Cryptocurrencies

This Week: SmartStream, LSEG/Finbourne, FactSet/Cobalt, DTCC, BNP Paribas, and more

A summary of some of the past week’s financial technology news.

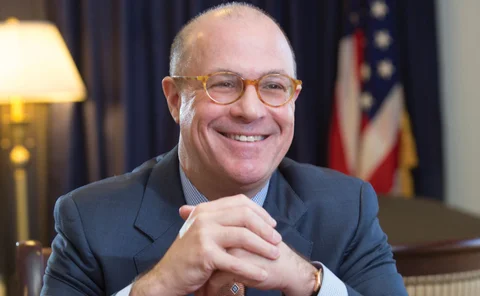

People Moves: Baton, Broadridge, BNY Mellon, Eventus, and more

A look at some of the key "people moves" from this week, including Mike Johnson (pictured), who joins Broadridge as VP and global product manager of derivatives clearing.

Waters Wrap: The expanding battle over reference data identifiers

Bloomberg, Broadridge, and Finra have all recently made news in the world of standards and identifiers. Anthony looks at some of the questions the reporters at WatersTechnology will be asking going forward.

Despite client concerns, LSE’s new Sedol fees take hold

Under the new fee policy, some of the largest users of the LSE’s identifier codes could see their Sedol spend more than double, though the exchange says the “vast majority” of clients will see no increase.

This Week: JP Morgan, Deutsche Börse, Refinitiv, and more

A summary of some of the past week’s financial technology news.

Waters Wrap: Would DLT really have prevented Archegos? (And thoughts on Itiviti)

While Christopher Giancarlo says distributed ledger technology could’ve helped prime brokers better monitor their risk exposures to Archegos Capital Management, Anthony (and others) are not so sure about that. He also looks at the Broadridge-Itiviti deal.

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

The former CFTC chair says managing collateral by using distributed ledger technology would enable the better oversight of risks.

Not all digital securities were created equal

Cusip’s Matthew Bastian explains that a tokenized asset offering is not the same as other products that get tagged as being a digital asset. The differences are becoming more important as the capital markets industry continues to explore these new…

BNY’s crypto gambit will test custody tech

As more traditional banks are starting to enter the digital asset custody space, Wei-Shen questions how interoperable they’ll be.

As the Benefits of Digital Assets Become Harder to Ignore, What’s the Path Forward?

Lisa Iagatta, Isitc chair, says financial institutions have an opportunity to create more efficient processes in areas such as trade settlements through the use of digital assets.

This Week: Janus/SS&C; Wolters Kluwer; Tora/Neptune; Standard Chartered/Northern Trust; SimCorp; & More

A summary of some of the past week's financial technology news.

EU’s Gaia-X Project: Reaching for Digital Sovereignty

Right now, details are scarce for the project, but Jo says that even if the initiative fails to get off the ground, it marks a big step in the bloc’s effort to achieve digital sovereignty.

Barclays Proposes New Taxonomy for Digital Tokens

The UK bank argues that a common approach to classifying tokens is needed to prevent regulatory arbitrage.

This Week: Northern Trust, HKEX, Digital Asset, SimCorp, and more

A summary of some of the past week’s financial technology news.

Brave New Coin Eyes Structured Products

The company aims to have a principal-protected structured income product by mid-September.

The Need for a Designated Crypto Asset Regulator

Senior academic says a new taxonomy—and a new regulator—is needed to determine whether crypto assets should fall under existing financial frameworks.

SocGen’s Digitized Bond Passes Settlement Test

Banque de France-backed deal pips private consortiums in dummy run for digital currency trades.

CryptoCompare Eyes Asia Cryptocurrency Indexes

The cryptocurrency data provider and index operator plans to exploit demand for digital currency trading in APAC by launching index products in the region.

This Week: Philippine Stock Exchange, IBM, Cboe, Esma & More

A summary of some of the past week’s financial technology news.

This Week: Charles River, Broadridge/IBM, Dash, TT, GAM/SimCorp

A summary of some of the past week’s financial technology news.

This Week: Fidelity Digital Asset, State Street, HSBC, Instinet, INTL FCStone, Quantopian

A summary of some of the past week’s financial technology news.

OKEx Expands Crypto Derivatives Offering

The Malta-headquartered digital asset exchange has upgraded its trading architecture, with an eye on futures and options trading features.