Scout Finance Bows Fundamental Research App for Buy Side, Investors

The app will allow users to search, view, cache and share research and company documents.

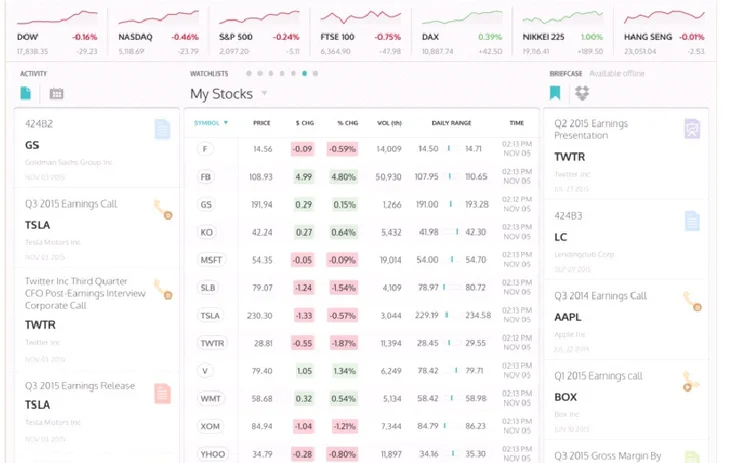

The app allows users to set up a watchlist of companies, then alongside that displays a feed of research documents, filings and company presentations relevant to companies in the list, sourced from Thomson Reuters, Morningstar, and from Scout Finance's own data collection process, where the vendor visits the websites of exchange-listed companies and downloads information using an algorithmic process.

Users can then search and annotate any of the documents, and can cache them to read later, and share them with whoever they want via an email link. The app also records, stores and caches earnings calls so users can listed to those in the background─even without an internet connection, such as on the subway.

"Normally, you would have to go to individual company investor relations sites to get and download filings and presentations. We hope to save users 30 minutes per day, instead of them spending that time trawling websites, printing documents and sending them out," says Scout Finance co-founder and chief executive Vivek Nasta. "If we can take between 30 minutes and two hours out of someone's day─especially around earnings season─we think people will be prepared to pay $200 per month for the convenience."

In the future, Scout Finance may seek to replace some of the data it currently sources from third-party vendors, such as any filings it does not already collect directly, though Nasta says collecting financial data "would need 1,000 people in India," but might be economically feasible in the long term.

"We pull in datasets such as fundamentals and recalculate them into a standardized format and also present them in ‘as-reported' format... and from the quarterly reports that we capture, we can roll those figures up into an ‘annual' figure in one step, rather than having to load it into Excel and roll it up from there," he says.

Scout Finance built the app natively for the Apple iOS operating system without using HTML5, since HTML5 does not support caching, Nasta says. "We thought this was a better way than building a desktop on the web and shrinking it responsively," he says. "We've tried to create a mobile-first product that serves on-the-go investors, such as long-short buy-side professionals who are out at conferences or in meetings."

The vendor does not plan to build an Android app, since officials say the vast majority of users have iOS devices. However, it will roll out a mobile-friendly, responsive next year that can support Android users.

Nasta set up the company early last year before officially launching in the middle of this year, after several months of already coding initial versions of the product. He then assembled a team of former Thomson Reuters and Bloomberg staff, including Ashish Muni, former chief technology officer and global head of mobile technology at Thomson Reuters, and Milan Manavat, a former senior mobile developer at Bloomberg.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

This Week: Trading Technologies completes ANS deal; State Street; Equinix; and more

A summary of the latest financial technology news.

Interactive Brokers looks beyond US borders for growth opportunities

As retail trading has grown in volume and importance, Interactive Brokers and others are expanding international offerings and marketing abroad.

JP Morgan’s goal of STP in loans materializes on Versana’s platform

The accomplishment highlights the budding digitization of private credit, though it’s still a long road ahead.

As data volumes explode, expect more outages

Waters Wrap: At least for those unprepared—though preparation is no easy task—says Anthony.

This Week: ICE Bonds and MarketAxess plan to connect liquidity networks, TS Imagine, Bloomberg, and more

A summary of the latest financial technology news.