Risk

People Moves: BNP Paribas, HKEX, Broadway, BMLL, and more

A look at some of the key people moves from this week, including Tim Baker (pictured), who joins BMLL as senior advisor.

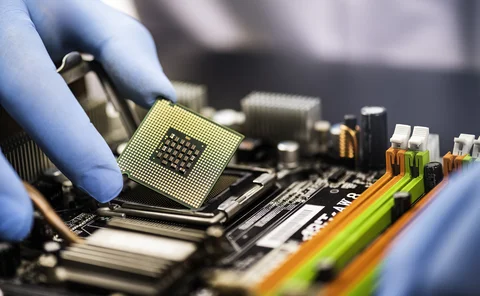

Euronext’s datacenter move on schedule despite supply chain issues

Despite chip and hardware shortages, the exchange group says it is on track to go live with the new datacenter on June 6.

The good, the bad, and the ugly of financial democratization

From crypto and Web3 to Robinhood and Reddit, democratization underscores it all. While it’s a largely benign concept that aims to level the playing field between institutions and individuals, it’s also really hard to get right.

People Moves: Tradeweb, Rimes, CME, LiquidityBook, and more

A look at some of the key people moves from this week, including Renaud Larzilliere (pictured), who joins Rimes as COO.

Danske Bank turns to licensing optimization for cost savings in the millions

In a cloud world, IT asset management can save on operational and compliance costs and get the most out of software usage. But it's important to find the right people for the job.

This Week: Amundi Tech; Broadridge/ Santander; Deutsche Börse & more

A summary of the latest financial technology news.

Eurex upgrade timeline too tough, say banks

As exchanges prepare roll-out of major upgrades, banks are struggling to cope

Waters Wrap: Mid-tier market data providers look to reinvent themselves

Anthony loves when his opinions spark debate. Following responses to a recent column on consolidation among mid-market data technology vendors, he provides something of a case study, which looks at how Exegy is evolving after its acquisition of Vela.

What the hell is Web3, anyway?

The next iteration of the internet is upon us, with the potential to deliver radical shifts to every industry, including banking. The movement, which is currently buoyed by the prospects of blockchain and virtual reality, has implications for computing,…

This Week: Red Hat/Temenos, Six/BIS/SNB, Avelacom/LSEG & more

A summary of the latest financial technology news.

Meme stocks, Reddit, and QAnon: A postcard from the origin of the metaverse

Join WatersTechnology for a look back at the most absurd stories of the year—Reddit/GameStop, the advent of meme stocks, and QAnon—and what they mean for you.

Quantum computing: kryptonite for bitcoin and cyber security

Race is on to secure new encryption algorithms for DeFi, before quantum computers become a present danger.

People Moves: Cboe, Esma, ASIC, State Street, NeoXam, and more

A look at some of the key people moves from this week, including Erik Thedéen (pictured), who has been appointed vice chair of Esma.

UBS equities team gets to grips with SFDR funds, ramps up ESG scoring

An active equities team at UBS is refining its approach to ESG integration as it converts funds to Article 8.

Cloud promises cost savings, but users still overspend

Cloud overspending and overprovisioning is a pervasive problem as cloud usage is poised to grow in 2022.

US banks harbor concerns over agencies’ cyber risk rule

The lack of a reporting template means “people can give the least amount of data possible”, warns a bank CISO, stymieing data sharing.

People Moves: NYSE, Broadway, FactSet, Tourmaline, and more

A look at some of the key "people moves" from this week, including James Bunch (pictured), who joins TRG Screen as chief technology officer.

Regulators turn gaze on ESG rating providers—for better or worse

Governments around the world are looking to clamp down on providers of ESG ratings and data products. Jo wonders what the implications could be for a still nascent market.

Nasdaq rolls out new fixed-income trade surveillance alerts

The vendor is introducing additional alerts for trade surveillance to help tailor its solution for OTC fixed income.

People Moves: Rimes, Broadridge, TP Icap, Sifma, and more

A look at some of the key "people moves" from this week, including Justin Brickwood (pictured), who joins Rimes as head of benchmark data services.

Bloomberg deploys math, not AI, to blend risk management and portfolio construction

The Mac3 GRM risk solution is live for equities users, uses no AI or machine learning, and will be rolled out to more asset classes next.

From burst to bust: What happens when cloud runs dry?

After years of initial resistance, the capital markets have come to depend heavily on the compute capacity of the public cloud. But increasing market volumes are rapidly outpacing the cloud capacity that organizations thought would be sufficient for…