Crypto Facilities Adds Settling and Clearing Standards to Bitcoin Trading with Elliptic Partnership

The Bitcoin exchange will now have a settlement and clearing mechanism separate from the exchange.

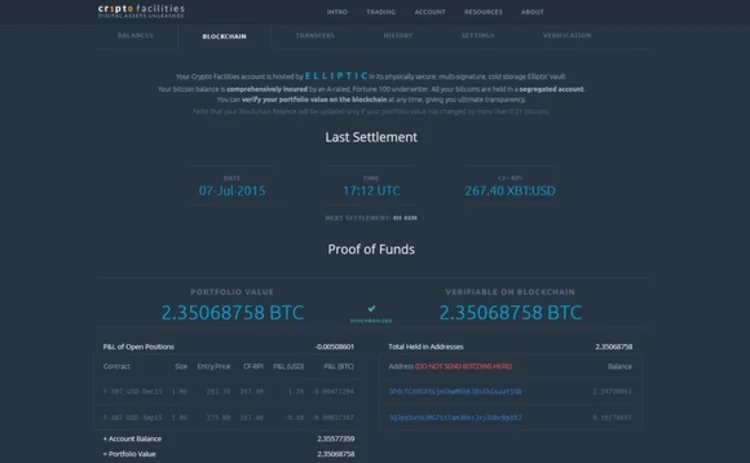

The exchange's client accounts will be hosted in Elliptic's vaults and insured by an A-rated, Fortune-100 underwriter. Each account will be settled blockchain technology every day and movement in the account can be verified through the blockchain.

The process differs from traditional Bitcoin trading venues, which typically combine clients' assets and manage them directly, according to the exchange.

Timo Schlaefer, CEO of Crypto Facilities, tells Sell-Side Technology that offering a settlement and clearing mechanism that separates Bitcoin custody from other exchange activities is a key component of reducing risk in the Bitcoin space.

"An exchange holding client funds is clearly one of the biggest risks in the Bitcoin ecosystem; 80 to 90 percent of the bad stuff that has happened [with Bitcoin] is due to exactly this problem," Schlaefer says. "It has to be removed, and I think the way to remove it is how you would do it in the business space. If you're an exchange, you don't want all the funds. I don't see any reasons why this should be different."

Schlaefer says Crypto Facilities, which was launched earlier this year, had always planned on implementing this service into its exchange. Both firms are based in London, and Schlaefer says the interactions the two sides had made him feel the Elliptic team had the right mindset for the job.

Right Tech, Right Time

Blockchain technology was designed to do this type of work, according to Schlaefer, and he's surprised it's taken this long for it to catch on.

"It's a common practice in the Bitcoin space that exchanges hold the funds in some sort of pooled wallet that is like a black box for an outside viewer," Schlaefer says. "You can do it very transparently by using a lot of blockchain technology."

Schlaefer believes this is a significant step towards legitimizing Bitcoin trading among the capital markets.

"I know that institutional clients will not trade without this. I think it's a necessary condition for professional markets when it comes to trading Bitcoin," Schlaefer says. "They can't just send funds through a company where they don't have any credit risk protection. That's not the way they operate."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

This Week: Trading Technologies completes ANS deal; State Street; Equinix; and more

A summary of the latest financial technology news.

Interactive Brokers looks beyond US borders for growth opportunities

As retail trading has grown in volume and importance, Interactive Brokers and others are expanding international offerings and marketing abroad.

JP Morgan’s goal of STP in loans materializes on Versana’s platform

The accomplishment highlights the budding digitization of private credit, though it’s still a long road ahead.

As data volumes explode, expect more outages

Waters Wrap: At least for those unprepared—though preparation is no easy task—says Anthony.

This Week: ICE Bonds and MarketAxess plan to connect liquidity networks, TS Imagine, Bloomberg, and more

A summary of the latest financial technology news.