When it Comes to IT Spend, RegTech Sees a Green Field

According to Opimas, the regtech space only pulls in 5 percent of the total IT spend pool, but that is going to change.

The term “fintech” has become as ubiquitous as “cloud” or “AI” when it comes to talking about technology in the capital markets. What used to simply be shorthand for “financial technology” is now used to describe everyone from startup companies looking to be disruptive, to behemoth vendors branching into new sectors or services, to even innovation arms of banks and asset managers. It’s a crowded space that poses both challenges and opportunities.

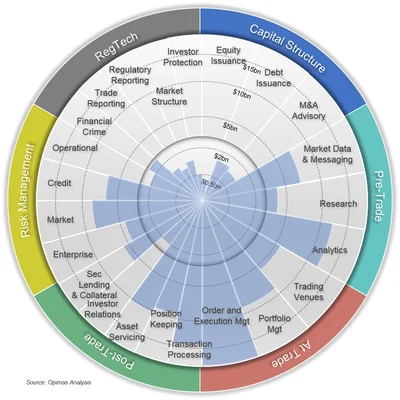

A new report released by consultancy Opimas, titled “FinTech Spending and Innovation in Capital Markets”, estimates that total spending on IT across all market participants in the capital markets will amount to over $127 billion in 2017. The report then breaks that number down between six categories: pre-trade, at-trade, post-trade, capital structure, risk, and the new buzzword garnering great interest, regtech.

Corralling the most investment are those in the trade sector: pre-trade ($41.7 billion), at-trade ($33.3 billion), and post-trade ($21.9 billion). This represents everything from market data and research (pre-) to portfolio, order and execution management (at-) and transaction processing, asset servicing, and collateral and securities lending (post-).

Opimas predicts that these areas are destined to see continued investment. Additionally, risk tech will also continue its upward ascent—currently at $23.6 billion, according to the report—while capital structure will be the sleepy nook of fintech at $2.5 billion. But tech spend as a whole is going to continue to rise as financial firms become more tech-focused. As a result, and thanks to a change in the regulatory landscape, the regtech space is poised for the greatest spike, but not necessarily for the reasons you might think.

Bodies

“I was surprised by the fairly low-level of spend on regtech because it’s an area that’s received so much attention,” according to Opimas’ co-founder and CEO, Octavio Marenzi.

The industry has been dealing with a raft of new regulation since the financial crisis, and, according to Marenzi, between 20-25 percent of operating budgets for some banks is spent on compliance. While investment firms have spent billions to answer these new mandates, the plan has largely centered on throwing bodies at the problem.

One executive at a large bank tells Waters that while people talk generally about Dodd-Frank or the revised Markets in Financial Instruments Directive (Mifid II), each of these are glaciers with complicated amendments and subsections. There’s confusion by the time it filters down from legal to operations and to technology. So for most, the aim is to hit the ground running, and then to maneuver and adjust over the course of time.

“So human resources are more beneficial than paying for a new system,” says the source. “You can’t bring in a new system and tailor fit it to our needs when it takes two years just to figure [the rule] out. So you keep throwing bodies at the problem.”

Calmer Seas

Ironically, it may take some semblance of regulatory stability to settle in before the regtech investment gets flowing, says Marenzi.

“The easiest thing to automate is something that’s very repetitive where you have lots of transactions that are very similar and they don’t really change over time. Compliance has always been a bit weird—the rules change and are subject to interpretation, and you sort of fudge the numbers at the end of each quarter to make them look good. That’s not something that lends itself well to automation,” he says.

“But I think we’ve reached a sort of high-water mark in terms of regulation because some sort of stabilization is taking place,” Marenzi continues. “In Europe, Mifid II is the last big thing coming out; in the US, it’s sort of plateaued and there’s not any sort of major regulatory change in the works—there are some new rules, but overall it’s stable. Once you have stability you can automate things and get rid of some of these head-count increases that we’ve seen in compliance.”

To be sure, pre-, post-, and at-trade activities are still the most intriguing for investment as artificial intelligence, robotic process automation, blockchain, public clouds and new visualization tools gain maturity. But those are already highly-competitive fields. Comparatively, according to Opimas, regtech, as it pertains to investor relations, market structure and, to lesser extents, regulatory reporting and financial crime, have room for new entrants.

Take, for example, the financial crime sector, which already has stalwarts including Nice Actimize, Nasdaq, FIS and Bloomberg offering services. But this summer the industry saw another tech giant—IBM—enter the space. And Marenzi points to upstarts like Behavox, TradingHub, and Sybenetix, which was recently acquired by Nasdaq, as interesting new entrants.

As much as the term regtech has been overused, it is an area where we’re likely only at the beginning of its evolution.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

The costly sanctions risks hiding in your supply chain

In an age of geopolitical instability and rising fines, financial firms need to dig deep into the securities they invest in and the issuing company’s network of suppliers and associates.

Industry associations say ECB cloud guidelines clash with EU’s Dora

Responses from industry participants on the European Central Bank’s guidelines are expected in the coming weeks.

Regulators recommend Figi over Cusip, Isin for reporting in FDTA proposal

Another contentious battle in the world of identifiers pits the Figi against Cusip and the Isin, with regulators including the Fed, the SEC, and the CFTC so far backing the Figi.

US Supreme Court clips SEC’s wings with recent rulings

The Supreme Court made a host of decisions at the start of July that spell trouble for regulators—including the SEC.