SuperDerivatives Aims to Shake Up Display Market with Low-Cost Alternative, App Store

Over-the-counter pricing and risk management software vendor SuperDerivatives has unveiled its DGX market data terminal, which opens the vendor to the front-office terminal business, expands its coverage to new asset classes, and offers additional data and tools from third-party providers via an app store-like marketplace of premium services, dubbed DGX Store.

The web-based terminal, which is accessed via SuperDerivatives’ website, will provide a real-time, widget-based display covering equities, indexes and exchange-traded funds, 800,000 bonds—some sourced via an agreement with a leading fixed-income trading platform—as well as major and emerging currencies, energy contracts as well as metals, agricultural and freight commodities contracts, interest-rate products and credit default swap curves.

“A lot of this real-time data is piped in [to our pricing services], so we are used to handling real-time feeds; we just didn’t display the data in real time before,” says David Collins, head of strategic development at SuperDerivatives, adding that the vendor’s intent is to build a product to compete with the Bloomberg Professional terminal. “If we tried to build a Bloomberg terminal, we would still be working on it in 10 years. But we don’t have to build it; we can have others build it for us,” he says, referring to the additional capabilities that will be available via the DGX Store.

The store is designed to provide premium services that would be prohibitive for SuperDerivatives to build in-house, enabling the vendor to offer a base edition of the workstation entirely “free forever” to clients of its SDX Pricing service, and free of charge to non-clients until next summer, after which it will introduce tiered pricing ranging from around $200 per month to around $1,500 per year, allowing users—such as banks, brokers, asset managers, hedge funds and corporates, all of which were among its beta test group—to pay for only the specific add-on premium services they need, Collins says.

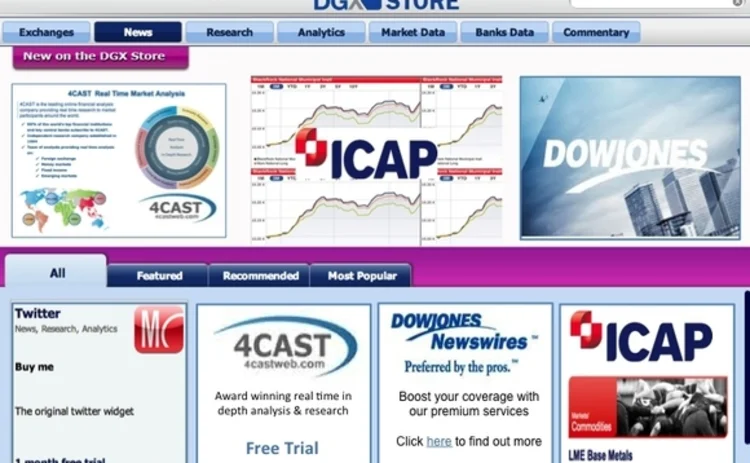

Data suppliers already committed to providing data via the store include foreign exchange commentary and research provider 4Cast—which will also provide a daily report in the base terminal—Thomson Reuters’ IFR capital markets news and analysis service, and major brokers including Icap, Tullett Prebon and Tradition, says Bonnie Eshel, head of market data at SuperDerivatives, who adds that to encourage a critical mass of third-party app developers to join the platform, the vendor will develop the container for vendors’ apps to run in DGX, and is also not charging a fee to be part of the DGX Store.

Firms can also package their proprietary datasets within the store, either for distribution to clients, or for internal use—which SuperDerivatives can restrict only to entitled users within a firm, Eshel adds. Other candidates could be live exchange feeds or premium research, she says, while Collins says this could equally include corporate actions, or granular municipal bond data that would augment a basic dataset available in the base terminal.

Other content included in the base version of the terminal includes historical charting, news content from Dow Jones—with the newswire’s premium content available for purchase in the DGX Store—and a Twitter news feed, live CNBC video content, and a chat capability, which will enable users to send instant messages to other DGX users and other messaging programs, to hold individual conversations, or to blast prices or requests-for-quote to groups of counterparties

In an update early next year, the vendor will introduce an Excel link, to allow users to download data into spreadsheets for more detailed analysis, and will introduce the ability to link widgets in the same screen so that if a user selects an instrument in a price display, it populates other windows with data relating to that asset.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Recent volatility highlights tech’s vital role in fixed income pricing

MarketAxess’ Julien Alexandre discusses how cutting-edge technology is transforming pricing and execution in the fixed income market amid periodic bouts of volatility

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

This Week: Trading Technologies completes ANS deal; State Street; Equinix; and more

A summary of the latest financial technology news.

Interactive Brokers looks beyond US borders for growth opportunities

As retail trading has grown in volume and importance, Interactive Brokers and others are expanding international offerings and marketing abroad.

JP Morgan’s goal of STP in loans materializes on Versana’s platform

The accomplishment highlights the budding digitization of private credit, though it’s still a long road ahead.

As data volumes explode, expect more outages

Waters Wrap: At least for those unprepared—though preparation is no easy task—says Anthony.

This Week: ICE Bonds and MarketAxess plan to connect liquidity networks, TS Imagine, Bloomberg, and more

A summary of the latest financial technology news.