Data license policies

Euronext Ups ’15 Data, Non-Display Fees

European exchange group Euronext has notified customers of changes to its market data licensing agreement, dubbed the Euronext Market Data Dissemination Agreement, including new fees for use and redistribution of real-time and delayed data from its…

Update: BGC Sets New Non-Display Data Policies

Editor's note: This story has been amended to reflect clarifications provided by BGC that the new policy will not introduce fees for "Public" datasets. Inside Market Data apologizes for the errors.

Open Platform: The ‘Hidden Tax’ of Index Data

As index use has grown, so have the ways in which entrenched index providers are extracting revenues from licensing their indexes and underlying data. But with cost still a key concern, with the popularity of exchange-traded funds growing, and with…

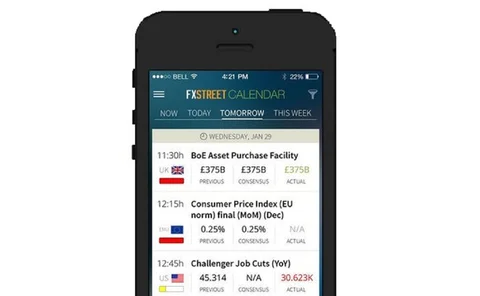

FXStreet's FXBeat Newswire Now a Premium Subscription Service

Foreign exchange news, commentary and data provider FXStreet has upgraded its FXBeat news and commentary feed to a premium service for traders and for brokers to integrate into their own trading platforms.

NYSE Overhauls Non-Display Data Fees

NYSE Euronext has informed clients of changes to its non-display policy for all real-time US proprietary market data products, which includes price increases of up to 100 percent for some products, in a move to bring its fees into line with those of its…

Screen Bows 2014 InfoMatch, Boosts e-Reconciliation, Index License Management

Dutch market data cost and contract management software vendor Screen InfoMatch has rolled out the 2014 edition of its InfoMatch data inventory and cost management tool, in response to demand for improved license management features from asset managers,…

Moscow Exchange Preps Unified Data Policy

The Moscow Exchange is expected to approve a new fee policy document within the next two months that will standardize the contract terms and costs of market data usage by its trading members, data vendors and other users, exchange officials say.

CME Eyes Summer Data Protocol Switch

CME Group is preparing to launch a new version of its market data platform later this year, MDP 3.0, which will feature a binary market data protocol designed to reduce the bandwidth required to deliver CME market data.

FISD Overcomes Non-Display Best Practices Stalemate

The Business Issues Policy and Procedures (BIPPS) Working Group of industry association FISD has reached an agreement on best practices around non-display data usage policies, following 18 months of stalemate on the issue resulting from conflicts between…

LME to Expand Direct Datafeed Access

The London Metal Exchange plans to introduce a new policy that will allow clients of its trading members to connect directly to a data-only feed from the exchange’s LMEselect electronic trading platform.

FTSE Urges EOD Index Data Compliance

London Stock Exchange-owned index provider FTSE has asked customers of its end-of-day index data to review their usage to ensure they are properly licensed, as part of continued efforts to promote transparency and compliance across its products and…

MDSL Preps Index, Trading Cost Management Tools

UK-based market data inventory management and usage monitoring technology provider MDSL is rolling out two new services aimed at helping financial firms manage their index data and FIX trading connectivity spend similar to how they manage market data…

NYSE Delays Order Imbalance Data Fees─Again

NYSE Technologies has delayed the introduction of new fees for order imbalance data from parent NYSE Euronext's New York Stock Exchange and NYSE MKT marketplaces for a second time.

2013 Review: Data Licenses Cause Friction Between Exchanges, Users

As exchange revenues from traditional activities such as trading continue to stagnate, more trading venues continued to increase market data fees and to change licensing policies to charge fees for datasets they previously made available at lower rates…

Russell Revamps, Unbundles Index Pricing

Russell Indexes, the index provider subsidiary of asset manager Russell Investments, is introducing a new pricing model for its RussellTick real-time feed of US and global consolidated index data, reflecting enhancements made to the product as part of an…

CME Readies Non-Display Data Fees

CME Group has notified customers of changes to its market data license agreement for 2014, including plans to introduce new fees for certain types of non-display data usage, Inside Market Data has learned.

BATS Chi-X Touts 2014 Data Price Cap, BXTR Reporting as Basis for EU Tape

BATS Chi-X Europe has pledged not to increase market data fees in 2014 for its US and European subscribers, following several well-publicized fee increases at regional exchanges, including the London Stock Exchange, which notified clients in October of a…

Opening Cross: Big Data, Small Print

The London Stock Exchange's consolidated data policy could bring benefits to end-users, though in most cases, more data and delivery mechanisms still means more fees.

LSE to Consolidate Data, FTSE Contracts

The London Stock Exchange Group is embarking on a project to simplify contracts within its Information Services division, which will see customers’ existing real-time market data contracts combined with licensing agreements from index provider subsidiary…

LSE Hits Users with Fee Double-Whammy

The London Stock Exchange has notified customers of a planned 2.5 percent increase in fees for a broad range of its market data services, covering the majority of its redistribution licenses, professional user fees, and non-display and application usage…

NYSE Cancels Global Agreements as WFIC Attendees Call for Data Admin Standards

NYSE Euronext has confirmed that it has put the introduction of its proposed new Global Data Agreements (previously known as Global Data License Agreements)—which seek to standardize the international exchange group’s multiple legacy data policies—on…

Chi-X Canada Bows "Retail Professional" Intermediate Data Fee Tier

Alternative trading system Chi-X Canada has introduced a new tier of market data fees for professionals such as investment advisors serving retail investors, developed with the assistance of market data and technology product management and marketing…

IMD Chicago: Exchange Data Fees, Policies Hindering New Entrants

The high cost of exchange market data─combined with unscheduled fee increases and a proliferation of new fees for previously free-of-charge data─continues to burden consumers, and is preventing newer firms from entering the market, according to a panel…