Trading Tech

Locking down the lifecycle: Trading Technologies turns to analytics and TCA in latest acquisition

The tech provider gains TCA, analytics, and algo optimization tools as established vendors vie to build more comprehensive platforms.

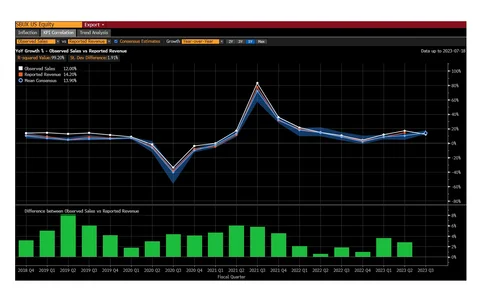

Bloomberg rolls out integrated alt data for Terminal users

The initial launch includes consumer spend and foot traffic geolocation data—pre-integrated with all the other data on the Bloomberg Terminal.

Behavioral analytics: the data trend that has asset managers looking inward

Vanguard and others are building tools that “nudge” investors to make better investment decisions.

Six banks team with Expand Research to create data vendor catalog

The initiative aims to help firms better manage the data they already use and to identify and compare alternatives available in the market.

Nasdaq moves second matching engine to AWS cloud

The exchange and its cloud partner are encouraged by the smooth migration so far—and also by capacity and latency improvements from running in the cloud.

Increasing securities settlement successes with unique transaction identifiers

Major improvements have been made to the securities services operating model over the past decade, but inefficiencies in trade settlement processes remain, leading to thinning margins and longer settlement cycles. Key to addressing these challenges is…

Goldman’s Marquee is a gradual revelation

Multiple apps are being corralled into a sticky cross-asset ecosystem, updated with Python and cloud

ASX, SGX earnings driven by diversified revenue

After the Chess disaster, ASX focuses on rebuilding confidence, while SGX continues investing in its derivatives business. Meanwhile, HKEx mulls data play.

Terminal velocity: MarketAxess bets on algo trading as electronification of fixed income gathers speed

MarketAxess hopes to bring fresh ideas from other asset classes with acquisition of multi-asset algorithm provider Pragma.

AI in sheep’s clothing? Wolfe Research develops finance chatbot

The bot is trained using financial and ESG data, but won’t replace humans—yet—says the firm.

The loan market has a new identifier, but the path to adoption isn’t clear

The CEI aims to bring interoperability to loan trading, but it’s entering a market dominated by a long-standing incumbent.

How exchanges are becoming more than just marketplaces

Wei-Shen examines how exchanges are branching out and pursuing new ventures that could bring them fresh revenue streams.

What’s the market for Ion Markets?

With whispers swirling that Ion’s chief executive is looking to cash out on his tech conglomerate, big changes could be coming to the world of fixed-income software.

ICE: LLMs drove 60% increase in ICE Chat trades

The exchange revealed it has been working with LLMs for a decade to drive automation around its messaging platform. Now, it’s looking for more uses across all asset classes.

Connective tissue: S&P's InvestorAccess enables secondary market-like trading of primary issues

Through a combination of its own technology and partnerships with fixed-income mainstays Bloomberg and Tradeweb, S&P is looking to create end-to-end workflows to simplify trading of primary bond issues for both buy-side and sell-side firms.

Tradeweb aims to expand FI trading footprint after Yieldbroker addition

In what CEO Billy Hult described as a “challenging backdrop” for the quarter, the marketplace operator is looking ahead on acquisitions, automation and a widening pool of market-makers.

Outsourced trading sees uptick as buy side seeks more bang for its buck

Buy-side firms see outsourced trading as a way to simplify their operating model, while custodians see an opportunity to sell bundled services.

A Fireside Chat with SmartStream's Jethro MacDonald

Jethro MacDonald explains how SmartStream is using AI and machine learning technology to help its clients address a number of challenges around their reconciliation functions.

MarketAxess looks to proprietary data and automation with new offerings

The fixed-income trading provider’s Adaptive Auto-X automation tool and new data offerings were a bright spot amid lackluster Q2 earnings.

Nasdaq’s Friedman hints at plans for Adenza post-acquisition

During Nasdaq’s earnings call, Adena Friedman explained to skeptical investors why the deal makes sense for the exchange operator.

Antitrust complaint against Cusip can go forward, SDNY judge rules

The federal judge presiding over the ongoing class-action suit against Cusip Global Services, S&P Global, FactSet, and the American Bankers Association, has dismissed all complaints against the defendants except one alleging the quartet violated Section…

Charles River, software, data sales drive State Street in Q2

As traditional revenue lines declined at the custodian as a result of market forces, front-office software sales made big gains in its quarterly results.

Banks’ internal watchdogs bark back at ChatGPT

Generative AI has plenty of uses in finance, but banks must first overcome compliance headaches

Waters Wrap: What’s next for desktop interop?

Anthony takes a look at the desktop application interoperability space—how we got here and where he thinks it's going.