Information Warehouse

The Depository Trust and Clearing Corp. (DTCC) is currently testing the Trade Information Warehouse (TIW), which will handle lifecycle events in the credit derivatives market. It was developed in partnership with IBM, Axoni, and R3. TIW is expected to go live in the fourth quarter of 2019.

CLS LedgerConnect

CLS partnered with IBM for a proof-of-concept to provide a secure, permissioned platform so institutional clients can access, share and deploy data and services. It will be built on IBM’s private blockchain using Hyperledger Fabric.

ASX

The ASX, along with Digital Asset, is in the process of setting up the replacement for its clearing system. Called Chess, or the Clearing House Electronic Subregister System, it lives on the blockchain and is expected to cut settlement time. ASX has had to push back its launch to 2021 after clients asked for a delay.

Northern Trust Private Equity Blockchain

Northern Trust got its blockchain for private equities off the ground in 2017. The blockchain aims to provide a space to share data and documents to private equities, lawyers and auditors. The bank announced it also plans to expand the private equity blockchain.

R3 Corda Blockchain

R3, a consortium of several banks and firms, released an enterprise version of its Corda blockchain network. Corda Enterprise already hosts live applications for the insurance, healthcare, and shipping industries. Financial firms like Finastra, Tradewind Markets and TradeIX have also announced applications going live on Corda Enterprise.

Paxos Precious Metals Blockchain

Paxos announced in May 2018 that it is going live with its blockchain for gold bullion in that same year. The precious metals blockchain is meant to ease the post-trade process for trading gold and other precious metals. Paxos originally partnered with Euroclear but released the platform on its own after Euroclear pulled out of the project. INTL FCStone is one of the first users of the service.

Symbiont Assembly

Symbiont is moving to production of its smart contract platform Assembly. With a $20 million capital infusion, the company says Assembly is a distributed platform that lets users create smart contracts so they can issue, manage and trade financial instruments but still keep a golden source of record.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

This Week: Startup Skyfire launches payment network for AI agents; State Street; SteelEye and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: Standard Chartered’s Brian O’Neill

Brian O’Neill from Standard Chartered joins the podcast to discuss cloud strategy, costs, and resiliency.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

The IMD Wrap: With Bloomberg’s headset app, you’ll never look at data the same way again

Max recently wrote about new developments being added to Bloomberg Pro for Vision. Today he gives a more personal perspective on the new technology.

LSEG unveils Workspace Teams, other products of Microsoft deal

The exchange revealed new developments in the ongoing Workspace/Teams collaboration as it works with Big Tech to improve trader workflows.