Covid-19 Tumult Prompts Rethink of Buy-Side Risk Management

Investment firms are making changes to their risk reports, stress tests and concentration limits.

Evolution rather than revolution. Now that markets have, at least for now, bounced back from March’s lows, this is how buy-side firms describe the impact of the Covid-19 crisis on risk management. But whether profound or otherwise, changes in approaches will be multiple and wide-spread.

For Sudi Mariappa, global head of portfolio risk management at Pimco, the metaphorical lesson from the experience is “[do] more exercise and eat healthy”.

“The evolution will be: continue to define what your risk objective is, how you’re taking risk earlier in the investment process. That was a part of the process but it’ll be a bigger part,” he says.

According to a recent survey conducted by WatersTechnology sibling publication Risk.net of asset managers, hedge funds and other institutional investors, 67% of buy-side firms plan to make adjustments to their risk management practices as a result of the market turmoil. The changes range from more detailed risk reports to lower risk limits and more thorough stress-testing. And a host of them relate to liquidity risk.

“To the extent people were getting complacent, the Covid-19 crisis has strongly reinforced the importance of risk management discipline in general and liquidity risk management in particular,” says Tatiana Segal, chief risk officer at Morgan Stanley Investment Management.

“I expect that a lot of people will be enhancing their liquidity reporting,” Segal adds.

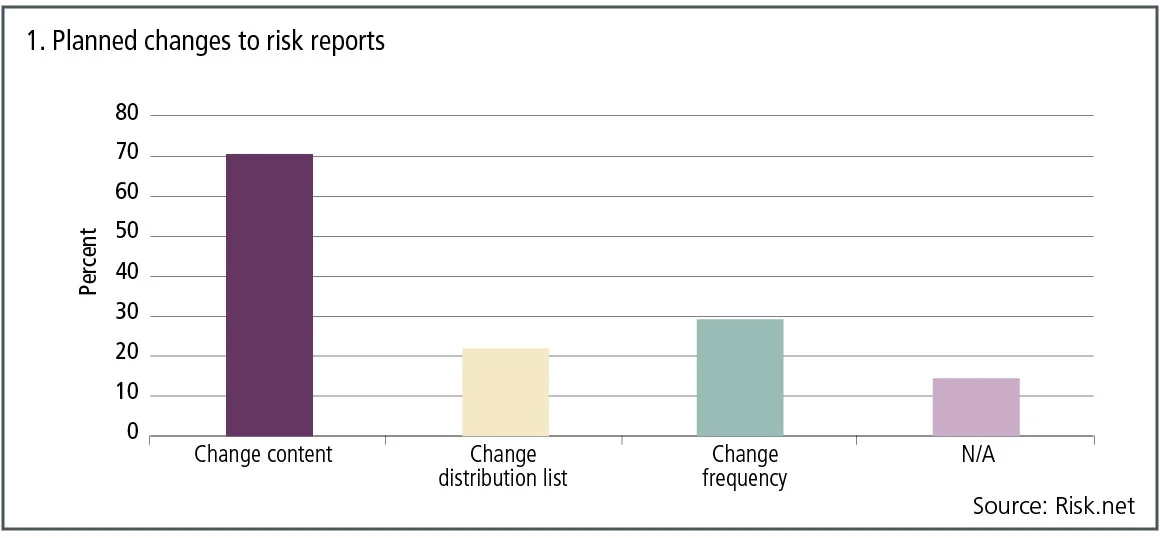

The survey responses suggest that the path to better risk management starts with more information: 71% of those firms that plan improvements intend to change the content of risk reports. According to risk managers and consultants, that means including more metrics in the reports.

But, according to Segal, it is not just the content of risk reports that matters—how they are delivered is also vital.

“In the fall of last year, we embarked on a project of building an interactive risk portal, and the crisis has really kicked this initiative into high gear,” she says. “With things changing so fast, it’s important to have the information at your fingertips, and having a curated collection of analytics available on a web portal rather than across various reports that are sitting in your inbox can be a game changer.”

Similarly, Nasreen Kasenally, chief risk officer at UBS Asset Management, emphasises the need to act quickly when markets turn stormy.

“I think everyone, not just in risk, has learnt that, during a crisis, making quick decisions and getting the right people to make the decisions are very, very important. How do we train our more junior staff to escalate more quickly? It has worked for us, but of course we can do it better,” she says.

UBS Asset Management was able to make decisions quickly thanks to a system of frequent updates across the firm, Kasenally notes. She received daily updates from her risk team and from portfolio managers and she also had regular calls with the executive team.

“We’ve since come up with a way to trigger those daily updates—for example, if the Vix increases by a certain amount, they will start again,” Kasenally adds.

The rise and rise of stress-testing

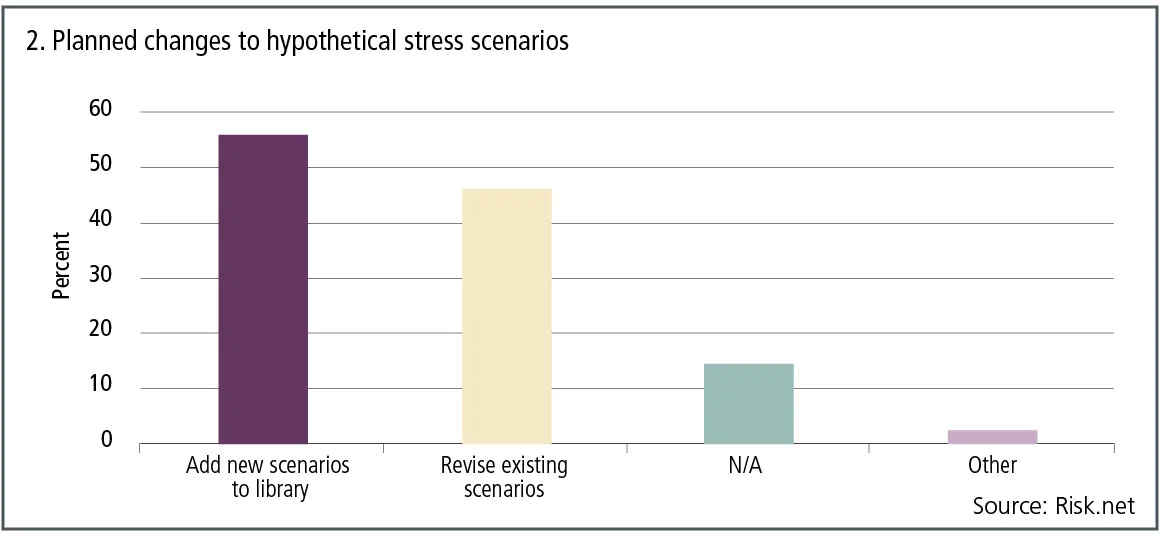

Another big conclusion from the market convulsions in March is the importance of stress-testing and getting it right. In the Risk.net survey, 56% of the firms making risk management changes plan to add new hypothetical stress scenarios to their libraries, 46% intend to revise existing hypothetical stress scenarios and 44% will apply more severe scenarios in liquidity stress tests.

Jorge Mina, head of analytics at MSCI, whose clients include asset management firms among others, says stress-testing came to the fore during the Covid-19 crisis.

“There are certain things that risk models can’t cover,” he explains. “For example, there was no way to anticipate a regulatory response, a policy response to the crisis. So the only thing you can do is have people who can imagine these scenarios and then run them through the models to see what would be the impact on your portfolio if the regulator responded in certain specific ways.”

Pascal Traccucci, global head of risk at La Française Asset Management, agrees. Speaking at Risk.net’s Quant Summit Virtual in July, he said the “quite significant” number of breaches of value-at-risk forecasts during the market selloff reinforced the firm’s view that VAR is “clearly not the right measure, especially for complex portfolios”.

Reverse stress-testing, conversely, is now seen as “even a better tool than previously” and La Française had been working recently on reverse stress tests for its portfolios. Such tests take a hypothetical outcome—say, a fund’s failure to meet a set level of redemption requests—and work backwards to see what combination of circumstances would lead to that outcome.

Mina at MSCI adds that another reason stress-testing is useful is because the process of coming up with stress scenarios leads to important discussions between risk and portfolio managers. “Just the process of doing that is valuable in and of itself,” he says.

Morgan Stanley Investment Management has constructed new scenarios related to the possible future directions of the pandemic with varying assumptions on the degree of support from the Federal Reserve. The aim is to capture changes in the worst-case scenario for the firm’s portfolios as exposures evolve, and to forecast liquidity shortfalls, says Segal.

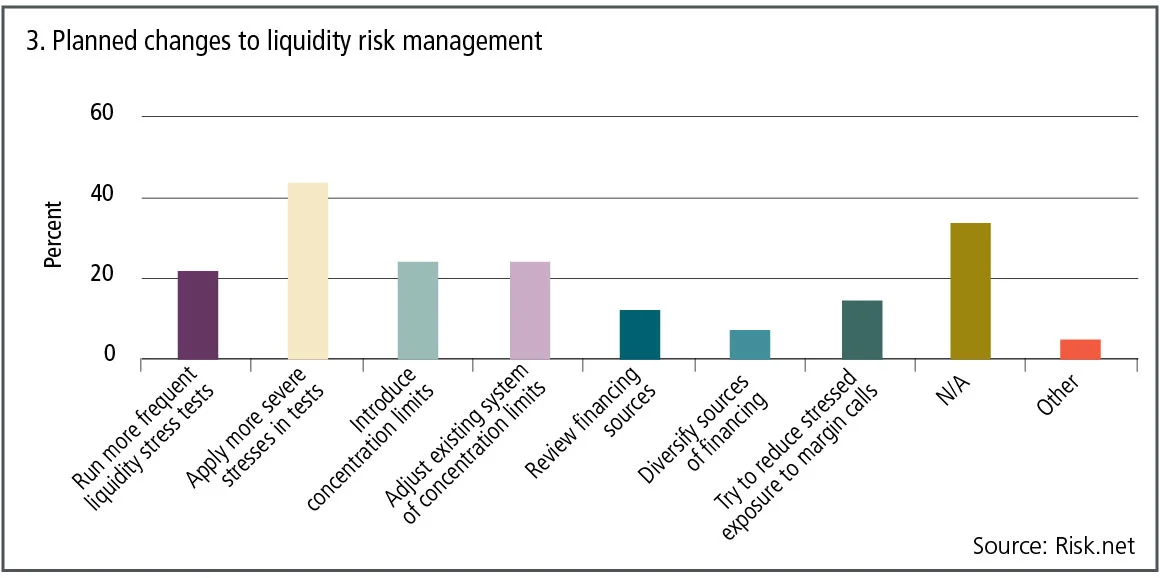

Stress-testing improvements feature prominently among planned changes to liquidity risk management, according to the Risk.net survey. In addition to using more severe stresses, which was flagged by 44% of the firms planning risk management changes, 22% will now run more frequent liquidity stress tests.

AllianceBernstein is one firm that will use more severe scenarios as a result of its experience in March.

“What if redemptions went up to 25%? Or 50%? Those are not scenarios that we would look at before,” says Andrew Chin, chief risk officer and head of quantitative research at the asset management firm. “What would happen if redemptions were like that? What parts of the portfolio would we have to sell? And what adjustments would we make across the portfolio to remain diversified? Because you can’t just sell all the liquid assets and end up with only illiquid assets.”

To set likely redemption levels for each fund, AllianceBernstein will work with its clients to understand their risk tolerance better, Chin adds.

“Clients don’t always tell you this themselves, so ‘this is what my leverage is, this is how I’m positioned’. Then we can make some estimates as to what they would do in a crisis,” he says.

You can’t just sell all the liquid assets and end up with only illiquid assets

Andrew Chin, AllianceBernstein

Redemption modelling has long been the poor relation of asset modelling—something the European Securities and Markets Authority has sought to rectify with its upcoming rules on liquidity stress-testing for funds.

But even on the asset side, predicting the liquidity of different assets in various scenarios is complicated by a lack of historical data, especially in fixed income and derivatives.

In partnership with various data providers, MSCI creates so-called liquidity surfaces for equities and fixed income assets. These are are used by its clients to estimate the cost to liquidate a position of a certain size over a given time horizon.

Still, Mina says every buy-side firm can help itself by aggregating and organising trading data from individual portfolio managers, so that risk managers can work with it.

“A lot of information is lost because it’s not collected in a way that can be used. And it doesn’t seem like a lot of institutions put emphasis on the collection of that data for use in a liquidity risk form,” he says.

Fewer eggs in one basket

Planned improvements to liquidity risk management also include introducing concentration limits and adjusting an existing system of concentration limits. In the Risk.net survey, each is mentioned by 24% of firms with risk management changes in the pipeline.

Amish Doshi, a partner in Accenture’s finance and risk practice, says his buy-side clients are monitoring their exposures to specific companies more closely.

“So if my firm is overexposed to a particular sector and if I decompose that into certain single names, depending on the strategy of the fund, then what are my concentration limits for those single names? How do I monitor those and what kind of data do I need? What analysis do I need, what’s my watchlist looking like? So on and so forth… I see firms upping the ante on that,” he says.

Mariappa at bond giant Pimco chimes with that. “What you’ll see now, what I call the aftershocks [of the crisis], might be more on a security or idiosyncratic risk level,” he says. “Sector concentration or single-name concentration may be a bigger risk going forward.”

One sector on his mind is energy, where defaults are rising. According to the latest monthly report from Fitch Ratings on US leveraged loan defaults, the default rate in the energy sector stands at 15.5% on the trailing 12-month measure, whereas the overall corporate rate is more than 4%.

For AllianceBernstein, there is another lesson on liquidity risk from the Covid-19 crunch. It did not come up in the survey but it is a risk that always looms large for asset managers: the danger lurking in liquidity mismatches.

“If the fund is daily liquidity but our instruments cannot be sold on a daily basis, then that’s a direct mismatch,” says Chin. “Now, you can have some such assets—maybe 5%, 10%. But if they make up 50% of your portfolio, maybe that’s not appropriate. You also have to match the liquidity of the investments in the fund with the horizons of the investors in the fund.”

AllianceBernstein will now be more careful about such mismatches, he says. For example, there will be a “robust” debate on less liquid instruments before they are put into a portfolio and the firm will consider limits on such investments in daily-valued portfolios.

If there is an overarching realisation from the crisis on what constitutes good risk management, it is probably this, as put by MSCI’s Mina: “You need to have different perspectives because different risk indicators are going to give you different signals depending on what’s going on.”

He points to survey findings on value-at-risk, stress-testing using historical scenarios and stress-testing using hypothetical scenarios: for each metric, around half of all respondents said it was somewhat useful during the selloff in March.

“And I think that’s the reality: any of these things in isolation are only somewhat useful—the usefulness comes from putting it all together,” Mina says. “That’s why the role of the risk manager is very important in interpreting that information. It’s about looking at various metrics and not looking at them point in time, but also looking at how they’re evolving.”

Additional reporting by Rob Mannix and Ben St. Clair

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.