Trade Finance as an Asset Class: Rough Seas Ahead

As global banks seek to promote trade finance as an investable asset class to the buy side, the sector’s lack of technology and data infrastructure have come to light.

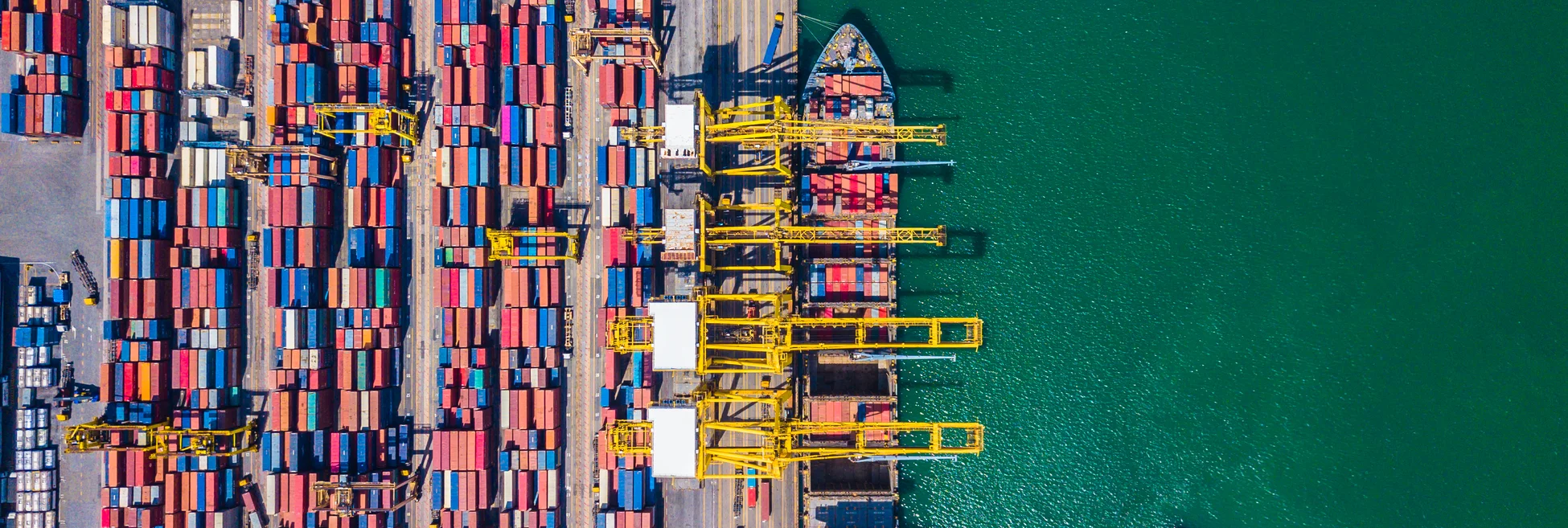

Banks have been the primary force behind trade finance for years. Trade finance is essential to the global economy and the sell side is now looking to turn this sector into an investable asset class—but it hasn’t been smooth sailing.

If the asset class is to take off, a lot of work still needs to be done when it comes to deploying technology and building out the necessary data infrastructure—something akin to what’s been seen in recent initiatives in the mortgage-backed securities field.

As an emerging asset class with some institutional interest, trade finance has been slow to take off due to a lack of standardization. As a result, it has been difficult to even create benchmarks that would allow the buy side to fully get involved. Naeem Khan, global head of trade finance at Crédit Agricole CIB, says technological changes to the sector will bring it more in line with other more traditional financial instruments.

“It’s an opportunity and a challenge for a traditionally paper-based sector, so bringing technology into it and digitizing it is positive. Once it has been digitized, it brings cost efficiencies and we can serve clients more efficiently,” Khan says. “I believe that in a few years, trade finance will grow in status and be seen as a truly investable asset class in its own right, to the extent that it is a viable alternative to equities and bonds. Various studies have shown that it is a lower risk proposition and is intrinsically tied to growth in the global economy.”

High Interest, High Confusion

Trade finance usually refers to financing—either by loan or a bond—secured by businesses in order to ship goods. Global trade highly depends on trade financing as it can get very expensive for small to medium enterprises to move their products or raw materials to their customers across oceans or via rail. Although it has been around for centuries, trade finance is not traditionally traded as a security. But it’s an attractive space because of its short tenor and low default rate, though it’s also a wildly inefficient sector.

Like the mortgage sector before it—which is also highly paper-reliant—banks and the buy side saw potential in creating an asset class based on trade finance. And as more companies learn about how this space can be made investable, greater attention can be paid to the infrastructure around it.

Technology itself can play a bigger role because it can digitize the underlying instruments. This means trading is much easier than bilateral, one-to-one negotiations

Francesco Filia

A report from Greenwich Associates and the EFA Group, Trade Finance: A Promising New Asset Class for Institutional Investors, notes that possible roadblocks to the investment vehicle include its lack of credit ratings, illiquidity and limited regulatory compliance measures. Unlike other asset classes, trade finance relies mainly on paper documents such as bills of lading, payment invoices, and letters of credit. Some countries actually require paper documents before a shipment can be accepted by customs. Naturally, it’s hard to analyze multiple trades without the help of an electronic document. This opaqueness makes it difficult to get a clear idea of what is involved in a trade-financed contract, and therefore hard to price.

Power in Numbers

As global trade grows, firms are facing a large financing gap. The Asian Development Bank estimates a gap of $1.5 trillion in financing that must be filled to keep global trade growing. Trade around the world, according to the World Trade Organization (WTO), reached $5.3 trillion in 2017.

While it’s true that the WTO expects a 2.6% drop in global trade in 2019 due to increasing trade tensions and economic uncertainty, it also predicts that global trade will rebound in 2020, which could lead to the financing gap increasing.

In light of this, banks including HSBC, ANZ, Deutsche Bank, Sumitomo Mitsui, Standard Chartered, Standard Bank, Crédit Agricole CIB, ING, Rabobank, and Lloyds started the Trade Finance Distribution (TFD) Initiative with the aim of promoting the use of trade finance as an asset class. Part of the initiative’s mandate is to standardize definitions in the industry and create a more digital environment for trade finance.

The TFD Initiative works with TradeTeq as its technology partner and also counts among its members multilateral groups like the International Chamber of Commerce.

Damian Kwok, head of trade portfolio management at ANZ Bank, says the big challenge for the initiative is assuring potential investors the asset class is sustainable, accessible and transparent.

“There are a couple of key things we’re working on, one of which is how to use technology to improve the process. Trade finance has typically been a difficult asset for investors to access, as the underlying assets can be quite small, high-volume and the tenor of the instrument can sometimes be very short dated—as little as 90 days or 180 days,” says Kwok, who also oversees trade and supply-chain for Australia, New Zealand and the Pacific at the bank. “The challenge therefore is to reassure [the investors] that the asset is going to be replenished, so that they can be locked into the yield that they require in a portfolio or investment horizon. [Banks need to know] how to demonstrate the ability to provide a portfolio of assets with the risk appetite aligned against desirable yield expectations.”

Kwok says technology can transform the whole trade finance process, but due to the global nature of the space, there are a lot of moving parts that need to be addressed. Banks like ANZ will need to figure out how digitization efforts inside their own four walls can help to improve processes and bring transparency. After all, while banks have looked to embrace digitization projects, they are not as easy as pressing a button and having these complex documents turned into machine-readable outputs.

Paper Problems

As noted previously, one of most persistent issues in trade and trade finance is its adherence to paper-based documentation. Because of the amount of paperwork involved, it can be difficult to truly gain insight into each underlying asset in a trade-financed security.

Asset managers interested in doing more business around the trade finance asset class are eagerly awaiting any technology that can ease a lot of the inefficiencies in the industry and make it more accessible without the need for a bilateral negotiation with a bank.

There are different types of trade-finance transactions, many of them highly esoteric. This makes it incredibly hard to have detailed and comparable datasets. It’s also very document heavy and requires a high level of specialization and lots of manual labor to parse those documents.

Andy Sweeney

Francesco Filia, CEO and chief investment officer at Fasanara Capital, a London-based fund managing about $500 million in assets, says transparency into the market is even more important because the buy side must adhere to strict compliance rules. Any technology built for the asset class must allow companies to report to regulatory bodies.

“[Trade finance] needs the right technology, which can provide greater transparency on the underlying assets at the line-item level so investors can conduct effective accounting and reporting that is compliant with regulations like Basel IV,” says Filia. “Technology itself can play a bigger role because it can digitize the underlying instruments. This means trading is much easier than bilateral, one-to-one negotiations.”

Fasanara has also joined the TFD Initiative. Filia says something like machine learning can do a better job of asset location using data analysis to help investors assess risk. Filia says this “has not been done to the full extent by banks because they base their activities more on relationships and have devoted more attention to the top end of the industry.”

But not all asset managers think the trade finance asset class will be transparent enough so that information around all trades can be readily available. The lack of standardization of forms and terms can make it hard to conduct like-for-like comparisons. The asset class is also not actively traded, so it is difficult to compare to other deals—there’s a dearth of information. This means benchmarking prices for securitized assets is a difficult undertaking.

Andy Sweeney, head of capital markets at asset manager Blackstar Capital, says it is highly unlikely the trade finance asset class will have market data readily available on a Bloomberg Terminal, or something similar.

“There are different types of trade-finance transactions, many of them highly esoteric. This makes it incredibly hard to have detailed and comparable datasets. It’s also very document-heavy and requires a high level of specialization and lots of manual labor to parse those documents,” Sweeney says.

But Sweeney says digitization would help the trade finance asset class grow as the number of documents that must be processed is very high—that’s the first step. He says it is labor-intensive and time-consuming to onboard customers around trade finance, which means some organizations “avoid transactions that are less than $30 million since there is simply not much profit for them.”

ANZ’s Kwok, however, points out that banks are pushing for greater standardization especially because of the variables found in trade finance. He says putting standardized terms and processes first will make the development of a technology and data infrastructure much easier.

“The challenge is that trade is a global business—you have banks from Australia, North America, South America, Europe and elsewhere serving their local regions. These banks face different regulations, and have different processes internally,” Kwok says. “The challenge for an investor is that if they go to a trade finance bank, how do they know that the underlying documentation is going to be the same as another given the different regimes?”

Another challenge is getting developing countries to accept digitized documents. Crédit Agricole’s Khan says that while many developed countries can readily onboard platforms like the one TradeTeq is building, emerging countries generally do not trust digital documents. He says the power of a technology infrastructure for trade finance relies on having all parties using the same types of documents and providing access to the asset class for all interested.

Enter the Vendors

There are efforts underway, though, to help alleviate some of these challenges. London-based software company TradeTeq is working to build a platform for this nascent market. The platform will incorporate machine learning algorithms to help make connections from a sea of documentation. TradeTeq CEO Christoph Gugelmann—who was previously at Goldman Sachs for about 12 years, Morgan Stanley for two years and Bank of America for three years—says the platform will aim to make trade finance more appealing by using automation and algorithms to reduce risk and add much-needed transparency and clarity in a paper-driven world.

“We are proposing a solution that is live and ready for production today. You need computing power, cloud computing and digitization, which really opens up new channels and creates trust. Looking ahead, we may work with other technology providers where we become a node on a blockchain or just an API—we remain agnostic,” he says. “We have a buyer–supplier relationship and there’s a critical need for an investor to assess all associated risks, including risk related to credit, fraud and dilution. Our machine-learning technology offers the transparency that investors need to measure the trading and credit risks associated with buyers and suppliers.”

He adds the company currently has several proofs of concept ongoing with banks using its live client data.

Financial institutions interested in the asset class make do with the technology they have. When banks and some asset managers want to trade the asset class, they do it through bespoke platforms or—more often—through voice-traded bilateral negotiations.

We are big believers in distributed-ledger technology; the industry has made huge strides forward, but we believe the technology still needs to be embedded and scaled across the industry before it is ready for full production

Christoph Gugelmann

Companies like R3 and IBM are aiming to digitize trade finance and use blockchain technology to provide the infrastructure necessary to underpin the sector. While these are not specifically intended to forward trade finance as an asset class, the idea is to create an electronic record for loans, bills of lading, invoices and other paperwork. These projects aim to provide transparency and efficiency, issues that become important when promoting the asset class.

R3, through an initiative called Voltron, built an application on its Corda enterprise blockchain that provides a synchronized shared database of transactions that acts as a letter-of-credit application. R3 officials tell WatersTechnology that its latest test with 50 banks and companies saw 96% of its participants accelerate documentary collection and reduce letter-of-credit transactions to 24 hours from five to 10 days. It flags errors and instead of requiring a phone call to correct discrepancies, it can immediately reconcile any differences.

Gugelmann says distributed ledger technology could be a boon for the trade finance space, and by extension, the asset class itself, but the technology just isn’t ready yet for the needs of the industry.

“We are big believers in distributed-ledger technology; the industry has made huge strides forward, but we believe the technology still needs to be embedded and scaled across the industry before it is ready for full production,” he says.

Logistics firm Maersk has also built its own system for tracking shipments across the world that involves digitized paperwork that details the contents of its ships. This is limited to goods shipped with the company, though it could be used as a blueprint for others to follow.

Baby Steps

Trade finance itself is ripe for innovation—those efforts will only help to improve it as an asset class.

Even if this never takes off, it’s clear that trade finance needs to evolve. So, for now, the ultimate goal of banks and the buy side is to grow interest in trade finance by showing that it can be improved—interest will help with standardization efforts, which will be underpinned by digitization projects, which will help to push technology projects forward, which will help to build out this sector as a true marketplace.

But this is going to be a long process. The question is, though, if there’s the institutional fortitude necessary to push these standardization and digitization efforts forward.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.