S&P debuts Spark Assist genAI copilot, draws up ‘Blueprints’ of combined datasets

S&P’s Kensho subsidiary has rolled out new emerging tech products leveraging AI to explore and combine the vendor’s wealth of datasets to solve common use cases.

Encouraged by the early results of a range of artificial intelligence-based initiatives introduced in Q4 last year, data giant S&P Global is pressing further ahead with making AI an “enterprise-wide strategic focus,” and as a result has developed S&P Spark Assist, a proprietary generative AI-based copilot, S&P CEO Doug Peterson told investors during the vendor’s Q1 earnings call on Thursday, April 25.

Spark Assist, developed jointly between S&P’s AI-focused subsidiary Kensho and S&P’s own internal technology teams, is being deployed throughout the vendor to increase productivity by reducing the time taken to accomplish menial, routine tasks. Peterson said that because of the technology strength of the internal teams, the chat interface for Spark Assist does not rely on any third-party vendors.

“As a result, we’re delivering the power of generative AI to our people in an easy-to-use platform at the cost of less than $1 per user per month,” Peterson said. He added that S&P is excited by the possibilities of the copilot and that the vendor will provide further details around use cases later this year.

Copilots are applications that help users navigate AI models using large datasets—digital personal assistants built using large language models (LLMs) enriched with a user’s own data to help augment their workflows. Recent examples of financial firms and vendors developing domain-specific copilots include BlackRock, Nasdaq’s Verafin anti-crime subsidiary, Man Group, and Microsoft.

S&P Global’s continued focus on generative AI was detailed earlier this year in February, when during the company’s Q4 earnings call, Peterson and Adam Kansler, president of S&P Global Market Intelligence, said the company had added a genAI search capability to Marketplace, its data “storefront,” through which users can browse datasets sourced from throughout S&P’s business. In that call, Peterson said, “We believe that AI will quickly become embedded in everything that we do.”

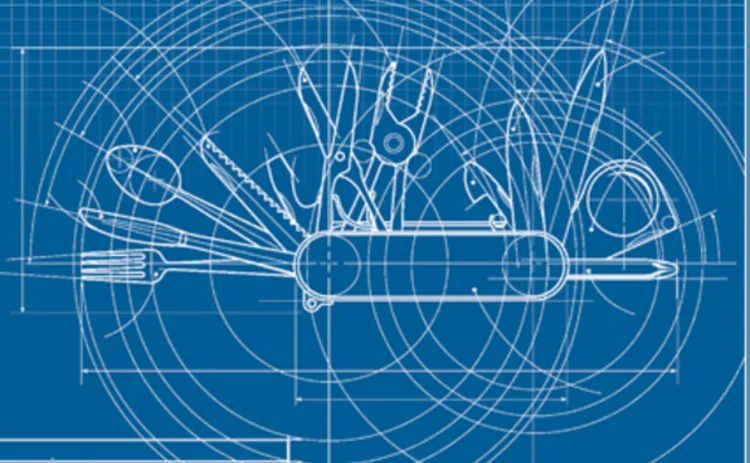

During the Q1 call, Peterson also announced that S&P has introduced a set of market intelligence packets of datasets and tools called Blueprints, which combine different S&P datasets and solutions to solve common use cases, based on specific customer personas and workflows, such as private markets performance analytics.

Blueprints already available include solutions for delayed filings analysis, private markets performance analytics, S&P credit ratings and risk analysis, banking liquidity assessment, and powering CRM, with additional Blueprints covering derivatives data and valuations, topical key phrases, and transcripts trending topics “coming soon.”

Each Blueprint pulls together data from multiple S&P assets to address all aspects of a specific topic. For example, the private markets performance analytics Blueprint includes data from the Preqin alternative assets fund performance dataset, primary and secondary market transactions data, company intelligence and company relationships, private company financials, and the S&P Global Marketplace Workbench. And the upcoming Blueprint for derivatives data and valuations includes consensus derivatives valuations from Totem, curves and volatility data for OTC derivatives; portfolio valuations; initial margin; and Derivatives Studio, S&P’s on-demand derivatives calculator.

“We introduced the first five Blueprints in the first quarter, with plans to add more in the coming months,” Peterson said. “These intuitive combinations allow customers to easily discover how our data and tools can work together to facilitate analytics and workflows in new ways.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

This Week: Startup Skyfire launches payment network for AI agents; State Street; SteelEye and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: Standard Chartered’s Brian O’Neill

Brian O’Neill from Standard Chartered joins the podcast to discuss cloud strategy, costs, and resiliency.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Chevron’s absence leaves questions for elusive AI regulation in US

The US Supreme Court’s decision to overturn the Chevron deference presents unique considerations for potential AI rules.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.

Startup helps buy-side firms retain ‘control’ over analytics

ExeQution Analytics provides a structured and flexible analytics framework based on the q programming language that can be integrated with kdb+ platforms.

The IMD Wrap: With Bloomberg’s headset app, you’ll never look at data the same way again

Max recently wrote about new developments being added to Bloomberg Pro for Vision. Today he gives a more personal perspective on the new technology.

LSEG unveils Workspace Teams, other products of Microsoft deal

The exchange revealed new developments in the ongoing Workspace/Teams collaboration as it works with Big Tech to improve trader workflows.