Thasos Group Assets Acquired By Market Service Inc.

The location data specialist has been sold after falling upon rough times last year.

All assets belonging to New York-based Thasos Group have been sold off to Market Service, Inc. (MSI), WatersTechnology has learned. Based in Long Island, NY, Market Service Inc. also owns AggData, another seller of location data. Thasos’ assets will be used under the MSI brand, a spokesperson for MSI said.

Terms of the deal were not disclosed, but it’s understood that the sale price was low compared to Thasos’ $42 million valuation from last year, according to two other sources familiar with the deal.

In September 2019, Business Insider reported that then-Thasos CEO and co-founder, Greg Skibiski, had stepped down, and the vendor cut roughly two-thirds of its staff. Throughout August and the first-half of September 2019, the 40-person staff was reduced to just 12, according to that report.

More details will be officially released by the company in the coming weeks, according to the spokesperson.

AggData offers a series of services. It’s Premium account provides unrestricted access to more than 6,500 datasets. According to its website, each dataset is extracted from primary sources and updated regularly. It provides historical data to examine trends over time, it provides access to a real-time API that connects AggData’s information directly into the user’s system, and it provides custom lists. While the spokesperson declined to say how Market Service would use Thasos’ assets, AggData and Thasos would clearly make a good pairing.

Lots of Promise

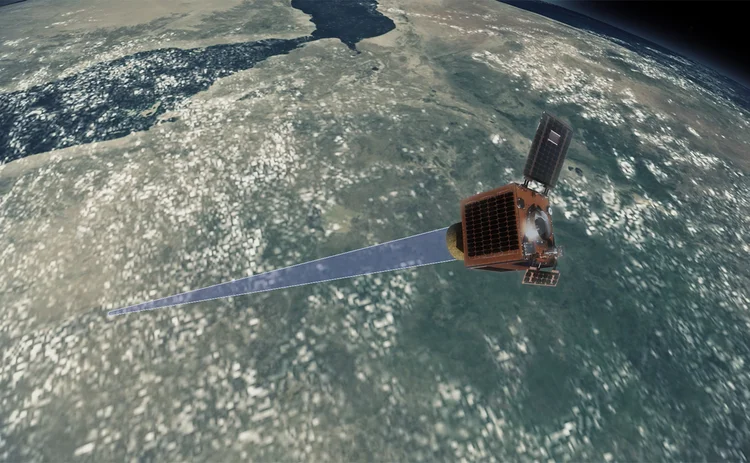

Thasos Group was one of the more interesting alternative data providers to hit the market at a time when this sector was really starting to take off. Founded in 2011 at the Massachusetts Institute of Technology (MIT), the vendor would take satellite images and location data from mobile phones to provide actionable trading information around foot traffic.

As an example, it had an offering called Streams, a time-series data service based around consumer traffic to retail stores or a company’s headcount, which can be leading indicators of company-level or broader macroeconomic health.

The Streams are broadly segmented collections of ticker-by-ticker data for metrics that can be measured based on the presence and movement of people in or to certain locations. Thasos launched its Consumer Streams service in March 2017, which at the time covered 150 companies, and monitored foot traffic in retail stores and restaurants, for example. Shortly thereafter the vendor launched its Non-Consumer Streams, then covering 200 companies, and providing figures for the number of people employed—and hours worked—in manufacturing jobs, or the number of patients staying in a hospital.

Then, in the summer of 2017, Thasos launched Mall REITS Stream, which analyzed consumer foot traffic within shopping malls to determine with greater precision which stores shoppers are visiting, how long they spend there, and what impact that could have on a retailer’s earnings. In 2019, it rolled out a superset of products specific to quantitative hedge funds called QStreams, which also monitored real-time foot traffic. QStreams provided subscribers with daily customer visitation and other fundamental metrics for every individual store, restaurant, factory, or other location owned or operated by more than 480 companies. It also was able to look back on four years of collected data.

Thasos had a lot of promise, in part, because of the company it kept. By summer of 2017, it had close to 25 hedge fund clients. Its investors, employees, and advisors included PDT co-founder Ken Nickerson, Acadian Asset Management founder Gary Bergstrom, former D.E. Shaw chief risk officer Peter Bernard, MIT Media Lab co-founder Alex “Sandy” Pentland, and Andrew Lo, director of the Laboratory for Financial Engineering at the MIT Sloan School of Management. Skibiski, himself, was the founder and CEO of Sense Networks, which used machine learning to create insights around mobile phone location and carrier call pattern data. The company was later acquired by YP, which was formed was from the merger of AT&T Advertising Solutions and AT&T Interactive, with Cerberus Capital Management holding a controlling stake.

In August, 2018, Skibiski joined the Waters Wavelength Podcast to discuss the alternative data sector and provides insights into some of the challenges, trends and use cases for this information. Click here to listen.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

This Week: Startup Skyfire launches payment network for AI agents; State Street; SteelEye and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: Standard Chartered’s Brian O’Neill

Brian O’Neill from Standard Chartered joins the podcast to discuss cloud strategy, costs, and resiliency.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

The IMD Wrap: With Bloomberg’s headset app, you’ll never look at data the same way again

Max recently wrote about new developments being added to Bloomberg Pro for Vision. Today he gives a more personal perspective on the new technology.

LSEG unveils Workspace Teams, other products of Microsoft deal

The exchange revealed new developments in the ongoing Workspace/Teams collaboration as it works with Big Tech to improve trader workflows.