Cost, security concerns dampen banks' appetite for multi-cloud infrastructures

As firms make progress on cloud adoption, they are discovering that multi-cloud strategies for individual businesses can not only duplicate costs, but can also inadvertently downgrade a firm's resiliency.

New regulation forces UK banks to scrutinize cloud

Firms say changing SLAs and getting required information from vendors like AWS, Azure and Google Cloud is a heavy burden.

What the hell is Web3, anyway?

The next iteration of the internet is upon us, with the potential to deliver radical shifts to every industry, including banking. The movement, which is currently buoyed by the prospects of blockchain and virtual reality, has implications for computing,…

People moves: Federal Reserve Bank of New York, DataBP, LME, Azentio, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who joins the Federal Reserve Bank of New York as head of the markets group.

2021: The year when Big Tech ‘Googled’ the financial markets and liked the results

Now that cloud has become widely adopted by financial firms, Big Tech companies are seeking to leverage their other services to become more ingrained in the workflows of the capital markets.

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

Quantum computing: kryptonite for bitcoin and cyber security

Race is on to secure new encryption algorithms for DeFi, before quantum computers become a present danger.

Waters Wrap: The biggest disruptors facing the capital markets as we head into 2022

In Anthony’s mind, eight topics will dominate the headlines in the New Year. They are…

Slow burn to a big bang: How the new wave of tech is changing market data platforms

For decades, market data platforms have been critical components of financial firms’ trading infrastructures. But with changing user needs and emerging technologies gaining ground, will the platforms of the past be replaced by upstart challengers—or can…

Cloud promises cost savings, but users still overspend

Cloud overspending and overprovisioning is a pervasive problem as cloud usage is poised to grow in 2022.

Waters Wrap: The changing role of the CDO (and NYSE’s musical chairs)

As data and analytics change, so too must the CDO function. Anthony also looks at the appointment of Lynn Martin as president of NYSE.

Disrupting data delivery: AWS Data Exchange gains ground with addition of FactSet content

Leveraging AWS’s presence on Wall Street, Data Exchange has the potential to shake up traditional financial data delivery and contracts, if it can add relevant content and overcome challenges like real-time streaming and connectivity in the cloud.

Digital rights group debuts ODRL, plans common tech framework

The community group is building a referencing architecture to test the theory that all participants in the data supply chain behave as originators, providers and users.

Waters Wrap: An EU consolidated tape—a story of market data costs & reality

After the European Commission released its proposal for an EU consolidated tape last week, Anthony explores some of the unanswered questions that still linger and what the greatest roadblocks appear to be.

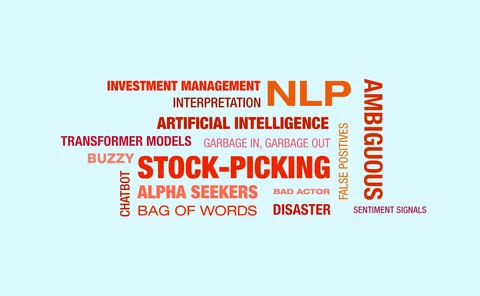

NLP for investment management: quants face a grab bag of words

Training models to interpret text can be dull; but doing it poorly can be costly.

New breed of NLP model learns finance better, study finds

Models trained by looking at sentences beat conventional approaches that contextualize words.

Waters Wrap: CME & Google—the first domino falls

Anthony explores some of the unanswered questions—and potential ripple effects—that come with the new partnership between CME and Google.

Banks seek greater clarity from regulators on cloud risk

Regulators have been reluctant to specify cloud risks, despite warnings of overreliance on three big providers.

Vendors push voice data across the trade lifecycle

Through partnerships and acquisitions, communications vendors are integrating voice data into different parts of the trade lifecycle to offer more sophisticated analytics and easier user interfaces.

Waters Wrap: On cloud migrations and VCRs

Financial services firms are increasingly embracing public cloud offerings, but there have been stumbles along the way, including around scalability, throttling, and a lack of true multi-cloud connectedness. These are lessons that must be learned if…

Bank of Montreal begins 2nd phase of cloud migration and development strategy

Similar to its competitors, BMO wants the future development of financial services tools to be cloud-native. The bank expects 30% of workflows to be moved to the cloud within three years.

Google aims AI at corporate actions challenges

The tech giant believes its AI tools have a multitude of applications across some of the complex data challenges of financial markets, and it’s starting with the manual and complicated world of corporate actions. Some believe it will be an uphill battle.

From burst to bust: What happens when cloud runs dry?

After years of initial resistance, the capital markets have come to depend heavily on the compute capacity of the public cloud. But increasing market volumes are rapidly outpacing the cloud capacity that organizations thought would be sufficient for…

Cloud: Capital markets’ Swiss Army knife

The best uses of the cloud so far have been as an enabler of performance and innovation. The best uses yet to come could reshape AI. So, Max warns, if you think cloud is about cutting costs, you’re thinking about it all wrong.