Regulations

Not so Fast: SEC’s SIP Rule Speeds Ahead, But Faces Bumpy Road

Jo is skeptical that the SEC’s finalized market data infrastructure rule will make the public market data feeds faster.

SEC’s Market Data Infrastructure Rule Not Easily Said or Done

The finalized equities market infrastructure reforms will make a difference, but some market participants are calling for additional clarity.

IBM Bets on Cloud & Containerization to Win Over Investment Banks

After its acquisitions of Red Hat and Promontory, IBM is looking to expand its footprint in the capital markets through containerization, as well as reg reporting in the cloud.

EU Regulators Spill More Ink Tackling Market Data Costs

The latest consultation on the market data obligations under Mifid II looks to provide better, cheaper, and more uniform access to market data. But will it be enough to standardize policies?

IHS Markit Adds Tool to SFTR Platform to Catch Missing LEIs

The data provider's SFTR offering provides opt-in features to minimize LEI-related errors in collateral messages.

Synechron Develops Differential Privacy Tech to Leverage Internal Data

The solutions are designed to allow firms to query data and build models more effectively without breaching global privacy rules.

Banks Explore Graph Technology to Tackle Data Complexity for Compliance

Although graph technology is still in the early stages of adoption, banks such as Wells Fargo and ING have begun leveraging it to find previously unknown connections between datasets.

New DTCC Consulting Unit Embarks on First Project

The market infrastructure firm founded a new advisory service last month, which has begun its first client engagement to evaluate regulatory reporting.

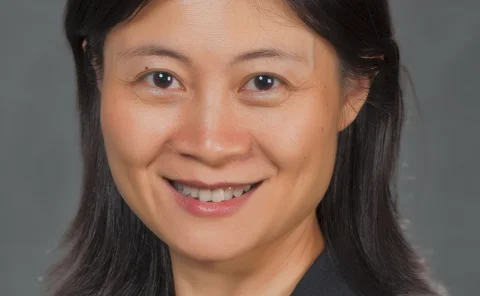

People Moves: BNY Mellon, big xyt, Temenos, SEC, Gresham, First Derivatives

A look at some of the key "people moves" from this week, including Fangfang Chen as (pictured), who has been appointed Asia Pacific chair and Asia Pacific head of asset servicing and digital at BNY Mellon.

EU Firms Seek Clarity on Tech Requirements for Incoming Cloud Guidelines

As Europe prepares for a new batch of outsourcing rules, some firms are looking for answers on how to test exit strategies and mitigate concentration risk.

Asset Managers Fear ESG Data Disclosure Gap

Investment firms need data to meet upcoming regulatory requirements. But corporates aren't making this data available in high enough quantity or quality.

Solidatus Builds New ESG Model

The software company aims to help banks' and financial institutions achieve higher ESG ratings.

This Week: State Street/Simcorp, Bloomberg, ACA, Broadridge & More

A look at some of the past week’s financial technology news.

Banking Experts: Tech Isn't the Whole Solution to Financial Crime

The industry and researchers are challenging the touting of privacy-enhancing technologies as a cure-all for KYC/AML failures, and advocating systemic reform.

Milestone Group to Launch Fair-Value Feature to Flagship Platform

The vendor will make the pControl add-on globally available to clients later in 2020.

EU Proposal Takes Aim at Major Cloud Providers

Jo writes that the EU’s new digital package could find large cloud providers operating in the bloc subject to potentially invasive oversight, as the EU strives for “data sovereignty”.

Slow Road to Consensus: CFTC's Behnam Talks Climate Risk

As CFTC commissioner Rostin Behnam’s report on climate risk to the financial system is published, WatersTechnology speaks to Behnam about data, greenwashing, and gaining support in Washington.

Isda 'Create' Marks Important First Step Toward Smart Contracts

WatersTechnology goes inside Isda Create to see how the organization is aiming to bridge the gap between the worlds of paper contracts and legal data.

This Week: SGX/Cassini, UBS/GitLab, QuantConnect & Snowflake

A look at some of the past week's financial technology news.

Eventus Systems to Add ML-Driven Trader Profile Feature to Validus

The new functionality will help to give context to market manipulation alerts.

Waters Wrap: Unintended Consequences & AI Regulation (And Mobile Trading Reg & BERT NLP)

Due to the pandemic and rapid advancements in the fields of AI and mobile technology, regulators in the US and Europe have unique challenges on their hands.

Covid Could Cause US Regulators to Rethink Surveillance

Not having specific requirements and procedures for firms to refer to ended up putting some funds in a tough place during the pandemic’s early days.

EU's AI Regulations Could Lay Blame With CTO

Jo wonders if the EC's approach to regulating AI could adapt existing liability laws—with implications for individuals.

Exchanges, SEC At Odds Over Odd Lots

Industry insiders warn that the regulator’s attempts to modernize equities data by redefining trading lots will fall short of the mark if odd lot orders remain unprotected.