CME Defends Bitcoin Futures Approach

Exchange says it will not look to increase volumes at the cost of additional risk as participants question listing process.

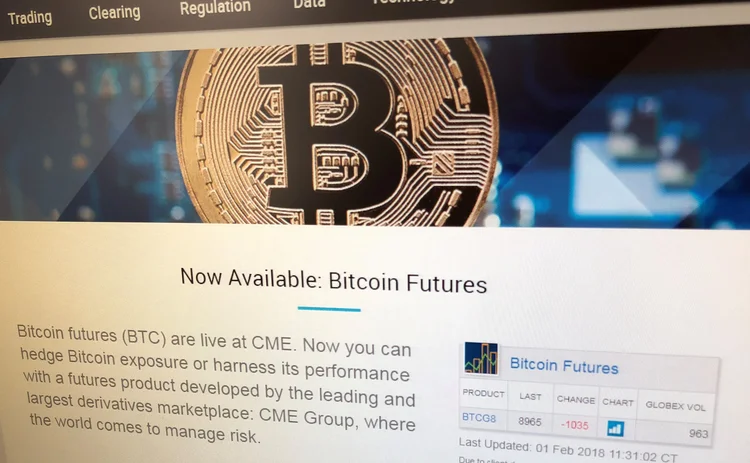

The Chicago Mercantile Exchange (CME) Group launched its futures contracts for bitcoin on December 17, one week after rival Cboe Global Markets debuted its own version of the contract.

While volumes have been relatively tepid since launch—coinciding with the end of a late-year bull run in bitcoin that saw its price reach over $19,000 at one point before falling to $8,950 today, according to Coinbase data—the exchange has attracted criticism from futures commission merchants (FCMs) concerned that the self-certification process for launching the contracts resulted in an inadequate level of wider debate.

Some of these criticisms have focused on the level of margin required to trade futures on the notoriously volatile cryptocurrency, and the mechanisms by which the collateral posted to guarantee trades is managed. Some FCMs believe that a separate default fund at clearinghouses, for instance, should be established to back up bitcoin trades and be segregated from wider futures default funds. Currently, the funds are commingled in the overall default fund.

In a call with analysts on February 1 for the exchange’s fourth-quarter results, however, CME chairman and CEO Terrence Duffy said that the exchange had managed the rollout prudently, and that it was not seeking to rush the process.

“This is wait-and-see,” he said. “The last thing I’d want to do is potentially lower the margins in the thought that we could effectuate a tremendous amount of trade off this. This is very much a walk as we go through this and not a run, so we will not do anything in the near term that we think could increase the trades at the point of introducing additional risk to the system.”

Open interest at the CME for January was around 1,400 contracts, while daily volumes tend to hover around 1,000 trades per day, which is marginal by comparison to more established contracts that the exchange lists—EMini S&P 500 futures, at the other end of the scale, had open interest of nearly 3.5 million contracts during the month.

Duffy also pointed to risk-management measures that had been developed specifically for the contracts in conjunction with the US Commodity Futures Trading Commission (CFTC) in the build-up to launch.

“As far as regulation goes, we worked closely with the CFTC before we launched this product,” he said. “We put new standards in place that we don’t have on our other contracts such as higher margins, velocity and stop functionality similar to what we have in the equity markets on percentages—I think it’s 7, 13, and 20 that we have on percentages as market volatility increases or decreases.”

Sean Tully, CME’s senior managing director and global head of financial and over-the-counter (OTC) products, added that the exchange has a position limit of 1,000 on the contract, while Duffy added the lot size is larger than Cboe’s at five bitcoins rather than one.

“We also designed this product, as you know, to make sure we did not attract the small retail participants. That’s not something that we want to be a part of, so our contract is much larger than our friends down the street’s contract, and I think that’s the prudent thing to do,” he said.

Futures Fracas

The CME earnings call followed an animated discussion at the CFTC’s Market Risk Advisory Committee (MRAC) on January 31, in which chairman J Christopher Giancarlo said the agency had been asked to amend the self-certification process by which exchanges are able to develop and list new contracts.

In a speech on January 19, he clarified that the exchanges were well within their rights to list the contracts without public consultation, and that “neither statute nor rule would have prevented CME and Cboe from launching their new products before public hearings could have been called.”

Despite this, he continued, he would be asking for enhanced disclosure in the future in the self-certification process.

The Futures Industry Association (FIA), a trade body that represents FCMs, had previously written to the CFTC in December, criticizing the “lack of proper transparency and input” in the process.

“A more thorough and considered process would have allowed for a robust public discussion among clearing member firms, exchanges and clearinghouses to ascertain the correct margin levels, trading limits, stress testing and related guarantee fund protections and other procedures needed in the event of excessive price movements,” the FIA wrote. “The recent volatility in these markets has underscored the importance of setting these levels and processes appropriately and conservatively.”

During the MRAC meeting, WatersTechnology’s sibling title Risk.net reported, representatives from exchanges said that while they believed the mechanism worked well as written, they admitted that there could have been a higher level of engagement with the industry.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

The costly sanctions risks hiding in your supply chain

In an age of geopolitical instability and rising fines, financial firms need to dig deep into the securities they invest in and the issuing company’s network of suppliers and associates.

Industry associations say ECB cloud guidelines clash with EU’s Dora

Responses from industry participants on the European Central Bank’s guidelines are expected in the coming weeks.

Regulators recommend Figi over Cusip, Isin for reporting in FDTA proposal

Another contentious battle in the world of identifiers pits the Figi against Cusip and the Isin, with regulators including the Fed, the SEC, and the CFTC so far backing the Figi.

US Supreme Court clips SEC’s wings with recent rulings

The Supreme Court made a host of decisions at the start of July that spell trouble for regulators—including the SEC.