Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

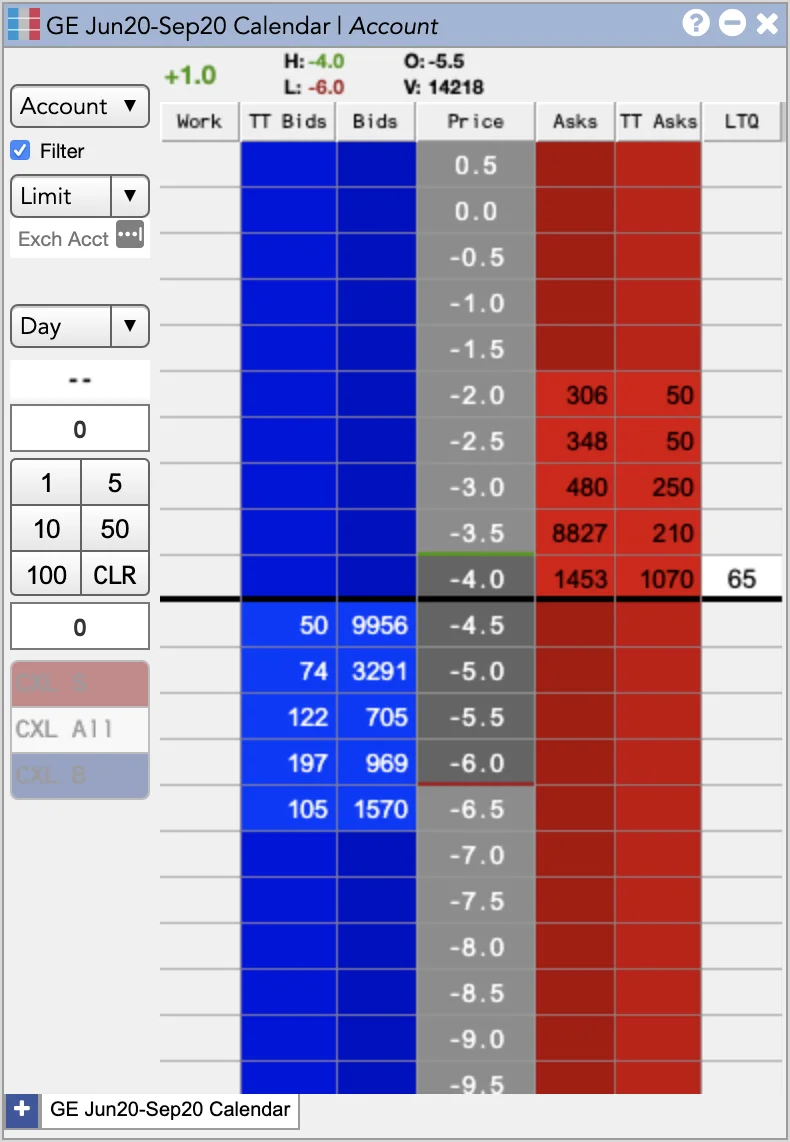

Trading Technologies (TT) is rolling out a new platform called Echo Chamber, which allows individual firms and groups of firms to see aggregated and anonymized order data in real time from more than 55 exchanges. At its core, Echo Chamber combines futures contracts traded on different exchanges to provide a single view of each, no matter where the contract is traded.

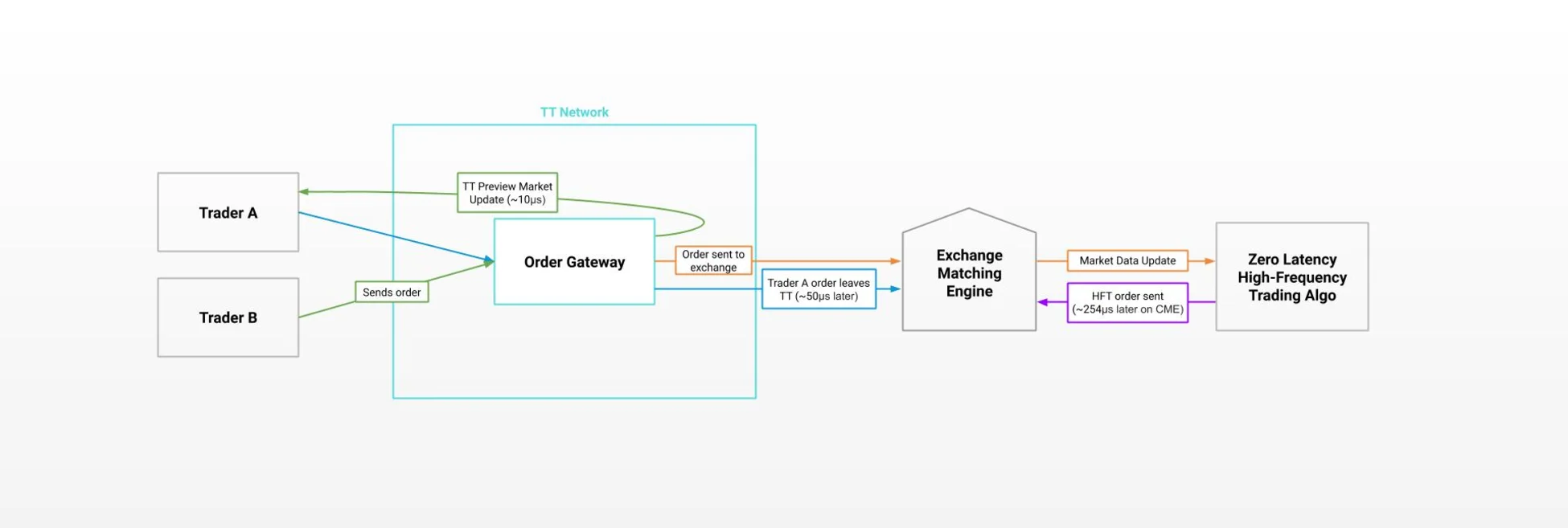

“We are not aggregating look-alike or similar market data feeds into one—that’s a practice that we’ve done for many, many years,” Rick Lane, chairman and CEO of TT, tells WatersTechnology. “What we’re doing here is we are taking all of the order flow that TT platform clients are trading, and before that order gets to the exchange, we are essentially echoing that order back as a book update. So we are creating a TT-only view into these publically-traded, exchange-listed derivatives that solves a couple of problems.”

At the top of that list of problems is the cost of market data, Lane says, as Echo Chamber gives firms an alternative market data source. He says that while TT clients represent a “significant portion” of lit liquidity at any given time on a particular exchange—“on many exchanges, in certain products, we are north of 10, 20, 30% of the volume traded”—they have to pay a significant price (upward of seven figures) to consume the market data that they are, in effect, helping to create.

“What TT is looking to do is take advantage of our scale and our client base—our distribution—and the fact that this now sits on top of a technology platform that can aggregate across 55-plus exchanges all of the global order flow that’s happening in real time,” he says. “This creates a TT-specific market data feed based on that order flow that they can consume in addition to, or in lieu of, the exchange-provided market data feed.”

While the Echo Chamber market data view will not be as exact as a direct feed from the exchange, Lane says that it will be close enough for a trader to work with for their secondary and tertiary markets that they trade on.

“If it’s your primary market that you’re trading and you need to see every last quantity and book update, chances are the Echo feed won’t be sufficient,” Lane says. But if a trader just wants to know where a particular secondary market is at that moment, this feed will suffice, and as a result, they don’t have to pay the exchange fee to receive that feed.

“Or maybe you’re feeding this market data feed into your own risk models where they really just need to know: ‘What was the last traded price, and what’s the inside bid and offer,’—all of these things, you pay the same amount for them [to the exchange],” Lane says. “So there’s a host of opportunities where someone could start to leverage the TT Echo feed to both save some money and [improve latency]. There is a tremendous latency advantage to being on-network and being on the TT platform.”

To that last point, Lane notes that firms who are on the TT platform, which is delivered using a software-as-a-service model, will see the orders live in the Echo feed before the exchange has had time to acknowledge the order.

“The longer it takes the exchange to acknowledge an order, the greater the advantages to anyone sitting on-platform,” he says. “While everybody else is waiting for the exchange to acknowledge, everyone on the TT platform has already seen that book update milliseconds in advance, essentially.”

The Opt-in Process

Firms will have to opt-in to have their order flow contribute to the Echo Chamber feed, and therein represents the first challenge for TT: convince clients to contribute their order flow “to the greater good,” Lane says, to create a robust, fully aggregated-and-anonymized datafeed.

To start, TT is actively seeking out early-stage adopters; once a critical mass is hit—Lane hopes by the end of this year—and the feed becomes more generally available, they’re not sure how the opt-in process will work: whether on an order-by-order basis, or a firm-by-firm or trader-by-trader basis.

Today, the vendor is engaged with “a handful of clients” that have large trading floors, sometimes trading the same asset class or product, where Echo Chamber provides a firm-wide view of order flow in real time. The next step will be for two or more firms that trade similar contracts or asset classes to pull their flow data together and create an aggregated book of the firms’ activities.

The final stage—which will be dependent on how the market receives this type of capability, is to have a swath of firms that agree to have their order flow aggregated on Echo Chamber.

Because Echo Chamber is a free service—in fact, the company may look to offer commercial incentives in the future for participation, Lane says—Trading Technologies hopes they will reach a critical mass by enticing firms to cut their market data costs.

“Before we do that, though, we will have to make sure that the incentives that would have a firm wanting to contribute their order flow to the greater good are enough to outweigh any concerns they might have on contributing that order flow to us,” Lane says, adding that it will be impossible for clients to get front-run on Echo Chamber, as the data is completely anonymized and fully aggregated, so other firms on the feed can’t see who is trading what, where.

With that said, Lane understands that an education process will have to take place in the beginning.

“The more people that want to contribute to Echo Chamber, the better this product will be, and the better the product is, we suspect and we hope that there will be more people who want to come and be on the network so they can reap the benefits,” Lane says. “Quite honestly, this initial coming-out party and announcement of Echo Chamber will be a first step toward gauging the industry temperature on something like this.”

X_Trader’s Sunset Leads to Echo’s Rise

The reason that TT believes that now is the time to go live with Echo Chamber—this is a project that the company has been thinking and working on for several years—is that Lane feels they have a client base that represents a significant portion of lit liquidity around the world. But just as important is the company’s migration to the TT SaaS-based platform from its legacy X_Trader system.

“We’re just now to the point in our migration that we’re approaching where 65-70% of our volume is happening on the TT platform. That will be a much bigger number a month from now and hopefully close to 100% by the end of this year,” Lane says. “So now we really do have the flow running through these pipes to turn something like this on and make it meaningful.” (To read more about TT’s infrastructure projects, click here.)

While TT employs a multi-cloud strategy to support its suite of trading products, in order for it to be a real-time service, Echo Chamber does not feed into a cloud, despite this being a very real “big data” solve-for. TT may add a cloud component down the line, though, to create some historical-data services. The company is also not using FPGA technology, despite its traditional speed benefits over software.

Lane says that even though “this is the type of thing that is tailor-made for an FPGA device,” they decided to start the project using highly-tuned Linux servers done entirely in software. He says this works because the latency advantages that they’re already getting due to the exchange-trade-acceptance latency is significant. But, Craig Mohan, the company’s chief growth officer who joined TT last year from CME Group, says they still may look to incorporate FPGAs in the future.

“With this being in the early stages of deployment, I think the flexibility of having this in software—given that we already have a significant latency advantage—outweighs the need to put it into a hardware solution,” he says. “Maybe down the road this may lend itself to that kind of a solution, but we’ll consider that more once this has been adopted more.”

Echo Chamber will also feed into TT’s suite of algo services, which includes ADL, which lets users build algos, and Autospreader, which lets users synthetically spread multi-legged contracts. “There’s a bevy of APIs and SDKs where people can build black-box algoso—all of that will benefit from the Echo Chamber preview book,” Lane says.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.