Demystifying private markets liquidity in 2023

Private markets are being democratized at an alarming rate, and the new entrants’ structures could be misleading. Time to cut through the noise.

At the institutional debt and equity levels, over-the-counter (OTC) trades have long allowed for liquidity following primary issues—albeit, liquidity with less transparency compared to public markets, prior to a final maturity payment or IPO. Across debt, investors come across odd-lot sizes under $1 million, which often trade differently than institutional lot sizes.

This same anomaly also occurs for single-name private stocks, frequently when an employee leaves the capitalization table for hundreds of thousands (rather than millions) of dollars; it is typical that their transaction would come with a final price lower than their earlier or more senior colleagues with millions traded per transaction.

ApeVue, an independent private markets data provider for institutional investors, observed an average size—including bids and trades—of about $12.5 million across a diverse dozen of the more liquid secondary names in 2023; issuers included Epic Games, Revolut, Databricks, SpaceX, and Flexport. Quantifying market depth here is key for institutions seeking liquidity and price accuracy, as a growing number of retail transactions obfuscate reality for asset managers.

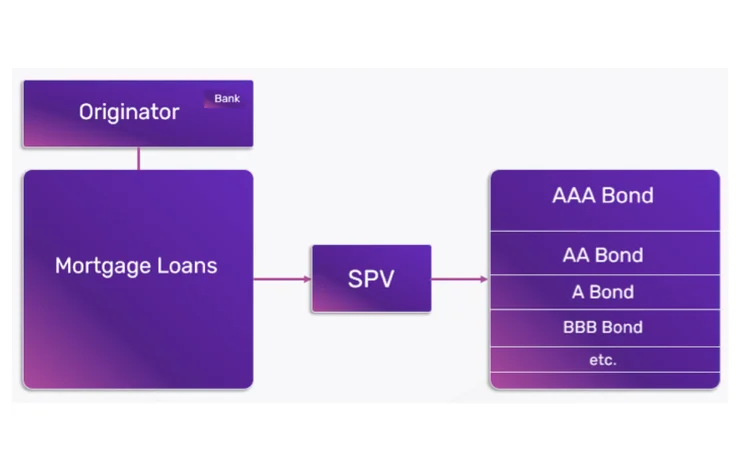

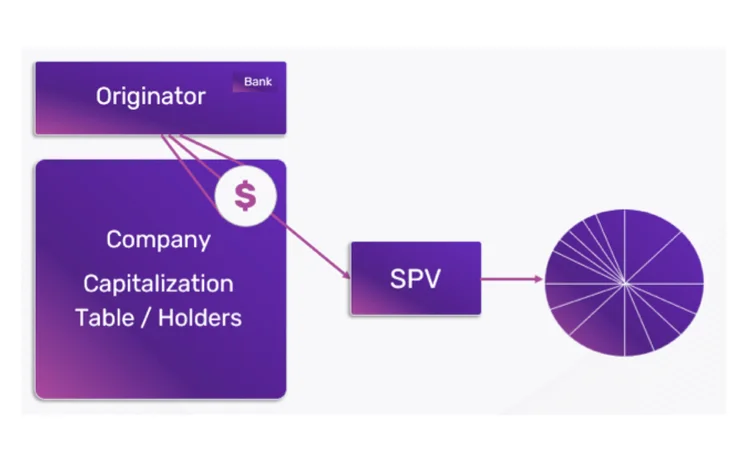

Albeit a different construct to how special purpose vehicles (SPVs) afforded the mass restructuring of mortgages pools, there’s separately a growing use for SPVs in private equity markets today that add to retail noise. Many recent private equity SPVs arguably bring more fragmented pricing to the market since the intent is not to tranche up varying cashflows for risk-weighted returns—as was done for mortgages—but rather allow for exposure at smaller client lot sizes. The simplified diagrams below compare an asset-backed security (ABS) SPV to an equity SPV*:

*Not all SPVs are built for the above construct, but this trend has grown to be significant.

There are several factors at play to be aware of on the equity side. The tranches sold through the vehicle are much smaller than the original stake, which may have traded as a normal institutional lot size, thus landing the originator directly on the capitalization table as a single $10 million or more “example size” line item.

Another comparison worth exploring when it comes to SPVs is who could be left holding the proverbial bag of asset/liability inventories. In the 2007–2008 mortgage market, Lehman Brothers and Bear Stearns were the bag holders

Underlying, however, there could be hundreds or thousands of participants with varying price points and terms—e.g., upfront fees and/or carried interest. Though the original entry example price at a $10 million size may be at a reasonable market-clearing price, these smaller resultant lots thereafter add an abstractly different view of the markets if used in liquidity or pricing measurement.

Another comparison worth exploring when it comes to SPVs is who could be left holding the proverbial bag of asset/liability inventories. In the 2007–2008 mortgage market, Lehman Brothers and Bear Stearns were the bag holders. Each firm held significant exposure to low-quality mortgage pools, which quickly deteriorated in value before the banks could unload the structured bonds to asset managers serving the general public, often with ratings as high as AAA.

The SPV process in private stocks today is less regulated, less understood, and substantially smaller. Stock issues will not come with a rating from the major agencies, which can of course speed up the time of structuring a large stock holding into many smaller SPV tranches, but marketing to retail investors who are also considered accredited truly takes time. In a declining market, this can be fighting the clock.

One of the saving graces of private markets historically has been that the last round valuations are outwardly marketed and used as today’s price, no matter how long ago this has occurred.

Coming full circle on liquidity, it is clear that in today’s secondary market, there are almost no buyers/trades at the last round price. If there is one takeaway on understanding pricing coming into 2023, it should be to focus on where institutional prices imply valuations.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Comment

In Absentia: Remembering Sandra Villena and finding her killer

Sandra Villena, a 32-year-old market data professional on the rise, was murdered while on vacation in October 2022. Nearly a year later, her friends and family are still seeking justice, while they learn how to live with the absence that now fills their lives.

In Absentia: Recordando a Sandra Villena y en búsqueda de su Asesino

Sandra Villena, una profesional de datos de mercado de 32 años con gran promesa, fue asesinada mientras estaba de vacaciones en octubre de 2022. Casi un año después, sus amigos y familiares todavía buscan justicia, mientras aprenden a vivir con la ausencia que ahora llena sus vidas.

Understanding investor overlap across late-stage private stocks

Investing in private markets is no longer just for venture capitalists and private equity funds. But as demand for stakes in these companies grows, so does the overlap in who is investing, as well as calls for more consistent valuations.

People Moves: DTCC, Octaura, Baton Systems, and more

A look at some recent people moves in the capital markets tech and data space.

American unicorns: When primary rounds are distant, secondary markets provide clarity

Unlike in the public markets, valuations of so-called ‘unicorn’ start-ups might only be updated following funding rounds. What if investors want insights more frequently?

Beware the duty of care! Why a level playing field for responsible data sharing in financial services is essential

By Elise Soucie, associate director, technology and operations division, at the Association for Financial Markets in Europe (Afme)

The tortoise and the hare ... and the unicorn

Where will private market unicorns finish in the race between the public market tortoises and hares? ApeVue looks at data from the opaque private markets for answers.

Waters Wrap: On getting back to normalcy

As “work from home” becomes the new normal, Anthony explores his own anxieties and whether they mirror similar trends unfolding in the workplace.