Data Management

Partnerships—Making the Data Industry Go Around

Exchange partnerships play a pivotal role across the capital markets by providing investors with data they wouldn’t ordinarily have access to, while simultaneously streamlining the legal and operational complexities associated with accessing that new…

As cybersecurity policy takes shape, are data vendors next in SEC's sights?

New rules target a range of players in the capital markets, from broker-dealers to trading venues, and the agency could be coming for data and analytics vendors and index providers.

Second class-action lawsuit targets Cusip’s ‘monopoly’ on identifiers

Days after a first class-action suit took aim at Cusip, S&P Global, the American Bankers Association, and FactSet, another plaintiff has filed a complaint alleging that the quartet of companies violated the Sherman Antitrust Act, as well as certain…

People Moves: BNP Paribas, HKEX, Broadway, BMLL, and more

A look at some of the key people moves from this week, including Tim Baker (pictured), who joins BMLL as senior advisor.

All about the integration: Melding tech is key to getting full value from vendor M&A

Recent tech and data M&A deals aren’t just about acquiring clients or 'bolt-on' solutions, but will yield longer-term gains through granular integration of the vendors’ product lines and technologies.

Waters Wrap: Questions raised by Cusip lawsuit

An investment bank and an asset manager have filed a class-action lawsuit against Cusip Global Services, S&P Global, the ABA and FactSet. Anthony explores some of the questions that such a suit raises.

As sanctions increase, banks struggle with growing compliance burden

Firms must get data management and compliance culture right if they really want to keep their books clean of crooks and sanctions-dodgers, and keep their reputations and bottom lines clean of regulatory fines.

Class-action lawsuit takes aim at Cusip, S&P, FactSet & ABA

A complaint filed March 4 seeks judgement on whether Cusip Global Services, S&P Global, the American Bankers Association, and (now) FactSet have violated copyright laws as well as the Sherman Antitrust Act by charging hefty licensing fees to use the…

Euronext’s datacenter move on schedule despite supply chain issues

Despite chip and hardware shortages, the exchange group says it is on track to go live with the new datacenter on June 6.

Barclays (and others) strive for machine learning at quantum speed

Embryonic work on quantum neural networks raises hope of faster, more accurate models

LSEG-Tora: A tale of crypto, Asia expansion and (more) integration burdens

When LSEG acquired Refinitiv, it added Eikon, FXall, and AlphaDesk to its portfolio of execution platforms. In February, the exchange also bought Tora, which has a stronghold in Asia, as well as a presence in crypto. While sources say there are clearly…

Europe’s banks brace for Russia-backed cyber retaliation

Beefed-up sanctions on Russia’s largest banks spark IT security alert; 100s of computers brought down in Ukraine

Waters Wrap: Google’s cap markets play portends a shift in trade tech philosophies

According to Google’s Phil Moyer, the capital markets are shifting from a world where location determined liquidity, to one where accessibility will be the main differentiator for exchanges. Anthony explores what this could mean for trading firms going…

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

People Moves: Tradeweb, Rimes, CME, LiquidityBook, and more

A look at some of the key people moves from this week, including Renaud Larzilliere (pictured), who joins Rimes as COO.

Asset managers seek greater transparency into ESG index providers’ ratings

While there is no consensus on whether ESG ratings providers should be regulated, asset managers largely agree that more transparency into their vendors’ methodologies is needed.

Memx data fees tackle professional vs. non-professional audit risk

The exchange delivers on its promise to reduce the cost of exchange data, but subscribers still face an administrative cost burden associated with the lower user fees.

Tech vendors rethink risk in era of surging options volume

As options volumes soar, technology vendors are thinking about new risks posed when legacy infrastructure meets increasingly complex markets.

People Moves: ASX, Nasdaq, Capco, FDIC, and more

A look at some of the key "people moves" from this week, including Edwin Hui (pictured), who joins Capco as executive director and APAC data lead.

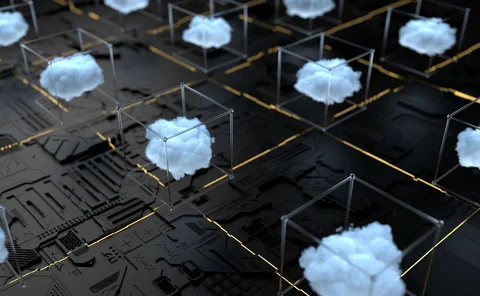

Waters Wrap: Data ownership & storm clouds brewing

Thanks to technological advancement, firms are finding new ways to monetize data. While the question of “who owns the data” was never a pressing one in the past, Anthony says that there are reasons to believe that will soon change.

Looming court battle could void SEC’s market data efforts

Litigation preview: What will the big exchanges argue in a court case to reverse the SEC’s initiatives?

Cost, security concerns dampen banks' appetite for multi-cloud infrastructures

As firms make progress on cloud adoption, they are discovering that multi-cloud strategies for individual businesses can not only duplicate costs, but can also inadvertently downgrade a firm's resiliency.

Danske Bank turns to licensing optimization for cost savings in the millions

In a cloud world, IT asset management can save on operational and compliance costs and get the most out of software usage. But it's important to find the right people for the job.

Whose data is it, anyway?

The issue of data ownership may be obscure, but has important consequences for firms considering alternative data models, or firms looking to commercialize their in-house pricing or other resources. So ask yourself some serious questions: Who owns ‘your’…