Fees

The market data vending machine: The pros and cons of self-service procurement

Brokers and exchanges have begun rolling out “self-service” portals that allow clients to choose data and services on an a la carte basis. Opinions vary on whether they are the Holy Grail or a poisoned chalice.

SEC’s CT Plan timetable is ‘unrealistic’

Implementing governance structure for new US public equities datafeeds within a year is highly unlikely, say industry observers.

UnaVista SFTR closure casts doubt on viability of reg reporting

The decision to shutter the service is another blow to the industry and the business case of reg reporting under SFTR.

Market data hopefuls await deadline with bated breath

August 9 is when regulators could approve the governance plan for the new system of datafeeds in the US. Jo says this would be an important step forward for those hoping to create new businesses under the regime.

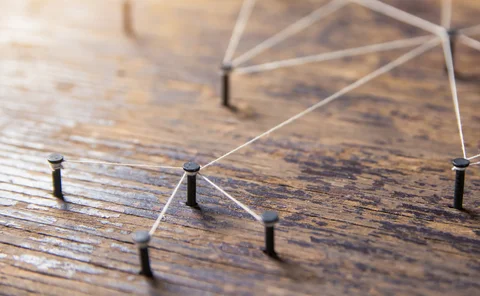

One step closer: How exchanges are seeking tighter relationships with clients

Increasingly, exchanges are trying to get closer to their customers, in a bid to better understand how they use market data. This move may come at the expense of data vendors that are being gradually squeezed out of the exchange-client relationship.

Waters Wrap: Market data & consolidation—a never-ending timeline (And rise of the fees)

While last week it was announced that Exegy and Vela are merging, Anthony says that the deal is only a sign of what’s to come in the market data space. He also poses some questions about the LSE raising its Sedol fees.

Despite client concerns, LSE’s new Sedol fees take hold

Under the new fee policy, some of the largest users of the LSE’s identifier codes could see their Sedol spend more than double, though the exchange says the “vast majority” of clients will see no increase.

Waters Wrap: The looming data storage wars (And Bloomberg killers)

Anthony first looks at the data storage space, explaining that fees are likely to increase for buy- and sell-side firms in the near-term. He also wonders if there’s a market in the terminal/workstation space for innovative startups to gain traction. As…

Bloomberg’s new data retention policy vexes buy-side firms

Impacted users will have to pay extra costs to retain communications data for longer than two years.

Waters Wrap: Big Tech takes control of cutting-edge encryption (And consortium flat circles)

In addition to growing their cloud presence in the capital markets, Big Tech companies are, unsurprisingly, taking the lead on encryption and security in the cloud. Anthony sees positives and negatives. He also looks at bank-led consortiums.

Citi, other banks set to ink ‘Octopus’ deal for new multi-bank CLO platform

Sources say initiative is designed to fend off higher fees and disintermediation in case established multi-dealer platforms start trading CLOs.

Mystery surrounds rumored Ion acquisition of Italian trading platform provider List

While it would appear that Ion has acquired the Pisa-based vendor, details are murky. If the deal has gone through, though, it could mean contractual changes will occur in the near future for List users.

US competing consolidators grapple with pricing uncertainty as SEC, exchanges battle over new Sip regime

Vendors who want to provide consolidated market data under the SEC’s new system can’t make plans until they know how they are going to be charged for market data. But the fee schedules are mired in legal action and confusion.

Jumping ship: Concerns raised over LSEG’s 2022 Docklands datacenter move

The project comes at a time when Euronext is considering a datacenter move, and sources speculate that Six might also be another candidate to migrate. Market participants are split on the news of the LSEG migration, with some calling it “frustrating,”…

OTC FX options market gears up for faster electronification

The share of electronic trading in the market remains low, but a host of factors promise to change that for good.

Bloomberg RHub fee hike reflects cost pressures of regulatory reporting industry

Market participants say the price hikes reflect the struggle among regulatory reporting service providers to run sustainable and profitable businesses.

Broker data policies stoke fears of ‘exchange-style’ fees and audits

Interdealer brokers are looking enviously at the way exchanges have been able to grow data revenues, providing a stable stream of profits as other business lines have declined. But following the exchange model has its own challenges.

Waters Wrap: On Refinitiv and Old Rivalries (And FIGI & Data Governance)

Anthony explores some of the questions raised by Refinitiv's plan to move away from Eikon and Thomson One. He also looks at data governance trends, and asks why the FIGI is having such a tough time gaining acceptance.

Waters Wrap: The NEX Brand Slowly Disappears (Plus Market Data Fights & AI Integrations)

Anthony looks at what's become of NEX since the CME acquisition, as well as discussions over odd lot reform and S&P's Kensho implementation.

Buy-side Firms Reject EMS Brokerage Charges

Some users favor a licence fee over per-trade charging—and have forced vendors to make the switch.

Despite New Approaches, Industry Still Divided Over Data Licensing

Data licensing agreements remain a source of contention for the industry, as suppliers look to differentiate offerings via disruptive pricing structures.

MEMX Builds Out Infrastructure as it Waits on Regulatory Approval

The exchange’s CEO and COO discuss its matching engine, Intel partnership, cloud strategy and plans for the future.

After Fidessa Exodus, Some Users Brace For Trouble

WatersTechnology spent three months examining Fidessa to see what has transpired inside the vendor since the Ion acquisition. During a period of great change, a lot of questions—and worry—remain.

.jpg.webp?itok=Pq23rQbT)