Transaction-cost analysis (TCA)

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

This Week: Goldman Sachs, MSCI/MarketAxess, Cboe/ErisX, & more

A summary of the latest financial technology news.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

This Week: SimCorp; Liquidnet; Appital; Qontigo & more

A summary of the latest financial technology news.

Buy one, get one free: Algos learn to multi-task

For years, brokers have offered suites of algorithms, each geared toward a certain strategy and outcome. Now, firms are compressing these into multifaceted algorithms that can switch between different strategies or markets in response to trading…

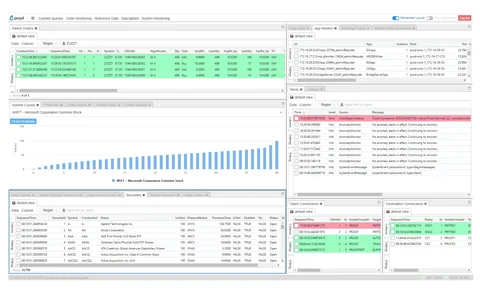

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardization progress, say market participants.

Futures trading algos ripe for disruptive new entrants

Algorithm development specialist BestEx Research is making a play to address inefficiencies in futures trading algorithms.

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

oneZero Expands into Institutional Market

The vendor has been adding members to its team with buy-side and wholesale broking backgrounds.

TradingScreen Continues OMS Expansion on the Buy Side

Vendor firm will release enhancements to allocation, pre-trade compliance, and reporting and analytics in September.

This Week: Vanguard, OneMarketData, SS&C, Xignite, Esma, SimCorp, Nasdaq

A summary of some of the past week’s financial technology news.

Covid-19 Reveals Need for Better Comms Plug-Ins for Traders

Traders should have real-time voice modules in trading systems and the ability to add detailed notes to replicate trading floor experience.

State Street Incorporates Charles River into Outsourced Trading Service

State Street will also integrate BestX equity TCA into its outsourced trading desk.

The Rise of the Algo Wheel

An examination as to how the buy side is embracing algo wheels and where the challenges still remain.

Itarle to Open New York Office, Co-Locate at CME

The Swiss best execution and TCA provider is set to open an office in New York, and co-locate with the CME.

Industry Steps Up Calls for European Consolidated Tape

Traders in Europe face rising data acquisition costs and increasing regulatory reporting pressures argue that a pan-European consolidated tape is long overdue.

SEC’s Redfearn: US-Style Consolidated Tapes Won’t Solve Trading Data Needs

As European market participants bemoan the lack of a consolidated tape, a senior SEC executive debunks the idea that a pan-European tape, similar to the US, will resolve issues around data access and costs.

Warsaw Stock Exchange Bets on Blockchain

The exchange group is launching a separate technology arm for capital markets focused on blockchain, cloud and artificial intelligence.

Andrew Shortland To Steer International Expansion at Trade Informatics

The vendor's first local office outside the US is London, with plans for regional presences elsewhere in Europe and Asia.

BNP Paribas Partners with Itarle Group for TCA

Independent validation and ease of distribution to clients are among the factors for the partnership.