Hedge funds

CryptoCompare Eyes Asia Cryptocurrency Indexes

The cryptocurrency data provider and index operator plans to exploit demand for digital currency trading in APAC by launching index products in the region.

Wavelength Podcast Ep. 199: Working Through Covid-19

Marshall Saffer, vice president and head of Americas sales at Hazeltree, discusses how Covid-19 has affected the treasury management space.

Pandemic Fuels New Wave of Surveillance Tech

Firms are investing in new solutions for monitoring the front office in lockdown conditions, but the latest technologies raise concerns about privacy and intrusion.

This Week: MEMX, Sifma, Bloomberg, State Street, Digiterre, Infosys

A summary of some of the past week’s financial technology news.

UBS Evidence Lab Uses Machine Learning for Maritime Datasets

Financial services firms have been looking to maritime data for economic insight during the coronavirus pandemic.

Despite New Approaches, Industry Still Divided Over Data Licensing

Data licensing agreements remain a source of contention for the industry, as suppliers look to differentiate offerings via disruptive pricing structures.

Balyasny AM's CDO: Going Quantamental with Alternative Data

Carson Boneck shares his thoughts on Balyasny's efforts to marry the best of its fundamental and quant teams.

Morgan Stanley’s AlphaWise Uses Alt Data to Track Coronavirus

The bank’s research business is using artificial intelligence, traditional consumer surveys, and visualization techniques to monitor the impact of Covid-19.

Alt Data Market Could Take Deep Hit Due to Coronavirus

If hedge funds and VCs tighten their spending in 2020—a likely outcome—it could be the alternative data market taking the brunt of the punishment.

'Data Mining is Bullsh*t' — An Examination

With the growth of alternative data in the capital markets, firms are struggling to find value, and are disillusioned by the loss of time, human capital, and money. Goldman Sachs’ Matthew Rothman believes this has created a situation where vendors and…

HazelTree Looks to Get Ahead of UMR Phases 5 & 6 with AcadiaSoft Partnership

As a result of UMR, the vendor forecasts the buy side will attempt to minimize its risk, and will pay big if it doesn't.

Man and Machine Need Each Other – Systematica CEO

“The errors made by humans and robots are different,” says Leda Braga

Crédit Ag Taps AI to Lure Swaptions Business

The machine learning model predicts client demand with high accuracy, giving traders an edge in pricing.

This Week: Fidelity Digital Asset, State Street, HSBC, Instinet, INTL FCStone, Quantopian

A summary of some of the past week’s financial technology news.

Systematic or Discretionary: Point72’s Granade Says Lines Are Blurring

At Waters USA, the chief market intelligence officer of hedge fund Point72 discussed how tech and data are disrupting traditional ideas about investing.

Banks Begin Exploring Homomorphic Encryption Use Cases (Part 2)

Josephine Gallagher explores some of the real-life applications of homomorphic encryption in development and the main roadblocks to its adoption.

TradingScreen Looks to Asia, New Order Management Products for Growth

The EMS provider is looking to build out its suite of solutions for the buy side, including a new algo wheel and visualization tools.

Alt Data Providers Struggle To Stand Out

Adopting an optimal and sustainable business model, as well as staying on the cutting edge of analytics, are two hurdles still to be overcome by alternative data providers looking to keep their heads above water.

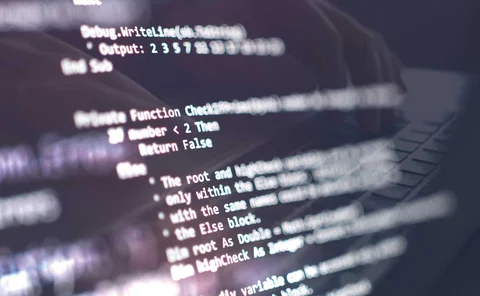

QuantConnect Wants to Create a ‘League’ for Algo Testing

The crowd-sourced trading platform is looking to create a competitive arena for quants to test their algorithms.

Battle Bots: Charting AI’s Next Phase in the Back Office

Financial services firms are deeply entranced with artificial intelligence (AI), yet the revolution is under pressure as the industry continues to become more educated and selective about it. Recent research data from WatersTechnology and SmartStream…

The Secret Source: Machine Learning and Open Source Come Together

A deep-dive into how capital markets firms are using open-source tools to experiment with machine learning.

Real Estate as a Tradeable Asset Class Faces Data Hurdles

The value of real estate markets dwarfs other asset classes, but a lack of data has hindered its development. Part 1 of a 2-part series.

Machine Learning Takes Aim at Black-Scholes

Quants are embracing the idea of ‘model-free’ pricing and deep hedging.

Satellite Images Drive Climate Conversations

Investment firms are turning to pictures from the sky to understand environmental impacts for alpha generation.