Reference data

Using genAI for post-trade processing could reduce failures, fines

Shortening settlement times are pressuring firms to do more, faster. IBM’s Soren Mortensen argues that genAI and ML can help eliminate errors and speed up post-trade processes.

Goldman Sachs looks to ‘Amazon’-like ecosystem with MarketView launch

The new research and collaboration tool is delivered through Goldman’s Marquee platform.

New crypto Isins seen as ‘really important’ step for TradFi adoption

Execs at TP Icap and Societe Generale say the identifier removes a major barrier for crypto acceptance.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Waters Wrap: Market data spend and nice-to-have vs. need-to-have decisions

Cost is not the top factor driving the decision to switch data providers. Anthony looks at what’s behind the evolution of spending priorities.

The Cusip lawsuit: A love story

With possibly three years before the semblance of a verdict is reached in the ongoing class action lawsuit against Cusip Global Services and its affiliates, Reb wonders what exactly is so captivating about the ordeal.

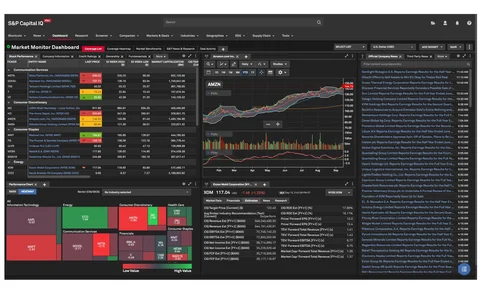

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Waters Wrap: The drama within reference data

Anthony looks at four major stories recently published that will not just affect reference data professionals, but firms of all shapes and sizes.

Derivatives Service Bureau allows alternative identifiers for OTC derivatives UPI

The numbering agency has partnered with SmartStream and ICE to cross-reference and map the underlying asset’s identifier to the relevant Isin.

The loan market has a new identifier, but the path to adoption isn’t clear

The CEI aims to bring interoperability to loan trading, but it’s entering a market dominated by a long-standing incumbent.

Gleif hopes to entice LEI laggards with new digital identifier

The vLEI has ambitions to become the backbone of digital trust.

Antitrust complaint against Cusip can go forward, SDNY judge rules

The federal judge presiding over the ongoing class-action suit against Cusip Global Services, S&P Global, FactSet, and the American Bankers Association, has dismissed all complaints against the defendants except one alleging the quartet violated Section…

Bloomberg, Snowflake ally to accelerate cloud data adoption

Bloomberg has built an app in Snowflake’s cloud framework that will make it simpler and faster for Snowflake clients to populate their cloud-hosted tools with Bloomberg data.

FRTB forces banks to rethink entire data management infrastructure

Data mapping and getting historical time series data are among the challenges banks face in conducting calculations necessary for FRTB. But they have help.

Tomorrow’s institution cares more about its risk than its performance

Execs from BlackRock, BMO, and Ness Digital Engineering discuss the balancing act of the wildly shifting priorities each of their organizations contend with every day.

Buy side demands better data aggregation for primary corporate bonds

With electronification and tech development increasing in fixed income, participants are looking for better data access in the primary market for corporate bonds.

Alt data’s growing pains: Integration and aggregation challenges stall wider adoption

Demand for alternative data continues to grow among investment firms. So why are some alt data providers taking products off the market?

Does the case against Cusip have legal merit? We’re about to find out

As the parties involved in the Cusip lawsuit wait to see whether the case will proceed to trial, Reb discusses what it might mean if the defense's claim that the case has no legal merit is true.

Big bank mergers, big cuts in data spend? Not so fast, experts say

With hundreds of millions of dollars spent per year on data and associated technologies, a merger the size of UBS’ takeover of Credit Suisse has the potential to take a huge chunk out of data vendors’ revenues. What’s the path forward?

S&P Global–IHS Markit post-merger: One giant leap for data analysis?

The combined entity will look to tap into AI tools provided by S&P’s Kensho outfit and AWS’ cloud to build new analytics platforms.

Waters Wavelength Podcast: Episode 262 (Previewing Nafis)

Wei-Shen and Tony take a look at what’s to come at the North American Financial Information Summit (Nafis).

Waters Wrap: On SVB, Credit Suisse and questions left in the wake

After the latest 'crisis' that claimed Silicon Valley Bank, Credit Suisse and others, Anthony questions whether anyone will learn a lesson.

This Week: Finos, Cboe Global Markets, Aiviq/Alliance Bernstein & more

A summary of the latest financial technology news.

.jpga486.webp)