How Schroders is Bypassing the Noise in News Sentiment to Identify Credit Risk

The UK asset manager is using Owlin's media analytics platform to identify negative news sentiment linked to credit risk.

When Emmanuelle Mathey joined Schroders two years ago, its credit risk team was inundated with news articles about counterparty risk.

The six-person team—responsible for identifying risks across 420 parent companies and 850 underlying legal entities—had the arduous task of combing through hundreds of media alerts and probing those relevant to the world of credit. At the time, they were using an undisclosed third-party, a web-based toolkit that offered a tailored service for the firm, where it delivered long lists of articles to their email inboxes each day.

The solution was illsuited for what the team needed to monitor the scale of news coverage they required, as the information was delivered in a bulky, noisy, unstructured format. Soon after Mathey’s appointment to the role of head of credit risk in September 2018, the team began searching for a new third-party provider. This led the asset manager to partner with news analytics platform provider Owlin following a free three-month demo.

“What was key was finding a company that would be able to narrow that news net,” she says. “Owlin is targeted and focused on negative news only, excluding both positive news about an entity and articles published by the entity itself, meaning that we can look through the noise to focus on the relevant information.”

The main value-add of the platform is the ability to see the woods for the trees.

Emmanuelle Mathey, Schroders

The credit risk team primarily monitors banks and brokers. The challenge for a small unit like this is that sell-side entities—particularly the largest institutions—are constantly in the news or are frequently mentioned in research reports or are ancillary figures in larger news stories. Mathey says the team needed a tool that could facilitate an alert-based approach that could deliver and visualize the most valuable news to the team but not overwhelm them with information.

Equally important, though, was to incorporate a tool that could clearly bring forth negative sentiment in a news article, as that is most important for determining credit risk, she says. The key for Schroders, then, was to define the term “negative’ ”, as something that might be negative news for one individual, could be positive for a different person.

“There is specific news that will impact the value of stock prices and are negative for the investor, but could be positive for creditors. What matters is therefore defining what we mean by negative,” Mathey says.

Fine Tuning

The Owlin platform analyzes sentiment from over three million global news sources in 12 different languages, including English, Spanish, and Chinese. Using natural language processing (NLP), data points and insights are identified in articles, and then customizable functionality and drill-down capabilities are developed alongside the end-user.

After the three-month trial, the Owlin web application took around six weeks to be configured to the asset manager’s specifications. The technology was adapted to support Schroders’ portfolios, including all relevant entity names, and the visuals were adjusted to display themes that the credit risk team find most valuable. For instance, Schroders excluded news about merger and acquisition activity, as well as leadership changes from its main dashboard. Mathey says that it can be difficult to assess whether an acquisition will impact credit risk unless you conduct a full credit analysis, and there are better ways to achieve this.

“The main value-add of the platform is the ability to see the woods for the trees,” Mathey says. “One way Owlin achieves this is by allowing my team to define themes that can be carved-out of the monitoring either because we want to be able to have a more narrow focus on them—for example, reputational risk—or because they create a lot of noise and so are easier to manage separately—for example, merger and acquisitions or leadership changes.”

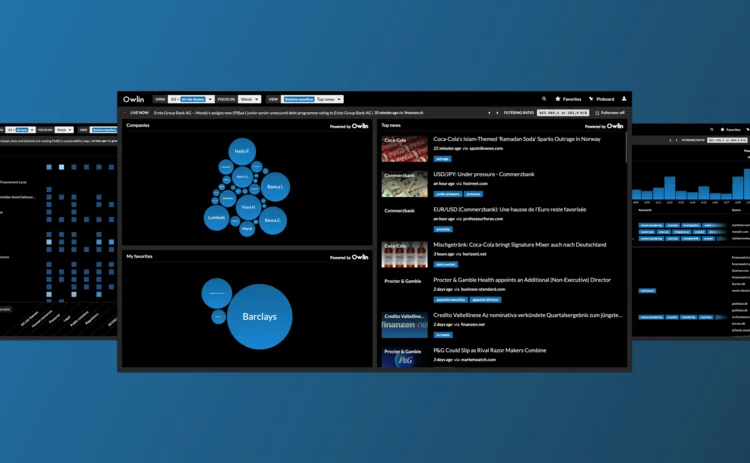

As part of the design, the information is presented in bubble graphs, bar charts, and in tabular formats. The firm uses two displays for monitoring credit risk: relative news flow and overall news flow. Relative news applies to the customized display, where it includes a variety of themes and adjusted weights based on the importance of the news alerts according to the team’s specifications. So, for example, if a small broker that rarely features in the news and is relevant to its portfolio is mentioned negatively, a large bubble representing the broker will appear on the relative news display on the main dashboard.

“That means that every user—or every batch of users—can take their own perspective on the markets and we translate that into our algorithms,” says Sjoerd Leemhuis, CEO and co-founder of Owlin. “So, the way that Emmanuelle and the credit risk team look at risk in the market, that is custom to Schroders.”

The overall news flow display includes all relevant entities covered by the buy-side firm without the adjusted weights. There are then several news themes or filters to switch between.

The main ones the firm uses include reputational, financial, legal, operational, and general news. The tool also enables users to share and annotate articles within the platform, and depending on their configured options, they will appear as a notification on their desktop and, or, mobile application, followed by an email alert.

The asset manager is constantly working with Owlin to train its algorithms to meet their needs better. The credit risk team can flag articles as “useful” or “not useful”, and send feedback or functionality requests to update the platform.

Schroders accesses the news analytics through Owlin’s web-based version, but in the future, the asset manager plans to develop a widget and integrate the technology into the credit risk dashboard that it is currently being built internally.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.