European Union (EU)

MarketAxess rolls out DataBP's self-service portal to simplify market data licensing

MarketAxess is looking to scale its business and launch new offerings by leveraging DataBP's platform, which utilizes API and cloud-based technology, to optimize its management of post-sales relationships and market data.

This Week: Six/Sustainalytics, Nice Actimize, SmartStream, and more

A summary of the latest financial technology news.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

Dutch sandbox aims to broker EU consolidated tape

As data quality issues are a main impediment to a viable consolidated tape in Europe, Dutch regulator AFM has helped develop pilots in its Innovation Hub sandbox.

This Week: Bloomberg/Google; SocGen; Aquis Exchange & More

A summary of the latest financial technology news.

As sanctions increase, banks struggle with growing compliance burden

Firms must get data management and compliance culture right if they really want to keep their books clean of crooks and sanctions-dodgers, and keep their reputations and bottom lines clean of regulatory fines.

This Week: Bloomberg, MSCI, Liquidnet & more

A summary of the latest financial technology news.

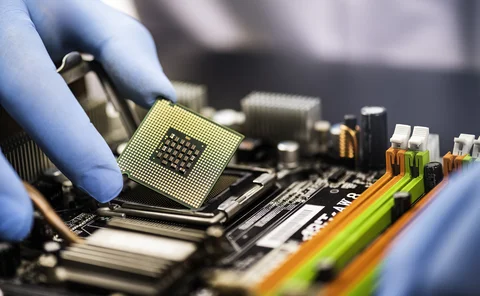

Euronext’s datacenter move on schedule despite supply chain issues

Despite chip and hardware shortages, the exchange group says it is on track to go live with the new datacenter on June 6.

This Week: SS&C; DTCC; LPA & More

A summary of the latest financial technology news.

This Week: Bloomberg/HSBC, Refinitiv/Microsoft, IBM, Jump Trading, & more

A summary of the latest financial technology news.

This Week: SimCorp; Liquidnet; Appital; Qontigo & more

A summary of the latest financial technology news.

This Week: Amundi Tech; Broadridge/ Santander; Deutsche Börse & more

A summary of the latest financial technology news.

This Week: Red Hat/Temenos, Six/BIS/SNB, Avelacom/LSEG & more

A summary of the latest financial technology news.

Buy-side traders start to cool on ESG-deficient dealers

Managers adopting ESG metrics in counterparty evaluations may exclude dealers that aren’t up to scratch

An EU Consolidated Tape: Advancements made in 2021, but still far to go in ’22

The second half of the year saw some long-awaited progress in the mission to fill the void of a consolidated tape in the European Union.

UBS equities team gets to grips with SFDR funds, ramps up ESG scoring

An active equities team at UBS is refining its approach to ESG integration as it converts funds to Article 8.

Waters Wrap: An EU consolidated tape—a story of market data costs & reality

After the European Commission released its proposal for an EU consolidated tape last week, Anthony explores some of the unanswered questions that still linger and what the greatest roadblocks appear to be.

Regulators turn gaze on ESG rating providers—for better or worse

Governments around the world are looking to clamp down on providers of ESG ratings and data products. Jo wonders what the implications could be for a still nascent market.

Top venues mull offering joint EU consolidated tape for bonds

Market participants worry a venue-led CT could be of low quality, with CT data used to create expensive additional products.

Competing CTPs won’t work, warn EU firms, calling for single tape provider

As the industry awaits upcoming EC proposals, some firms are voicing concerns that mandating multiple CTPs could create fresh problems around data fragmentation and connectivity costs.

Six partners with BMLL for best execution analysis

The Swiss exchange is using the vendor's data and analytics to provide insight to brokers around Swiss EBBO liquidity.

Anna Service Bureau upgrade aims to evolve with emerging data landscape

Modernization will help numbering agency data hub adapt to new technologies and improve data quality post-Isin review.

This Week: Deutsche Borse; State Street; IHS Markit; MSCI; & more

A summary of the week's financial technology news.

SFDR pushes fund administrators to rethink ESG offerings

Some fund admins prefer to build ESG products in-house, while others, notably Northern Trust, consider it ‘inefficient’ from a cost and time perspective.

.png.webp?itok=nEWKPzDM)

.jpg.webp?itok=8P9RK9DR)

.jpg.webp?itok=H5U_2mHy)