SS&C continues Blue Prism rollout, eyes other acquisition targets

The company is focusing on organic growth while keeping its eye on potential acquisitions.

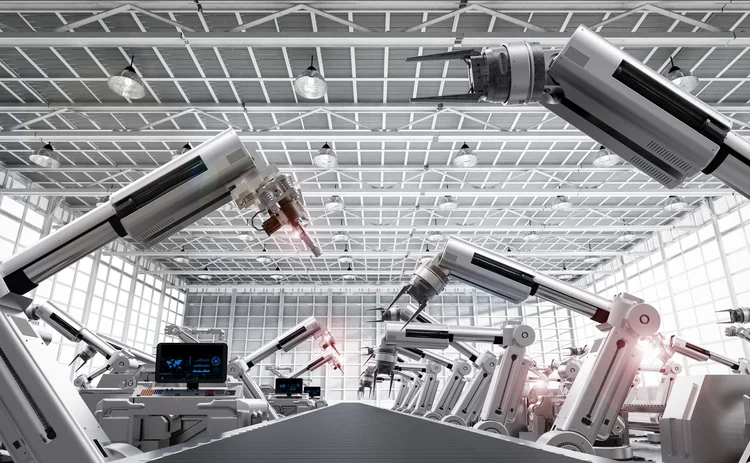

SS&C Technologies is continuing to roll out Blue Prism—a robotic process automation specialist it acquired in 2022—internally.

“We are continuing to roll out Blue Prism within SS&C. In some ways, we are building momentum because as more people get trained up, we have more capacity to have additional processes be subject to that robotic process automation and AI-type enhancements,” Rahul Kanwar, president and COO at SS&C, said during the firm’s Q2 earnings call on July 25.

The firm released the next generation of Blue Prism in March this year, which is aimed at offering organizations greater scale, agility, and access to the latest capabilities via a hybrid cloud deployment model.

Kanwar said the release contains generative AI capabilities as part of its workflow, making it easier for SS&C to roll out internally and helping improve its product differentiation from others in the marketplace.

William Stone, chairman and CEO at SS&C, said the intent of the $1.6 billion Blue Prism acquisition was for it to be “the floor” for all its applications and services.

“The intent when we bought Blue Prism was to buy something that was horizontal that would act as almost like the floor for all of our different applications and services to hang off on, or to improve with and be able to present a technological differentiator that we can train everybody on across the enterprise,” he said on the earnings call.

This has helped SS&C take Blue Prism externally, too. “We’ve done 75 acquisitions, so there’s a lot of teaching and training and implementing of Blue Prism, both internally and then as we take people out externally, they get a lot of confidence because we’re using it. We’re eating our own dog food. We’re processing on Blue Prism across almost every one of our disciplines inside,” Stone said.

In response to a question about potential future acquisitions, he said the current valuations are still “elevated,” but SS&C continues to look for relevant targets.

“We’ve really built the company around organic revenue growth and acquisitions. We see a lot of stuff out there. We see things that are on the low end of ridiculously priced, so we are willing to look hard,” he said.

He added that the company would like to deploy capital in acquisitions to further build out its portfolio of products and services.

“I don’t see any $5 billion or $10 billion acquisitions on the near-term horizon, although SS&C will be in the running if any of those things come on the market,” Stone said.

He stressed again that SS&C has a strong focus on organic revenue growth and has looked at a few acquisitions, but said, “… the ones that we really like are pricing at 10-times revenue, so we don’t like them that much at that price.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

This Week: Startup Skyfire launches payment network for AI agents; State Street; SteelEye and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: Standard Chartered’s Brian O’Neill

Brian O’Neill from Standard Chartered joins the podcast to discuss cloud strategy, costs, and resiliency.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

The IMD Wrap: With Bloomberg’s headset app, you’ll never look at data the same way again

Max recently wrote about new developments being added to Bloomberg Pro for Vision. Today he gives a more personal perspective on the new technology.

LSEG unveils Workspace Teams, other products of Microsoft deal

The exchange revealed new developments in the ongoing Workspace/Teams collaboration as it works with Big Tech to improve trader workflows.