Bloomberg

Waters Wrap: Some random thoughts about Big Tech disruption and M&A in Q4

Anthony looks at what he thinks will be the biggest topics during the last quarter of 2021.

Waters Wavelength Podcast: Episode 241 (Big Tech and the capital markets)

Wei-Shen and Tony explore the idea of big tech companies disrupting the traditional Wall Street vendors.

This Week: CME/IHS Markit, Bloomberg, OpenExchange, Equinix, and more

A summary of some of the past week’s financial technology news.

A tale of two titans: Microsoft vs. Bloomberg

Bloomberg has fended off rivals to its business for years but Jo believes a more credible threat may be emerging.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

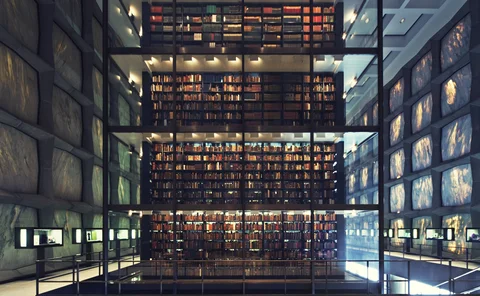

Waters Rankings 2021: Best market data provider—Bloomberg

Product: Bloomberg Market Data

Waters Rankings 2021: Best reference data provider—Bloomberg

Product: Bloomberg Reference Data

Waters Rankings 2021: Best sell-side order management system (OMS) provider—Bloomberg

Product: Bloomberg TOMS

Waters Rankings 2021 Winner's Interview: Bloomberg

Phil Harding chats to Bloomberg's Phil McCabe about his firm's win in the best sell-side OMS category in this year's Waters Rankings.

People Moves: Tradeweb, BondLink, Boosted.ai, Transcend, and more

A look at some of the key "people moves" from this week, including Devi Shanmugham (pictured), who joins Tradeweb as global head of compliance.

‘Connect’ schemes will force Chinese buy side IT overhaul

Initiatives that provide greater access to international markets, like the Stock Connect and Bond Connect programs, will drive change at Chinese asset managers struggling with legacy trading technologies.

Waters Wrap: Can interop connect the bond market better than consortiums? (Yes)

Anthony says that if trading firms want to take advantage of new datasets in fixed income and advancements in machine learning, they’re going to first have to embrace interoperability.

As fixed income edges toward automation, the interop movement is cutting in

Valantic FSA, a European solutions provider, wants to remake the fixed-income tech scene in interoperability's image, taking on incumbents like Ion Group.

This Week: Bloomberg, Broadridge, Rimes, Glue42, and more

A summary of some of the past week’s financial technology news.

Research management systems vie to double as data, analytics providers in one-stop-shop bid

RMS providers Sentieo and MackeyRMS feel the pressure to become quasi-data and analytics providers in their quest to cover the gamut of the buy-side research analyst workflow.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

Investment bank wraps up major tech overhaul after Covid-19 setback

Stifel Europe weathered 2020 volatility and switched vendors in looking to simplify its middle- and back-office functions and increase tech investment.

Symphony’s Seven-Year Itch

After seven years and half a billion dollars in funding, Symphony has made strides but arguably has not delivered the “big win” of living up to its early hype as a Bloomberg-killer. Max asks how long its investors will continue to back the venture,…

People Moves: BMO, Drawbridge, FinLync, GoldenSource, and more

A look at some of the key "people moves" from this week, including Lindsay Black (pictured), who has been appointed managing director of strategic initiatives in BMO's data & analytics group.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

New entrants want to feed bond market’s hunger for data

In the absence of a consolidated tape for debt securities in the EU, vendors with different approaches to distributing fixed-income market data are emerging.

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

This Week: Symphony, Digital Asset/Nasdaq, State Street, Finos & more

A summary of some of the past week's financial technology news.