FactSet Embraces Web Technologies for Workstation

The research and data giant is using OpenFin to build out web capabilities for its Workstation platform.

Last November, FactSet announced it would make its research platform Workstation available in the OpenFin operating system. Today, the FactSet Workstation is available as an installed or fully web-based platform, and the web solution is getting “close to parity” with the installed workstation, Patrick Starling, director of sales engineering at FactSet, tells WatersTechnology.

There are still reasons for users to install the application locally—such as for Microsoft Office integrations—but the future state of the FactSet offering is driving toward the web. As new web-based tools are becoming available, trading firms want to use platforms with open frameworks so as to take advantage of those new tools; they don’t want “to be in a box anymore,” Starling says.

“We’ve been trying to pivot to an open and flexible approach to all of our different solutions here at FactSet, so that means being open on the front end and embracing stuff like OpenFin,” he says. “Because we’ve moved to web technologies for the front-end, we can also do stuff like disaggregate the workstation and clients can take individual views or components of FactSet and embed them in their own portals, they can put them in OpenFin, and we’ve been building digital experiences for clients using all of those same properties.”

By embracing web technology, everything underneath the Workstation hood on the back end now has an API, he adds. This push began before the OpenFin partnership, but because of it, FactSet has been able to more quickly roll out browser functionality for the service.

While the vendor has long used APIs, about 18 months ago, FactSet started rolling out a new generation of APIs, the first of which was an analytics API, which serves as the underlying calculation engine that powers Workstation’s portfolio analytics tool.

“I think we have in the range of 20 to 30 major API families up on our developer portal covering content, analytics—all sorts of stuff,” Starling says. “So we’re going through this big endeavor of opening up the platform—APIs for everything, APIs as a first-class citizen of our solution stack. It’s also taking all the same content that you can see in FactSet and putting it into all sorts of different feed mechanisms. So, APIs being one, but we have a wide array of standard data feeds that clients can take in and put in their cloud, put on-premise—wherever they want that stuff—all normalized, ready-to-go data models as opposed to lots of custom, bespoke tools.”

Opening Up

OpenFin, which is one of the major vendors in the desktop app interoperability space, provides the container: the browser, through which different applications—whether that’s a bank’s internally built analytics app or a vendor’s research platform—can seamlessly “talk” to one another. (To read about how Barclays is using OpenFin to revamp its BARX trading platform, click here; to read about how RBC is using OpenFin for its Salesbook order management system, click here.)

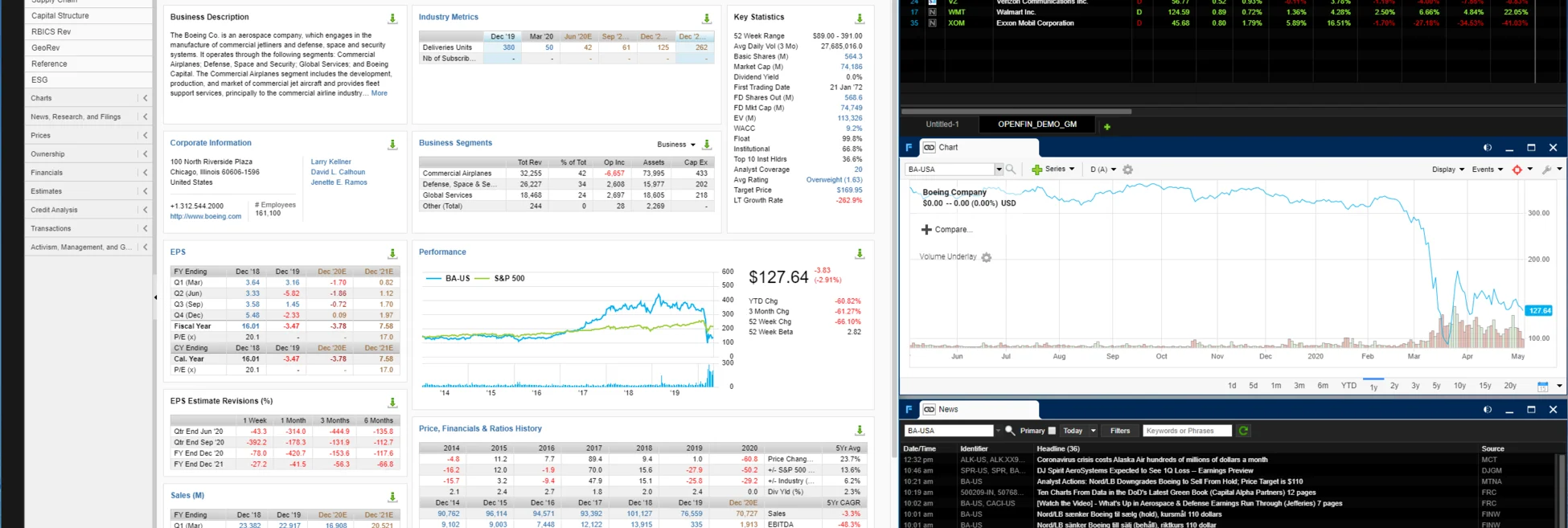

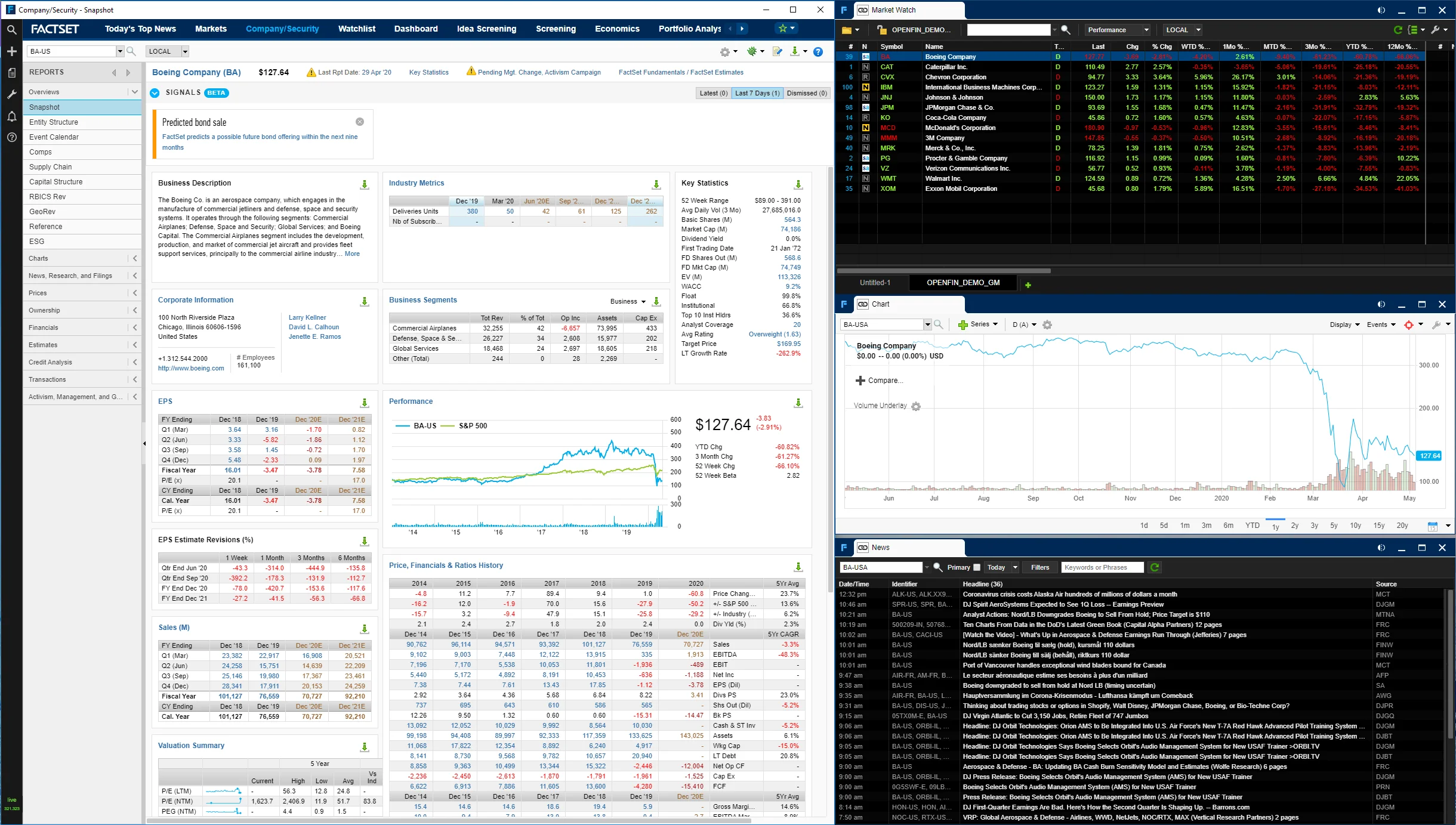

So, for example, a FactSet user can have Workstation open and dock that to a third-party app—say, Giant Machine’s GM Portfolio app, which is built on the OpenFin bus and pulls together market data suppliers, authentication providers, and common user interface tools and libraries for grids and data visualization. Clicking on a company in the GM Portfolio app automatically updates in the Workstation app, and vice versa.

If the user, for example, adds a charting platform and a different vendor’s data feed—because they’re all built in the container using the Financial Desktop Connectivity and Collaboration Consortium (FDC3) standards—and enters a command in one app, that information flows out to the three other apps.

“If I’m always manually jumping back and forth, that’s really tricky,” Starling says. “OpenFin makes that seamless. You get these [applications] side by side and that interop is super valuable.”

Users of the FactSet Workstation in OpenFin can also pull out individual components of the solution. So for example, if a trader wants the news view from Workstation in a different spot, they can drag that out and dock it to another application in the container.

Starling says that while OpenFin essentially breaks everything down into little components that can be snapped back together to build a completely new user experience, FactSet approaches this from a different perspective.

“Within FactSet, we have workflows built out for different user types right in [Workstation]. We’ve had people try to take all these different company security reports, break them out, put them back together in OpenFin and, at times, struggle with that because there’s a lot of business logic built [into Workstation] in terms of how we service a portfolio manager or how we service an analyst. So we’ve been taking a slightly different philosophical tack there where we want to give people the biggest amount of the FactSet experience that they’d want, but they can also take this and pop components out of it,” he says.

The Microsoft Office Piece

While the industry is moving toward more web-based tools and platforms delivered using a software-as-a-service (SaaS) model, there are still limiting factors from full web adoption that extend beyond simple client comfort and security. For Workstation, while the web version is almost on par with the installed version, there’s still more work to be done to close the gap. And some issues are not FactSet’s to solve.

Even though there has been talk of moving away from Microsoft Excel spreadsheets for years, they are still prevalent in the capital markets. Both vendors and end users have been waiting on Microsoft to provide a way to build in add-ins online—and a sea change might be afoot.

As Microsoft has invested more money to build out Microsoft Office 365—its online combined application service—and the Azure cloud platform, the tech giant is also starting to open up its services around Excel online, Starling says.

FactSet is currently in a publicly available beta period where users can run FactSet models in Office 365 online from a browser using a FactSet add-in, just like they would see in the installed version of Excel. It even works on an iPad, but—again—not in the Excel app, only in a browser.

“For analysts or portfolio managers or people who live and die by Excel, you’re starting to get more and more of that FactSet functionality that they rely on, right in a browser,” Starling says. “So you’re already ticking off reasons why you [don’t] necessarily need a full standalone FactSet installed Workstation. You still need all the Workstation functionality, but the installed Workstation piece is going. … People are looking for things that are much more flexible, dynamic, cloud-native than they’ve had in the past. The older, black-box solutions don’t scale like that and people can find those very limiting.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.