Reference data

Defendants in Cusip suit make their case for dismissal

Cusip Global Services and its affiliates have filed a joint motion to dismiss the anti-trust class-action lawsuit.

Waters Wrap: The DTCC, Cusip and questions of a monopoly

While the companies that oversee Cusips find themselves embroiled in a lawsuit, Anthony questions where the DTCC stands in this unfolding drama.

Privacy-enhancing tech and data pooling—a new way to turn the tide on financial crime

Technological innovations have given some players cause to hope that cross-institutional data sharing could become a reality in spite of concerns around data protection.

SEC’s $5M Bloomberg BVAL fine targets ‘dark magic’ in fixed income pricing

Recent actions against Bloomberg and Ice for violations relating to evaluated pricing services suggest the US regulator may be setting the stage for stricter regulations to govern the sector.

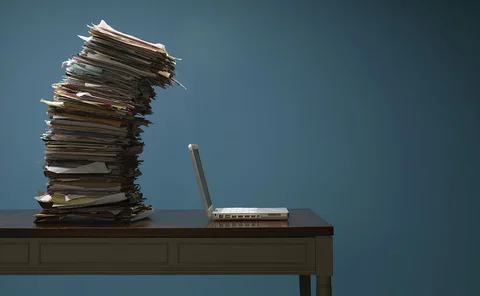

Waters Wrap: For data managers, the new problems are the same as the old

While much attention has been given to cloud, AI, blockchain and other buzzwords, without a proper data foundation, those tools will not deliver the results that have been promised.

Industry participants: ‘Digital Token Identifier’ aims to increase interop, usage

While some trading firms are welcoming the use of a new non-proprietary code for identifying digital tokens, the onus will be on local regulators to enforce its adoption.

Bank-backed Versana takes aim at syndicated loan tech

Born from a consortium that includes JP Morgan and Bank of America, Versana aims to bring up-to-date and permissioned data to the syndicated loan market—the first step to a more transparent and faster operating market.

The year identifiers wanted some attention too

Cusip! Figi! Isin! BTC! LEI! Taylor Swift? How did we get here and where do we go now?

In 2022, cloud shows true potential to displace legacy data platforms

Once wary of the cloud, financial firms, their suppliers and the marketplaces where they trade are openly embracing it. And there are more signs of big tech firms accelerating buy-in by literally buying in to clients’ migration projects.

Banks express concern over top venues’ bid for EU consolidated tape

End-users are worried about the repercussions of handing over a data monopoly to the heavyweight operators in the fixed income space.

Anna on track for Isin review deadline

The registrar of the barcode for financial instruments has adapted its systems to reflect the updated standard, ahead of February 2023.

Could cloud kill the data licensing debate and shake up pricing models?

Market participants say cloud has the potential to reimagine data licensing. But moving to the new operational model comes with a raft of unanswered questions.

State Street looks to bolster Charles River, Alpha platforms with FundGuard integration

State Street’s partnership with FundGuard will provide clients with multi-book accounting, allowing them to see two sets of records in one system.

Industry mulls identifier schema for digital assets

As crypto markets face a reckoning in the wake of the FTX scandal, standard-setters and industry participants say identifiers for tokens are key for the industry’s stability.

OTC Markets rescues Edgar Online, plans ‘comprehensive’ US disclosure data service

Edgar Online’s new owners discuss their plans for the financial data and filings provider, and how owning the data will be key to expanding the range of services it can offer.

Waters Wrap: Banks explore new avenues for cloud cooperation

As banks and asset managers move more workloads to the cloud, they’re trying to find ways to cooperate to cut costs and exert more influence over the likes of AWS, Google and Microsoft. Anthony wonders if these early efforts will yield beneficial results…

Symphony wants to be Wall Street’s phone book—but smarter

As Symphony strays further from its original purpose of being a chat platform, WatersTechnology sat down with Brad Levy at this year’s Innovate conference to discuss his vision for the firm.

New tech for corporate actions aims to improve the data extraction process

Demand for corporate actions data is increasing in the front and middle office, but the data can be hard to read.

Goldman Sachs, JP Morgan join forces to explore market data in the cloud

The banks’ vision is for vendors and consumers to be able to distribute and access all data sources in a multi-cloud environment. They’re mapping the way to get there.

Fees rise and questions linger as Esma ramps up analytics capabilities

The EU regulator’s expanded supervisory powers and big data capabilities have caused some confusion on how the data will be used and how Esma’s new role will shape reporting regimes.

Waters Wrap: Where have all the (data) cowboys gone?

Industry veterans says there’s a dearth of market data management talent in the lower ranks. Following Max Bowie’s coverage, Anthony explores some other reasons for this brain drain.

Data brain drain may prompt move to managed services for market data management

A shortage of data professionals with suitable experience to run large financial firms’ data organizations could drive firms to completely outsource the management and administration of their third-largest expense.

Is disruption finally coming for the index business?

Regulatory developments and startups gaining some ground may—one day—threaten the incumbent providers in this space.

As APIs go mainstream, good management is key

Though APIs have been around for a while, some financial institutions only consume 5% of them. To help better manage APIs, firms need to be aware of what they want to achieve with the APIs they create and use.

_0.jpg9b5e.webp)