Refinitiv Begins Move Away from Eikon, Thomson One with Debut of 'Workspace'

The new platform is first being targeted at advisors and wealth managers, and will eventually be available for traders, analysts, portfolio managers, quants, and developers.

Refinitiv, the former Financial & Risk division of Thomson Reuters, has begun rolling out Workspace, its next-generation data platform designed to respond to changes in the financial markets industry by providing distinct content and capabilities tailored to the needs of different types of users via a front-end display and APIs. Workspace will ultimately replace its existing Eikon terminal and Thomson One range of workstations.

“Workspace is our response to a transforming industry—we’re clearly at the beginning of a new era,” says Mitko Yankov (pictured), global head of platform at Refinitiv. “Asset managers and banks are responding to margin compression, and are looking to drive greater productivity across their workforce, and their tools and capabilities.”

Different iterations of Workspace are currently available “out of the box” for wealth advisors, investment bankers, and students, and the vendor also plans to release versions for traders, analysts, and portfolio managers, quants, and developers—though officials decline to give specific timelines for each launch.

Yankov notes that tier-one financial firms are reviewing and revamping their revenue streams and business models, and evaluating which mechanisms will make their individual staff and teams most productive. This will require new ways of providing data, while other market segments will still adhere to traditional vendor-client relationships.

“In all of those, we are seeing a dramatic increase in workflow sophistication as they look for profits and returns for customers,” he says. “And with that, we are seeing massive amounts of machine-aided collaboration, and greater reliance on technology. And we’re seeing the rise of new skills in the workplace, such as developer-quants, or ‘bankers who code’. … people who expect everything you put in front of them to be extensible. You can’t put a market data terminal in front of them because they don’t work that way.”

Users will be able to perform much of what they currently do in Eikon in Workspace, and while the vendor will continue to support and develop Eikon, it will eventually subsume all the functionality of Eikon and Thomson One into Workspace.

“Eikon is a great product, and many of our clients use it and love it, and it will continue to be in the marketplace,” Yankov says. But, he adds, “We think the terminal of tomorrow will be very different to the terminal of yesterday. Traditional terminals were very rich out of the box, but were also very rigid, because they were designed as trading interfaces. With Workspace, we want to ensure that when it comes out of the box, it’s very adaptive to different user groups and their requirements.”

Workspace comes out of the box as a wealth advisory solution or an investment banking solution. Eikon doesn’t do that.

Mitko Yankov, Refinitiv

Workspace is built using the Electron open-source software framework (not to be confused with Refinitiv’s own Elektron low-latency infrastructure), which makes it easier to build JavaScript and HTML applications, make changes, speed up production cycles, and respond to client requests, without the “inherent rigidity” of older technologies, Yankov says.

Workspace also contains a cloud-based, integrated Python scripting environment, dubbed CodeBook, which enables users to build Jupyter notebooks using Refinitiv data. CodeBook is also available in Eikon. Separately, an integration with Microsoft Office allows clients to incorporate data via the vendor’s API into models built in Microsoft Excel, and other Microsoft Office applications.

However, while Workspace’s GUI is its most visible representation, its strength is its API-driven back end that enables clients to make use of its data in other applications, depending on a firm’s needs and model.

Yankov says clients will use Workspace in one of three ways. Some will use its front-end “container” as their main data interface to build and power their workflows. Others will use the APIs to take elements of Workspace’s content and functionality, and make them available elsewhere within their organization or in customer-facing application, thus replacing more elaborate workflows currently in place to deliver a 360-degree view of a stock. The third option would involve using Workspace as one component of larger firms’ proprietary data architectures.

“A research analyst at a tier-one bank, staff at a family office, or hedge fund would all have different requirements, and different starting positions,” Yankov says. “We can start with a foundation and build that out with components, or for clients who may not have a ton of data scientists, we can give them a turnkey solution that they can customize.”

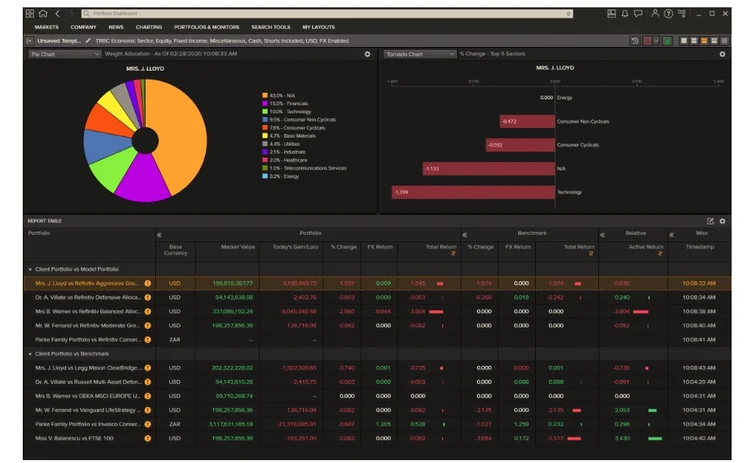

Workspace for Wealth Advisors has already been rolled out, and Refinitiv is making sales and upgrading existing clients who use its other products, Yankov says, adding that it helps wealth managers make their advisors more productive.

“For example, an advisor needs to be able to pull together all their institutional knowledge about a client—their trade history, current holdings, performance, and more—into a singular environment, and infuse that with market data. So when a market event occurs, advisors get a list of which clients they need to call,” Yankov says. “For traders, density of information and speed of responses is very important, given their limited [desktop] real estate. It’s important to achieve maximum output for minimum input.”

Wealth managers, on the other hand, have a completely different set of requirements. “For example, they spend longer [amounts of time] researching interdependency between different factors,” he says. “So, for them, it’s more important to have a web paradigm, and to present information in a more spaced-out way. It comes out of the box as a wealth advisory solution or an investment banking solution. Eikon doesn’t do that.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.