Cloud

This Week: Bloomberg, Broadridge, Rimes, Glue42, and more

A summary of some of the past week’s financial technology news.

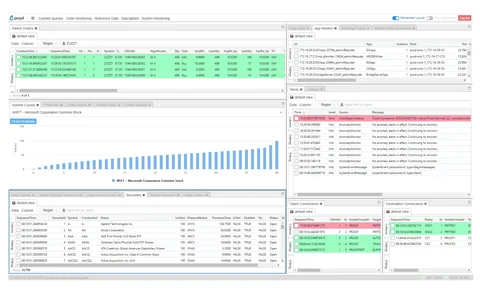

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

This Week: Nasdaq, NSCC, State Street, OpenFin/Broadridge, and more

A summary of some of the past week’s financial technology news.

Investment bank wraps up major tech overhaul after Covid-19 setback

Stifel Europe weathered 2020 volatility and switched vendors in looking to simplify its middle- and back-office functions and increase tech investment.

Symphony taps Google for cloud, AI, data-sharing tools

By leveraging Google’s AI and data-sharing capabilities, Symphony is strengthening its ties with the tech giant, which is also an investor in the platform.

Waters Wrap: On outages, teamwork & greed (And ESG innovation & consultants)

Anthony examines a proposed protocol in Europe that would help keep liquidity flowing if there’s a major exchange outage. He also discusses innovation in the realm of ESG, and Esma’s new data analytics platform.

Accenture wins contract for Esma’s big data analytics project

The consultancy will provide on-demand tooling for analyzing data collected from Data Reporting Service Providers.

Symphony’s Seven-Year Itch

After seven years and half a billion dollars in funding, Symphony has made strides but arguably has not delivered the “big win” of living up to its early hype as a Bloomberg-killer. Max asks how long its investors will continue to back the venture,…

People Moves: BMO, Drawbridge, FinLync, GoldenSource, and more

A look at some of the key "people moves" from this week, including Lindsay Black (pictured), who has been appointed managing director of strategic initiatives in BMO's data & analytics group.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

This Week: Oracle/Deutsche Bank, Northern Trust, Charles River, Simcorp, and more

A summary of some of the past week’s financial technology news.

Now that Oats is scrapped, regulators will have to (Cat)ch up

Retiring Oats is a milestone on the long and winding road to Cat implementation, but the SEC must make some major decisions in a very short timeframe before the Cat journey is over.

Waters Wrap: The Symphony-Cloud9 tie-up hints at a new tune for the comms provider

Anthony talks with Brad Levy about the company’s acquisition of Cloud9, its plan for future acquisitions, the possibility of an IPO, his thoughts on Big Tech providers, and more.

This Week: Symphony, Digital Asset/Nasdaq, State Street, Finos & more

A summary of some of the past week's financial technology news.

Rights automation group to debut digital language for market data policy expression

Community group that includes JP Morgan, Deutsche Bank, Amazon, and the CME plans to showcase over a year’s worth of work in a bid to drive broader adoption of the digital rights language.

Deutsche Bank leverages AI for securities services

The bank’s client segmentation offering creates more targeted post-trade offerings, while its prediction engine can help reduce settlement failures.

Nordea: Licensing changes could make RPA too expensive

The Nordic bank is looking for ways to mitigate costs as software vendors define new policy categories to capture robotic workers.

Waters Wrap: ‘Exponential technologies’ & the changing face of trading (And interop)

Evolutions in the realms of cloud, AI, and surveillance/encryption are making the possibility of a decentralized trading ecosystem more real. Anthony looks at how progress in these areas—as well as the interoperability push—will forever change the…

IBM’s ‘Cloud Satellite’ targets banks convinced of decentralized trading model

The tech giant believes a hub-and-spoke model is the future of trading. In part, it is using its new cloud offering to lure financial services firms that are looking to open remote offices to find new talent.

Waters Wrap: When will Big Tech providers turn sights on the market data space? (And deep learning)

In recent years, the major cloud providers have expanded their service offerings specific to capital markets firms. Some industry observers believe it’s just a matter of time until they get involved in market data M&A activity.