Settlement

Citi details API for HKEX’s Synapse

New pieces of technology, like Synapse, assist Citi in migrating clients to newer technologies, and newer ways to settle and clear more efficiently.

Waters Wrap: A glimpse of 2024 through the looking glass of 2023

Anthony examines some of the biggest stories from the past year to preview what might be ahead.

Managing the FX challenge for T+1

As firms prepare for T+1 in May 2024, DTCC’s Val Wotton says they should also consider the complexities for cross-border trades.

The move to T+1: This time is different

This whitepaper, created by Broadridge, focuses on leveraging robotic process automation and AI to ensure a smooth transition from T+2 to T+1 settlement.

Waters Wrap: Examining ASX’s CHESS do-over

The Australian exchange was the first exchange to be all-in on DLT—and the project failed. Anthony speaks with ASX’s Tim Whiteley to discuss the lessons learned and why he thinks the second attempt will succeed.

Bulletproof building: DTCC, AWS debut app resiliency prototype

The cloud provider and industry utility have jointly released a prototype and guidelines for building resilient financial services applications.

Settlement ‘instructions’: Firms look to US for guidance as Europe braces for T+1

Operations professionals in Europe look across the pond for lessons in managing shorter settlement cycles.

T+1: Complacency before the storm?

This paper, created by WatersTechnology in association with Gresham Technologies, outlines what the move to T+1 (next-day settlement) of broker/dealer-executed trades in the US and Canadian markets means for buy-side and sell-side firms

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: ICE, Nasdaq and differing views about cloud

As exchanges continue to embrace cloud, the decisions they make today will have long-lasting implications.

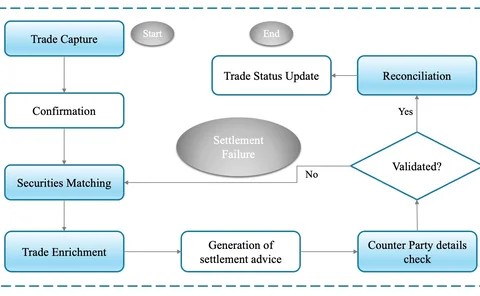

Increasing securities settlement successes with unique transaction identifiers

Major improvements have been made to the securities services operating model over the past decade, but inefficiencies in trade settlement processes remain, leading to thinning margins and longer settlement cycles. Key to addressing these challenges is…

Outsourced trading sees uptick as buy side seeks more bang for its buck

Buy-side firms see outsourced trading as a way to simplify their operating model, while custodians see an opportunity to sell bundled services.

Banks, asset managers look to vendors for T+1 support

This whitepaper, created by WatersTechnology in association with SmartStream, focuses on the upcoming move in the US to T+1 (next-day settlement) of broker-dealer-executed trades.

Optical computer beats quantum tech in tricky settlement task

Microsoft’s analog technology twice as accurate compared to IBM’s quantum kit in Barclays experiment

Shortening the Settlement Cycle: Then and Now in Asia

DTCC’s Joseph Capablanca says that while T+1 will bring benefits to Asia investors, industry participants need to improve ‘behavioral processes’.

Digital assets trade processing: The roadblocks and the road ahead

Institutional investors want digital assets, but have several key concerns. Kristin Hochstein of ISITC explores some ways to improve investor confidence in the space.

UBS found no advantage in quantum computing—ex data chief

The Swiss bank tested various use cases in its trading business before giving up on the technology.

Automating collateral management processes crucial for T+1 move

The reduction of settlement times from T+2 to T+1 for many US securities is likely to impact firms’ collateral management processes when it comes into force at the end of May 2024.

T+1: Cash and liquidity management functions impacted

The reduction of settlement times from T+2 to T+1 for many US securities, set to come into force at the end of May 2024, is likely to impact a number of business processes across the sell side. Nadeem Shamim, head of cash and liquidity management at…

Regulation Best Ex: Investors’ ‘new bestie’ or just extra hassle?

The SEC's proposed best execution regulation has ruffled some feathers. With a host of key details still to be resolved, industry experts say the rule in its current form could represent a big change in the way orders are handled.

Crypto custody faces regulatory death-roll

New measures to safeguard digital assets threaten to squeeze the life out of custody business, insiders fear

Waters Wrap: Blockchain—let’s put the hammer back in the box

With the ASX Chess DLT failure and users ignoring DTCC’s DLT option for its Trade Information Warehouse, Anthony wonders what it will take for the industry to stop touting this buzzword for non-specialized needs.