TipRanks Builds Financial News Service to Highlight Analyst Ratings Data

The vendor provides ratings of research analysts, bloggers, and other stock tipsters.

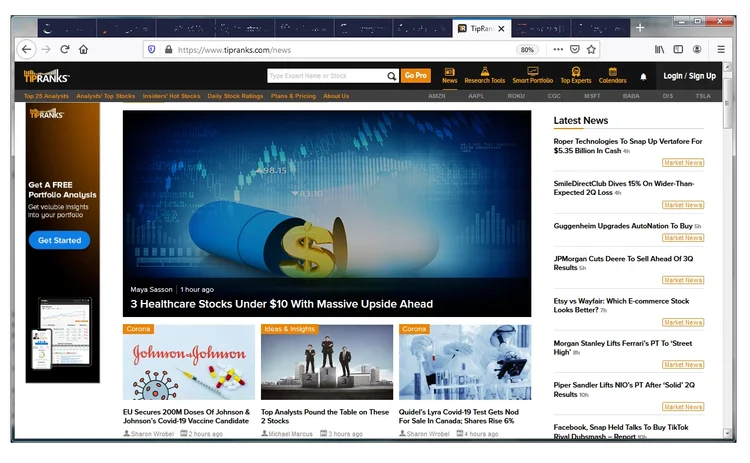

Tel Aviv-based TipRanks, a provider of ratings covering research analysts, bloggers, and other stock tipsters, has created a proprietary news service that provides unique stories based on analyst activity and corporate announcements, such as acquisitions and earnings.

The news service, unveiled earlier this summer, publishes news stories created by an in-house editorial team based on TipRanks’ analysis of news, research, financial blogs, and analyst recommendations, which the vendor collects to create its core service of monitoring analysts and comparing the success of anyone providing stock recommendations.

TipRanks, which serves hedge funds, financial websites, and retail brokers, decided to expand its existing content production operations late last year as it weighed how best to scale its business and expand its marketing efforts.

“We started producing news as a marketing channel on our blog. Initially, it wasn’t breaking news, but was articles based on our data. Then financial research websites started picking it up. So we started to create more and more news, and began syndicating it to other websites, and even though we’re not a ‘news provider,’ our content would consistently be the top stories on their sites,” says Uri Gruenbaum (pictured), CEO and co-founder of TipRanks. “Lots of users like to read that rather than get their hands dirty doing their own analysis of our research. Because we analyze so much news, research, blogs and analyst research, we can come up with news that would be hard to get—for example, stories showing the reliability and success of different blogs, and how bloggers compare to professional research analysts.”

Over the past year, TipRanks embarked on a recruitment drive to hire more journalists, and now employs around 10 staff dedicated to creating its own news, divided into two main teams. The first, comprised of four reporters and contributing authors, produces stories, analysis, and insights covering investment ideas and what analysts are saying. The second comprises five reporters, divided between breaking news and everyday news items, covering some notable analyst upgrades, but mostly focusing on corporate news events, such as earnings announcements.

Gruenbaum says TipRanks plans to continue growing its news operations, and to apply its rankings to its own news to promote transparency, and to be as search-friendly as possible to attract visits from investors searching for news online.

Some individual stories have already attracted upwards of 30,000 readers per day, and the site regularly attracts around 100,000 visitors per day, out of almost two million unique users. As well as making the news available on its website, TipRanks also publishes daily email newsletters.

Gruenbaum got the idea for TipRanks nine years ago, after his own investments made him question the reliability of certain analysts.

“I came across an article on a financial research website recommending that I should invest in Tata Motors. Six months later, the stock was down, and so I wondered why I should trust the analyst. So I Googled his name and read all his recommendations, and realized he was wrong most of the time,” he says. Gruenbaum also realized there was no one already collecting and ranking this information for market participants. “So I came up with the idea of software that aggregates all this information and allows investors to evaluate financial advice.”

Realizing that the venture would require an in-depth understanding of natural-language processing, Gruenbaum enlisted Gilad Gat—a former security software engineer—as co-founder and CTO, and started signing up Israeli banks as clients and investors, before expanding its service to the US and Canada, with coverage of more international markets planned for the near future.

The company has just announced $12 million in new funding from Prytek, a Singapore-based corporation that is an investor and also combines technology from different companies. Prytek already invested $3 million in TipRanks in 2018, Prytek chairman Yossi Serrousi was one of TipRanks’ first clients, when in 2013 as chairman of Israel-based Bank Hapoalim, he integrated the vendor’s data into the bank’s website.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.