DTCC

Monetary Authority of Singapore Releases Timeline, Finalized Forms for Revised Reporting Notices

Financial institutions in Singapore have 24 months to be fully compliant with the Monetary Authority of Singapore’s revised notices 610 and 1003 for collecting trade data—though details of some asset classes will be released later, as the industry…

Global Fragmentation Looms in FRTB Data Pooling Stand-Off

The upcoming FRTB market risk framework allows financial firms to take different approaches to non-modelable risk factors: either capitalize risk factors that lack observable pricing in-house, or use a vendor-run data pooling utility. But, as Dan…

Hong Kong Regulators Propose LEI Mandate

HKMA and SFC would stagger the implementation dates for different reporting entities.

Digital Asset Opens Smart Contract Language to Developers

Blythe Masters says that DAML is designed to reduce the risk of developer error creating broader problems for the market.

Witad Awards 2018 Write-Ups: Technology Innovator of the Year (Vendor)—Jennifer Peve, DTCC

As the co-head of the Depository Trust and Clearing Corp.’s (DTCC’s) office of fintech strategy, Jennifer Peve has the broad mandate of ensuring that the DTCC stays ahead of the industry when it comes to fintech. That means having to know about…

Witad Awards 2018 Winner's Interview – Jennifer Peve, DTCC

The DTCC's Jennifer Peve, co-head of the firm's Office of Fintech Strategy, won the technology innovator of the year (vendor) category at this year's Women in Technology and Data Awards.

Utility Belt: How Utilities are Stepping Up

Banks, looking for ways to cut costs and meet regulatory pressures, are increasingly turning to collaborative projects like utilities.

Waters Wavelength Podcast Episode 114: A Recap of FIA Boca - Blockchain, Crypto, AI, Brexit

WatersTechnology attended the Futures Industry Association's annual conference in Boca Raton, Florida. These are the takeaways.

DTCC Chief: We’re Going to 'Disappear' As Blockchain Evolves

The head of the US depository system says the utility will not exist in its current form, but will have a central role to play in a post-DLT world.

Thai Stock Exchange Settles in for T+2

The exchange is looking to use technology to innovate its post-trade processes and introducing e-proxy and e-voting to benefit shareholders.

Emerging Tech Could Help Push Utilities Forward

European trade group releases report highlighting the challenges and opportunities associated with building industry utilities.

Putting the Fintech House in Order

Without adequate standards in place that are globally coordinated, the rampant growth of fintech may introduce more problems than it solves.

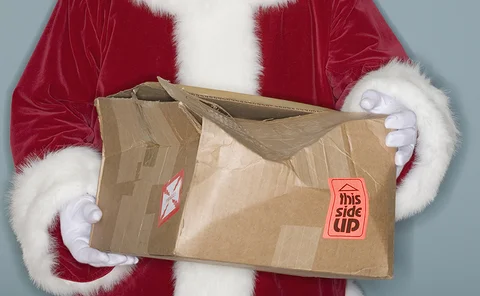

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.

DTCC Proposes Measures to Further Reduce US Settlement Times

The two proposals could bring settlement down to a day-and-a-half from time of trade, but still need more feedback from the industry.

DTCC Taps Taskize for Speedy Post-Trade Solutions

Post-trade market infrastructure provider leverages Taskize technology to help users quickly resolve trade exceptions.

Derivatives Market Prepares for Emerging Tech Implementation

2018 is the year when large numbers of participants in the derivatives market expect to see emerging technologies being integrated into their existing technology ecosystems

Lind to Lead Data Services at DTCC

The Depository Trust & Clearing Corp. appoints industry veteran Tim Lind to manage data services, following the departure of Ron Jordan in December 2017.

DTCC Launches Exception Management Tool

Depository Trust & Clearing Corporation bolsters Institutional Trade Processing product suite.

UPDATE: ESMA Grants Six-Month Grace Period for Mifid II LEI Compliance

Banks and trading venues will be given an extra six months to comply with LEI requirements

Data Head Jordan Departs DTCC

Jordan has held various senior roles in market and reference data at DTCC and NYSE over a 35-year career.

DTCC Debuts ‘Same Day’ LEIs

Issuer anticipates demand for one-day delivery of Legal Entity Identifiers after Mifid II comes into force.

In Capital Markets, Blockchain's Evolution Has Left the Bitcoin Model Behind

Axel Pierron of Opimas looks at five blockchain projects set to go live in 2018 that the industry should keep an eye on.

Sibos 2017: Disrupting the Disruptors

The key themes from this year's industry mega-event.

Merrill Lynch, JPMorgan, Sibos: A Week in Review

John recaps some of Sell-Side Technology's best stories of the week, including (more) blockchain developments, noteworthy fintech graduates, and significant regulatory fines.