Fixed income

Summit: Fixed Income Needs Collaboration, Better—Not Faster—Tech

More collaboration and better technology can bring liquidity back to fixed income

DealVector Adds SCI Prices to ‘BWIC Board'

DealVector will make SCI data available free of charge for a 30-day period

MTS Preps Adds to MTS Bonds.com Data

London Stock Exchange Group-owned MTS Markets International (MTS US) is planning to launch a new market data service that will enable users to subscribe to individual bonds and groups of bonds traded on its recently acquired MTS Bonds.com trading…

Allianz Allies with Thomson Reuters for Bond Pricing

German banking and insurance giant Allianz is to use Thomson Reuters' independent pricing service to meet the firm's fixed income pricing data needs around valuation and meeting international accounting standards.

Allianz Taps TR For Fixed Income Pricing

The global insurance and asset management giant says it will use Thomson Reuters Pricing Service (TPRS), covering 2.5 million fixed income securities, derivatives, and bank loans, to meet valuation, reporting and regulatory requirements.

Infront Expands Credit Content to Boost Cross-Asset Ambitions

Norwegian data vendor Infront has added corporate bond data and analytics to its Infront Plus market data terminal, in response to increased demand for these instruments following the 2008 financial crisis.

BondHawk Launches Fixed-Income Platform

BondHawk Systems has announced the release of its BondHawk Trader platform, focusing on fixed-income trading on both the buy and sell sides.

IDC Expands Real-Time Bond Evaluated Pricing Service

Interactive Data has expanded its continuous fixed income evaluated pricing service to provide users with real-time evaluated prices for US Treasury, agency and corporate bonds, TBA mortgage-backed securities, and mortgage-backed securities pass-through…

Thomson Reuters Adds BGC OTC Data

Thomson Reuters is making real-time over-the-counter data from interdealer broker BGC Partners available via its Eikon desktop, its Elektron Real Time feeds infrastructure, and its Tick History and DataScope Select products, to increase OTC data…

Fixed Income's Dead? Long Live Its Technology

SEC Commissioner Mary Jo White hinted last Friday that fixed income might be the next technology rabbit hole the Commission jumps down. That seems like good news for the buy side—but is it?

Brazil’s Anbima Preps Vendor Reference Price Feed

Brazilian self-regulatory authority Anbima, an industry association that governs member trading and investment firms, is preparing to create a datafeed of fixed income price data from Brazilian market participants that will target vendors and…

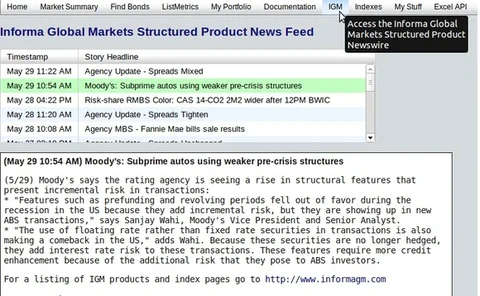

Empirasign Adds Informa GM News Commentary to Dealer Runs

New York-based fixed income dealer offering data provider Empirasign Strategies has incorporated two news feeds from Informa Global Markets into its online portal that provides prices and trade color parsed from emails between dealers and counterparties,…

ING Installs MDX Tech for Real-Time Fixed Income Data Distribution

Dutch banking group ING has rolled out the MDXT Connect data connectivity platform from UK-based data technology provider MDX Technology to enable the bank to distribute real-time fixed income prices and data analytics from its trading desk in Amsterdam…

Empirasign Bows MyData Excel Integration Web Service

Empirasign Strategies, a New York-based provider of fixed income dealer offerings and trade color, has rolled out Empirasign MyData, which allows users to upload a list of bond tickers to Empirasign's website and have the vendor return updated prices for…

SuperDerivatives Adds Icap G7 Data to DGX Store

Over-the-counter pricing and risk management software vendor SuperDerivatives is adding real-time market data from interdealer broker Icap to the third-party app store on its DGX market data terminal, to provide customers with an overview of rates from…

EDI, Beast Apps Partner on Fixed-Income Derived Data

Algorithms provided by the Beast Apps are using data from Exchange Data International to derive 11 data fields that are available in a new feed

Tabb Report: Illiquid Bond Pricing is "World's Most Complex Sudoku Puzzle"

The data industry must work harder to improve pricing of illiquid fixed income asset classes by harnessing contextual data to understand instruments, particularly as demand continues to rise for intraday and real-time pricing, according to a report…

Empirasign Adds to Dealer Run Quotes

Empirasign Strategies, a New York-based provider of dealer offerings and "trade color" for mortgage and asset-backed securities, is adding new datasets covering bids and two-way markets to its database of fixed-income pricing, in response to client…

Thomson Reuters Adds ANZ Bond Pricing

Australia and New Zealand Banking Group has begun contributing prices for more than 2,700 credit bonds denominated in Australian, New Zealand and US dollars as well as pounds sterling and euros on Thomson Reuters' Fixed Income Trading bond platform.

Thomson Reuters, SGX Ally on Bond Indexes

Thomson Reuters has unveiled a suite of Singapore dollar bond indexes, developed with the Singapore Exchange, to help fund managers, asset owners and custodians benchmark investment performance and to provide increased transparency into local bond…

Interactive Data, Icap Strike Data Distribution Deal

Interactive Data has signed a licensing agreement with Icap Information Services, the data services arm of interdealer broker Icap, to make the entire universe of Icap data available on its Consolidated Feed of data from more than 450 exchanges and over…

Brownstone Investment Group Taps Martines for Munis Trading

The fixed income investment firm has hired Matthew Martines as new managing director for its municipal trading and electronic market-making units.

Sunstate Bank Taps SS&C for Fixed Income Trading

Sunstate Bank, which is headquartered in Miami and has $164 million of total assets, is extending its partnership with SS&C Technologies to support fixed income trading.

S&P CapIQ Adds Credit Risk Indicators to XpressFeed

S&P Capital IQ is planning to make its entire universe of pre-scored point-in-time, short- to mid-term and long-term credit risk indicators for financial institutions and non-financial corporates available via its XpressFeed data platform.