S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

S&P Global has released a new version of its Capital IQ Pro workstation, which integrates the wealth of data acquired via the vendor’s purchase of IHS Markit, along with new charting resulting from its acquisition of ChartIQ. And by year end, the vendor expects to add a generative AI search interface dubbed ChatIQ to the terminal to make it easier for users to derive more useful insights from the platform, faster, and using natural-language queries.

The vendor developed the AI tool using the Kensho AI business acquired in 2018. ChatIQ is still in training, and S&P recently updated one of its back-end large language models to OpenAI version 3.5. It can search all of S&P’s data and its responses include links to the underlying data in Capital IQ on which ChatIQ based its response, allowing users to drill down into the data and perform further research.

Speaking on the vendor’s Q2 earnings call last month, S&P CEO Doug Peterson called ChatIQ the first example of how Kensho will deploy LLM technologies across all of S&P Global. “Kensho gives us an advantage [in AI], but it’s not the only one,” he said. “The datasets we have—large, proprietary, and truly differentiated—create a remarkable advantage for S&P Global as well.”

It’s this marriage of the Kensho machine-learning technology—which the vendor has already been putting to good use—with S&P’s and IHS Markit’s data that makes it as rich a combination as peanut butter and jelly, Warren Breakstone, head of desktop and channels at S&P Global Market Intelligence, tells WatersTechnology.

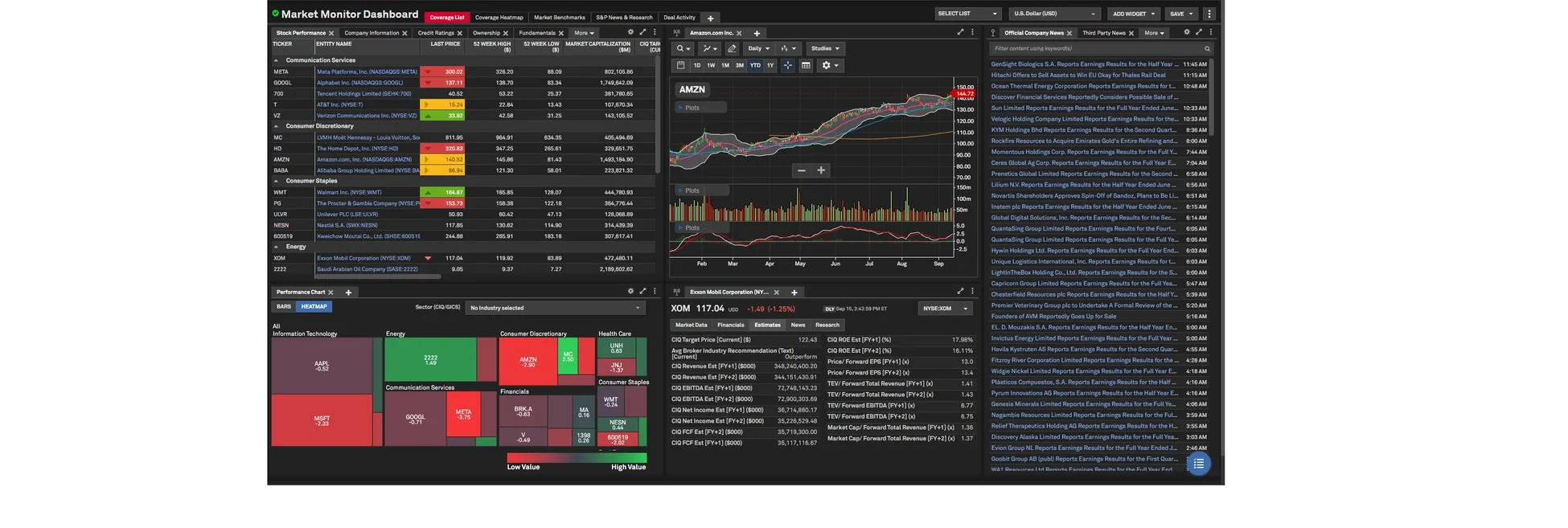

“It’s an integrated value proposition: it integrates around 100 different datasets—mostly from S&P, and some from third parties—and layers visualizations and analytics on top of those to help users make different decisions,” he says.

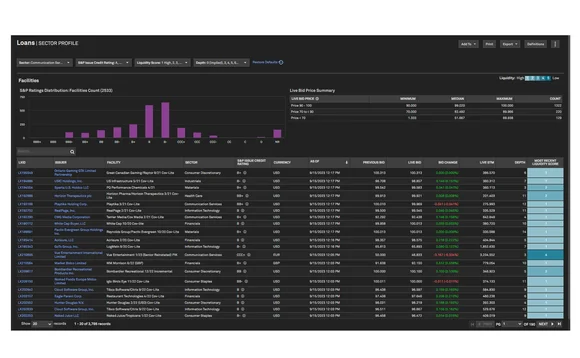

Some of these datasets come from the IHS Markit acquisition, included at no extra charge to Capital IQ users under a new Markets & Deals tab. For example, the platform now includes loans data from IHS Markit, including data on 115,000 loan facilities, along with liquidity scores and pricing, combined with ratings from S&P Ratings. Users can drill into each element, and any value displayed in blue indicates additional data elements—from the definition of a term or additional information displayed in pop-up boxes when a user hovers over that value, to being able to click-through to the original source document behind a number, so users better understand where data is coming from and the context around it.

Not only is the platform carrying more data; the way it displays data in charts and visualizations is new, too. All visualizations in the workstation now use technology from ChartIQ, which S&P has already fully integrated into the platform after buying the vendor in January this year. Breakstone says that not only are these more modern displays, but Capital IQ can now offer more technical studies than before.

This is key given the range of end users that subscribe to the platform, including off-trading floor front-office staff, those involved in decision-support roles, M&A investment bankers, buy-side analysts, corporate development officers, and commercial banking staff.

“Because of the number of different users and user types … the product is designed to surface content and capabilities in a way that adapts to different client personas,” Breakstone says. “For example, for a buy-side analyst, banker or corporate development professional, the product renders capabilities tailored to the way you work.”

Users build a profile that best defines their responsibilities and workflows by choosing their function, role, and the areas or geographies they focus on, and Capital IQ creates a display that it determines best reflects the user’s workflow. Then, users can personalize their screen further—for example, not just to include a pane of news, but to prioritize what topics appear in that news feed.

Data + AI = democratization

With this much data now contained in the platform and with such a variety of user profiles looking to gain targeted insights from it, it’s no wonder that S&P decided to develop a generative AI tool to help users navigate the wealth of data more productively. As data sources continue to consolidate and acquire ever-more voluminous datasets, navigating them goes from the equivalent of swimming across an indoor pool to circumnavigating the globe.

Patrick Wegner, senior capital markets analyst at research firm Celent, has witnessed multiple demonstrations of similar tools applied to large datasets—most notably, Bloomberg releasing BloombergGPT for the Terminal earlier this year. He says it helps to democratize data analysis and search.

“Traditionally, if a senior executive on the business side has an idea, they would describe it to an analyst and send them off for a couple of days to research it, and the analyst would then come back with what they’ve found or built,” Wegner says. “The value of this is that it brings the ability to access vast datasets to business users, rather than just technical users, in a fraction of the time, and allows them to act on it. That’s what I mean by democratization.”

Wegner says this is the first iteration of how generative AI can be useful to data vendors and other data sources to help users find and make sense of massive amounts of data quickly and simply. Additionally, by limiting the AI to proprietary or internal datasets, data providers can avoid some of the broader concerns and regulatory scrutiny surrounding data privacy when dealing with public and individually identifiable data.

However, he adds that many firms are still in the early stages of these efforts because they first need to address the underlying datasets themselves and data quality issues.

“For many, there’s still a lot of work to be done, because first they need to figure out what data they already have, and then they need to implement a data structure to make that data usable,” Wegner says.

In S&P’s case, its 2018 purchase of Kensho was instrumental in mapping and linking its disparate datasets faster than would have been possible manually, creating the foundational structure on which ChatIQ can operate. But S&P has also been able to exploit the Kensho technology in other ways to create more content—faster—for users.

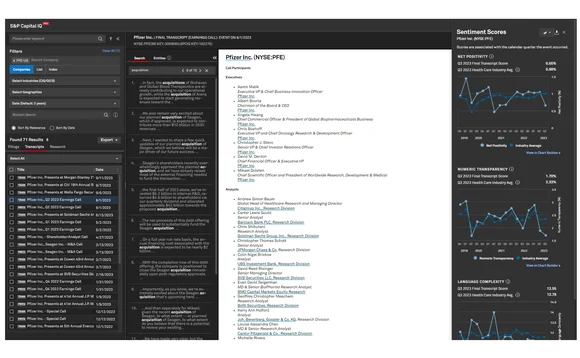

For example, S&P’s Doc Viewer tool has been available on the desktop for almost two years and uses Kensho technology to examine and extract data from lengthy company documents, such as earnings results, filings, or relevant broker research, and to identify and compare information—e.g., companies identified as competitors. It also identifies references to a company in similar materials from those competitors, enabling users to understand how a company is viewed by its peers and competitors.

This information can be created by transcribing earnings calls using Kensho Scribe, identifying and tagging the information using Kensho’s Nerd tool for identifying entities in text, and linking that to relevant companies and identifiers using Kensho Link. Doc Viewer can also include sentiment scores of earnings calls based on factors such as net positivity, numerical transparency (measuring the amount of actual figures cited on a call, since more figures generally translates to greater transparency), and complexity of the language used by executives speaking on the call (simpler language being seen as an indicator of better results), and can compare them to the sentiment of results from prior quarters or years.

The additions are already generating positive feedback from Capital IQ users and contributing to S&P’s ability to grow its user base at existing clients while also attracting new ones. The platform currently has around 330,000 users, a 10% increase over last year, Breakstone says.

“We have to keep up with the markets we serve, and we’ve seen an acceleration of innovation and the pace of development,” Breakstone says. “It all comes back to being able to bring together all the datasets we offer and display them in the way clients want to work.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

New working group to create open framework for managing rising market data costs

Substantive Research is putting together a working group of market data-consuming firms with the aim of crafting quantitative metrics for market data cost avoidance.

Off-channel messaging (and regulators) still a massive headache for banks

Waters Wrap: Anthony wonders why US regulators are waging a war using fines, while European regulators have chosen a less draconian path.

Back to basics: Data management woes continue for the buy side

Data management platform Fencore helps investment managers resolve symptoms of not having a central data layer.

‘Feature, not a bug’: Bloomberg makes the case for Figi

Bloomberg created the Figi identifier, but ceded all its rights to the Object Management Group 10 years ago. Here, Bloomberg’s Richard Robinson and Steve Meizanis write to dispel what they believe to be misconceptions about Figi and the FDTA.

SS&C builds data mesh to unite acquired platforms

The vendor is using GenAI and APIs as part of the ongoing project.

Aussie asset managers struggle to meet ‘bank-like’ collateral, margin obligations

New margin and collateral requirements imposed by UMR and its regulator, Apra, are forcing buy-side firms to find tools to help.

Where have all the exchange platform providers gone?

The IMD Wrap: Running an exchange is a profitable business. The margins on market data sales alone can be staggering. And since every exchange needs a reliable and efficient exchange technology stack, Max asks why more vendors aren’t diving into this space.

Reading the bones: Citi, BNY, Morgan Stanley invest in AI, alt data, & private markets

Investment arms at large US banks are taken with emerging technologies such as generative AI, alternative and unstructured data, and private markets as they look to partner with, acquire, and invest in leading startups.