Exchanges, FINRA Issue RFP for SEC-Mandated Audit Trail Operator

US exchanges and regulator FINRA -- collectively known as self-regulatory organizations (SROs) -- published a request-for-proposal on Feb. 26, to solicit proposals from parties interested in building and operated the Consolidated Audit Trail, as mandated by the Securities and Exchange Commission's Rule 613, which is designed to capture trades, quotes, cancellations and other information across US listed equities and options, to make it easier for regulators to monitor, analyze and investigate market activity.

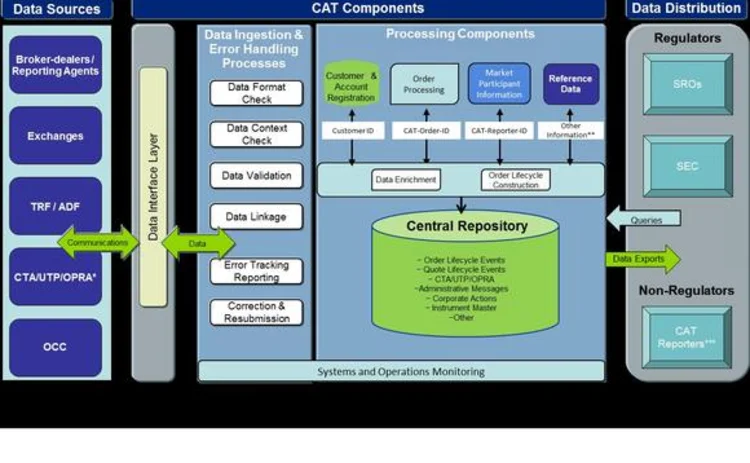

The RFP process, which is being managed by Deloitte, aims to identify a single provider-- though they may use sub-contractors and other vendors to provide their service -- to run a repository of data collected from exchanges, along with tools for participants to submit data and for regulators to access and query the data, replacing existing systems operated by individual SROs, such as the SEC's Electronic Blue Sheets and FINRA's Order Audit Trail System.

According to the RFP, the CAT operator must be technically prepared to utilize a standard message protocol to accept data from up to 2,000 sources -- including 14 equities exchanges and 11 options exchanges, trade reporting facilities, alternative display facilities, Securities Information Processors and the Options Price Reporting Authority, the Options Clearing Corp, as well as around 2,000 broker-dealers, with the flexibility to accommodate increased numbers of data sources providing information-and provide testing environments, disaster recovery facilities, data validation, and datafeed and symbology management. For example, symbology management ensures the CAT operator can accept data in proprietary exchanges' formats, and link "issue data across any time period so that data can be properly displayed and linked regardless of changes to issue symbols and/or market class.... The bidder is required to create and maintain a symbol history and mapping table, as well as to provide a tool that will display a complete issue symbology history that will be accessible to CAT reporters, NMS plan participants and the SEC."

Bidders must be able to support at least 58 billion records daily, based on current averages -- which amounts to about 13 terabytes of data per day -- and retain five years of data, which will result in a total of 21 petabytes of data within five years, and an additional archive of at least two years. These records can comprise quotes, orders and trades from all participants, corporate actions an security definitions, self-help messages, sponsored access designations and customer account data for equities and options markets.

Another requirement of the RFP is that interested parties must dedicate staff -- including a chief compliance officer and helpdesk staff capable of handling 2,500 calls per month -- to managing and administering the operation of the CAT. In addition, bidders are expected to provide detailed cost estimates for every component of the solution -- from staff costs to hardware -- which the SROs will use to elicit industry feedback on what constitutes a reasonable cost of providing the service.

The deadline for responses to the RFP is April 25. Then, the SROs will make a preliminary selection in July, and file the plan with the SEC, before announcing a formal selection within two months following SEC approval. The SROs will hold a bidders' conference on March 8, and will hold further calls in March and April to address questions raised by potential bidders.

The RFP follows the formation on Feb. 22 of a CAT development advisory group to advise the SROs on issues relating to the CAT, which will comprise up to nine individuals from the SROs, as well as one each from industry associations SIFMA, the Financial Information Forum, and the Security Traders Association.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

The costly sanctions risks hiding in your supply chain

In an age of geopolitical instability and rising fines, financial firms need to dig deep into the securities they invest in and the issuing company’s network of suppliers and associates.

Industry associations say ECB cloud guidelines clash with EU’s Dora

Responses from industry participants on the European Central Bank’s guidelines are expected in the coming weeks.

Regulators recommend Figi over Cusip, Isin for reporting in FDTA proposal

Another contentious battle in the world of identifiers pits the Figi against Cusip and the Isin, with regulators including the Fed, the SEC, and the CFTC so far backing the Figi.

US Supreme Court clips SEC’s wings with recent rulings

The Supreme Court made a host of decisions at the start of July that spell trouble for regulators—including the SEC.