Market data plans revive proposals to move odd lots onto Sips

Consultation on democratizing odd lots data closes next week, but more solutions to order protection concerns may be needed.

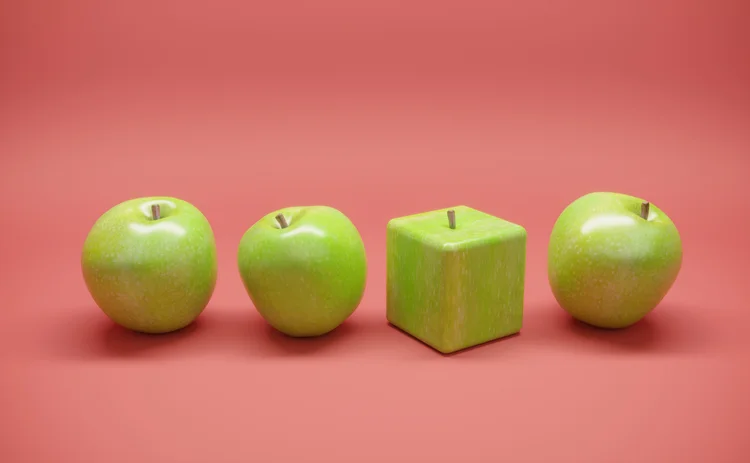

US equity markets trading is based on what many market participants consider to be an anachronism: the use of round lots—units of 100 shares of a stock—as the standard unit of trading, with any order of fewer than 100 considered an odd lot.

For most of the equity markets’ history, odd lots constituted a relatively insignificant proportion of liquidity, but from around 2015 they began to account for a growing proportion of all exchange trades. Mostly this is because retail investors have shifted from buying individual shares to buying ETFs, so corporates are no longer splitting stock to make it affordable for smaller investors. This, combined with the fact that some boards believe a high stock price confers prestige, means that today, companies like Amazon and Alphabet are trading at around $3,000 and $2,500 per share, respectively.

Retail investors, of course, trade individual stocks in odd lots. The reason is obvious: If Amazon is trading at $3,000 per share, a round lot of that stock would be $300,000. For context, the Nasdaq and the New York Stock Exchange define a block trade as a trade worth more than $200,000. And so odd lots volume has risen.

Research carried out by the Securities and Exchange Commission using data from its Midas platform has found that the figure for odd lots as a proportion of all exchange trades for all corporate stocks ranged between roughly 29% and 42% in 2018; in 2019, the rate exceeded 50% several times.

The problem is that because of the legacy of round lots, odd lot quotations are not reported to, and thus do not appear on, the US equity consolidated tapes unless they are big enough to be aggregated into round lots (odd lot transactions, on the other hand, started printing to the tapes in 2013). With all the trading activity happening in odd lots, that is a lot of liquidity going unseen by those who only subscribe to the tapes.

The tapes are disseminated by the US’s two Securities Information Processors (Sips), which not only pump out top-of-book data to their subscribers but also calculate the national best bid and offer (NBBO)—the best available bid and ask quotes at which brokers must trade when buying or selling securities for clients. If more sophisticated users want depth-of-book information, including odd lot quotes, they must buy the enriched datafeeds sold by exchanges.

So, the exclusion of odd lot quotes from the Sips, now that they represent a larger and growing portion of trades in the US, clearly has implications for best execution. Many market participants also point out that only round lots are considered protected quotations under the SEC’s Order Protection Rule, meaning that while regulation protects round lots from trade-throughs, orders can trade through odd lot quotes that are better priced than the NBBO.

The SEC has worried about information asymmetries between those investors that only subscribe to the Sips and those that pay for odd lots data from the exchanges. Market participants and exchanges discussed the issue at the SEC’s Market Data Roundtable in 2018, where most agreed that odd lots should be on the Sips.

In October 2019, the operating committees of the CTA and UTP plans responded to these concerns with a proposal to do just that.

The opcos postponed these efforts, however, when, in February 2020, the SEC published its own proposal—a major effort to modernize US equity market data dissemination. The SEC’s proposal, eventually finalized in late 2020 as the Market Data Infrastructure Rule (MDI Rule), was so radical that some at the time referred to it as “Reg NMS II”. Among many other things, the SEC’s proposal contemplated options for incorporating odd lots on market data feeds disseminated by new kinds of competing Sips called competing consolidators.

The MDI Rule may be a long time coming—and could be killed off entirely by the DC Circuit Court of Appeals. The rule is currently bound up in litigation: The three large exchanges—Cboe, Nasdaq and NYSE—have taken the SEC to court, saying the regulator does not have the authority to issue the rule and asking for it to be abandoned.

Given that the MDI Rule is delayed, and perhaps may even cease to exist, the plan operating committees might have felt that they needed to move ahead on the odd lots issue on their own steam. For whatever reason, they resurrected their odd lots proposal—which they say will serve as a “blueprint” for the inclusion of this data on the current Sips—on March 28 of this year. Anyone who wants to comment on the proposal has 30 days from date of publication to do so, which means the deadline is Tuesday, April 27.

The MDI Rule and the plans’ proposals take different approaches to including odd lots quotations on the Sip. The MDI Rule redefines round lots: instead of the current definition of 100 shares of a given stock, they are now defined by their share price, pegged to four tiers of pricing. The SEC says this will make it possible for more odd lots to meet the standard for aggregation into round lots, bringing them onto the Sips for more transparency and subject to the Order Protection Rule.

The MDI Rule also redefined core data on the Sips to include odd lots priced at or better than the NBBO, so lower-priced odd lots could make it onto the Sips also.

The plans’ proposal is more straightforward, simply contemplating publishing odd lot top-of-book quotes from each exchange on the Sips. The Sips would also use these quotations to calculate an odd lot NBBO and publish that when the best of the odd lot quotes are at or better than the protected NBBO. As proposed, that would be a single datafeed.

The intent is to provide increased market visibility to Sips subscribers, democratizing access to this data at no extra cost to subscribers.

The proposal acknowledges that there might be a tech lift for feed recipients, who, because it envisages a single channel of market data, would have to upgrade their tech to receive the odd lot quotes even if they never intend to use that information. Consumers will have to add code to their systems to either receive or ignore the new fields of data. Publishing it as an integrated feed, however, could be less resource consumptive, requiring no new hardware or more bandwidth.

In tiers

Comment letters to the plans’ initial proposal give an indication of how market data consumers might react to the current one. Most commenters, whether investment firms like BlackRock and Charles Schwab, exchanges like IEX, or vendors and trade associations, were supportive of the kind of approach the SEC adopted in the MDI Rule—of redefining round lots based on tiers of share price. This would to some extent solve the order protection issue, commenters said.

BlackRock, for instance, said this kind of approach is “a more elegant solution to the inclusion of odd lots”. “The sizing of round lots provides an intuitive mechanism for expanding odd lot coverage because its designation as the normal unit of trading is embedded in exchange rulebooks and market regulations. As such, a reduction in the round lot size would naturally propagate to the relevant rules which govern protected quotations, determination of the NBBO, and the behavior of order types,” the firm’s representatives wrote.

Some wanted the odd lots information on the Sip to be an optional feed for consumers.

The Securities Industry and Financial Markets Association’s general counsel, Theodore R. Lazo, wrote that while it is helpful for firms that need odd lot information in their trading to obtain that from the Sips, not everyone will need it.

“Because the additional odd lot information will not be useful to all firms for trading purposes, broker-dealers that purchase the Sip data products should be able to opt out of receiving and displaying odd lot information if they so choose,” Lazo wrote.

Others worried, however, that adding odd lots data to the Sip could raise costs for downstream users, due to the sheer volume of odd lots trading that now occurs. Plan participants and consumers would have to add storage and feed capabilities to manage all that data, said TD Ameritrade, one of the few commenters that seemed to be entirely against the idea of adding odd lots to the Sip.

“These changes, which are required to accommodate the additional data points, would be reasonably expected to increase the inherent latency within the system,” Joseph Kinahan, managing director of client advocacy and market structure at the firm, wrote in his firm’s response.

Market data users who would like to weigh into this proposal can submit comments via the CTA Plan’s website.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

The costly sanctions risks hiding in your supply chain

In an age of geopolitical instability and rising fines, financial firms need to dig deep into the securities they invest in and the issuing company’s network of suppliers and associates.

Industry associations say ECB cloud guidelines clash with EU’s Dora

Responses from industry participants on the European Central Bank’s guidelines are expected in the coming weeks.

Regulators recommend Figi over Cusip, Isin for reporting in FDTA proposal

Another contentious battle in the world of identifiers pits the Figi against Cusip and the Isin, with regulators including the Fed, the SEC, and the CFTC so far backing the Figi.

US Supreme Court clips SEC’s wings with recent rulings

The Supreme Court made a host of decisions at the start of July that spell trouble for regulators—including the SEC.