OpenFin outgrows container tech origins with Workspace UI launch

New interface will standardize notifications, user interactions and content presentation.

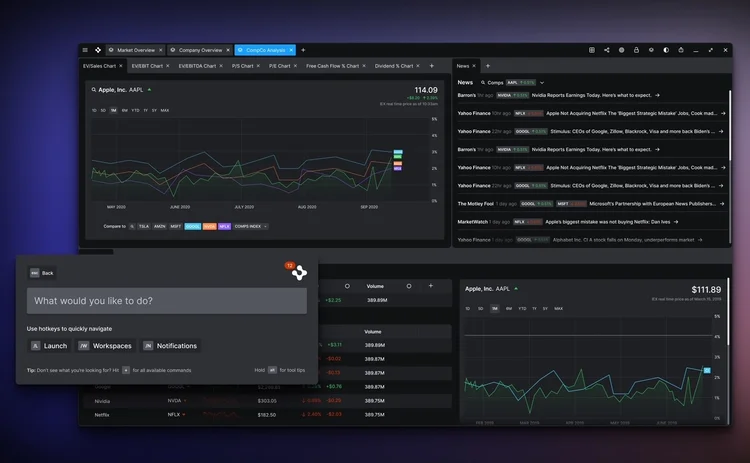

OpenFin, a New York-based provider of desktop technology, is rolling out Workspace, a user interface comprising a browser, integrated notification center, app store, and digital assistant. The new release will function as a homepage for financial desktops, allowing trading and operations professionals at banks and buy-side firms to launch apps on the desktop.

CEO Mazy Dar says this release is the first time OpenFin has built an out-of-the-box user interface. Typically until now, its customers have built their own UIs on top of the OpenFin container, which can take up to two years. But there has been growing demand from banks and asset managers for the vendor to provide an OpenFin UI, he says.

“What has happened over the last few years is that several of the largest ones who have been building this have said, ‘Look, we have built something, but it’s harder than we thought it was going to be, and it’s taking longer than we thought it was going to take.’ And many of the other firms just have not had the resources to even get it going,” Dar says.

Workspace has been in private beta with five clients over the past three months. Ahead of its official launch today (April 27), it is already in use at two major banks, two large hedge funds, and a major sovereign wealth fund.

OpenFin began this latest iteration of Workspace about a year ago, as the Covid-19 pandemic was unravelling across the globe, forcing workforces—including traders and ops teams—to work remotely with fewer screens at their disposal. The vendor spent that year collaborating with existing customers to build an interface that could maximize productivity, enable faster decision-making, and leverage existing interfaces into which clients had put significant time and money.

The process led to one of the key components of Workspace, dubbed “Home”—a keyboard-driven digital assistant and app launcher that was originally built as a point-and-click solution before being redesigned. Controlled by keyboard demands, it is prompted by pressing Ctrl+Space, and can search and discover available applications and navigate proper communication channels through its integration with major chat platforms such as Slack, Symphony, and Microsoft Teams. For instance, if using it to peruse contacts and send a message, Home is designed to sense the primary chat platform used by any individual and lists its symbol near their name.

A browser feature focuses on eliminating data silos and distractions. Content from multiple internal and third-party sources are displayed in common windows, which can house several tabs or be dragged around screens, similar to a traditional internet browser. Workspace’s standardized notification center uses a color-linking scheme to differentiate between internal messages and messages from dealers, vendors, news sources, customers, and others, with the aim of helping users better consume and manage notifications from disparate sources.

“As an application provider, your goal is to be embedded in your customer’s environment so that they’re most likely to see your notifications when they come in,” Dar says. “And that is a problem that no bank, no buy-side firm, no vendor can solve on their own. For that, you need this standardized layer that everybody can build on top of that, which allows all of this to be normalized.”

OpenFin is no stranger to developing standards solutions. In 2018, the vendor led the way on an industry-wide initiative known as FDC3, which aimed to create open interoperability standards for the financial community. More than 20 capital markets firms participated in its inception, and the protocol has since been contributed to the open-source government framework of the Fintech Open Source Foundation.

However, “this is much, much bigger than FDC3,” Dar says, in reference to the standard UI. While interoperability has become an important tool in unifying the user experience, he says standards among interactions and organizing content within the tech—such as launching applications, conducting searches, sifting through notifications, or presenting content in a uniform fashion—do not fall under the scope of the common interoperability language, FDC3.

“I think interoperability was a key component that OpenFin delivered for the industry, and the founding of the FDC3 standard,” says Adam Toms, CEO of OpenFin Europe, in lockstep with Dar. “But what we are now saying is that we should also standardize notifications, interactions inside search bars, and everything else. And that is what we are setting out to do here, by delivering components that the industry can rely on. So, it’s much bigger than just interop.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

This Week: Startup Skyfire launches payment network for AI agents; State Street; SteelEye and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: Standard Chartered’s Brian O’Neill

Brian O’Neill from Standard Chartered joins the podcast to discuss cloud strategy, costs, and resiliency.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

The IMD Wrap: With Bloomberg’s headset app, you’ll never look at data the same way again

Max recently wrote about new developments being added to Bloomberg Pro for Vision. Today he gives a more personal perspective on the new technology.

LSEG unveils Workspace Teams, other products of Microsoft deal

The exchange revealed new developments in the ongoing Workspace/Teams collaboration as it works with Big Tech to improve trader workflows.